Gold Miners in 2025: When Discipline Outshines the Metal

- Why Are Gold Miners Beating Physical Gold?

- The New Mining Playbook: Less Risk, More Rewards

- The Dark Side of the Gold Rush

- Golden Opportunities Ahead?

- FAQs

Gold mining stocks have outperformed physical Gold in 2025, with some surging over 30% due to stronger balance sheets, disciplined capital allocation, and operational leverage. Companies like Newmont and Barrick now offer a compelling mix of cyclical gold exposure and shareholder returns. But risks like geopolitical instability and cost inflation remain. Here’s why miners might still be a golden opportunity.

Why Are Gold Miners Beating Physical Gold?

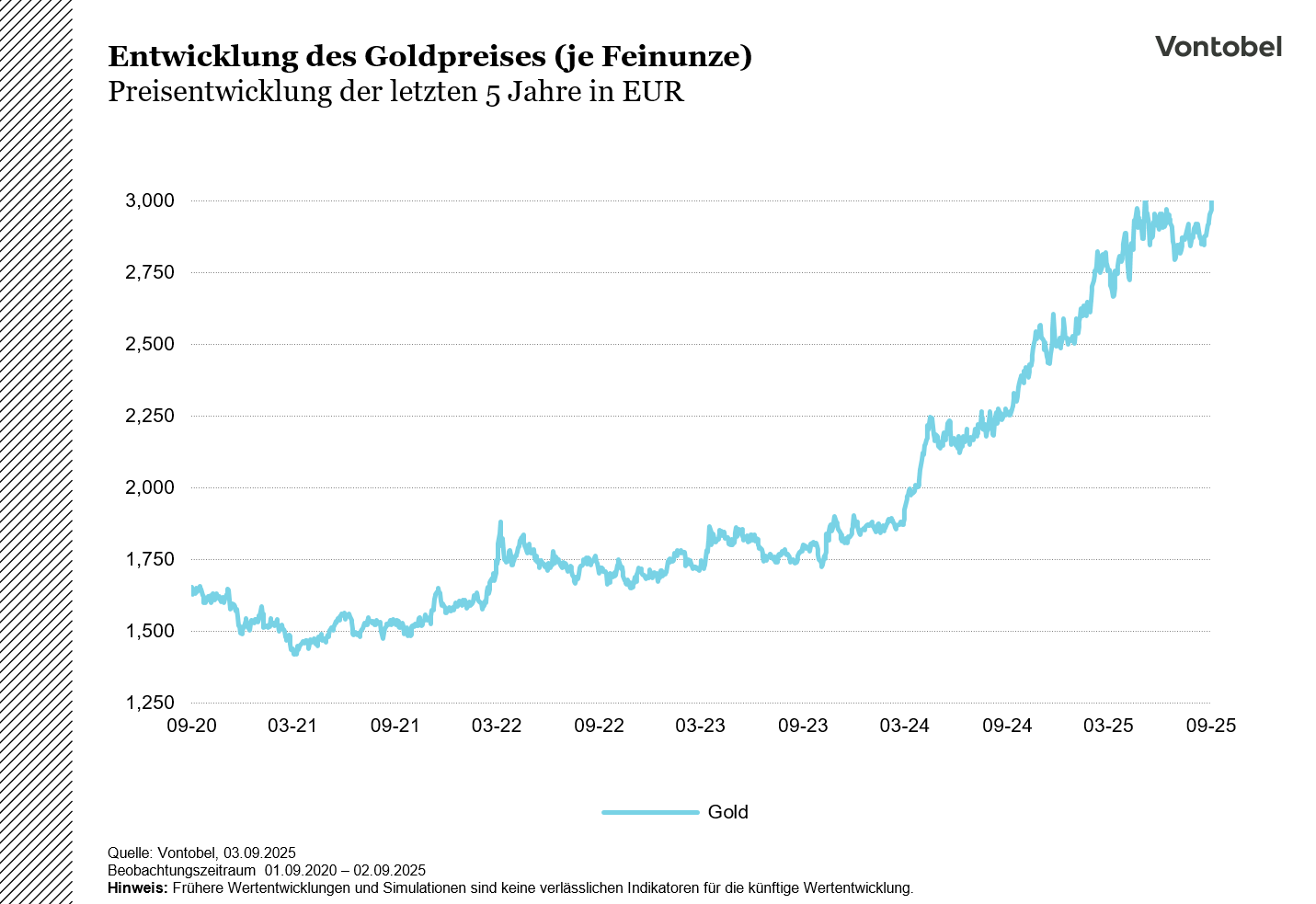

While gold hit a record $3,400/oz in 2025, mining stocks stole the show. The sector’s 30%+ rallies stem from what I call the "triple leverage effect": (1) operational gearing (fixed costs amplify margin growth), (2) financial discipline (Newmont’s $6B buyback program speaks volumes), and (3) investor sentiment shifting from "speculative bet" to "quality cashflow story." Franco-Nevada’s 50%+ EBITDA margins show how fat these golden geese have become.

The New Mining Playbook: Less Risk, More Rewards

Remember when miners blew cash on dodgy acquisitions? Those days are gone. The BTCC research team notes three seismic shifts:

- Balance Sheet Buffers: Newmont’s $7.7B cash pile and 0.6x net debt/EBITDA (2024 data) could survive a gold price earthquake

- Shareholder Focus: Barrick returned $1.2B via dividends/buybacks in 2024 - unthinkable during the reckless 2010s

- Cost Control: Inflation cooled to single digits after 2022-23 spikes, protecting those juicy 50-59% margins

The Dark Side of the Gold Rush

Before you dive in, consider these landmines:

| Risk | Example |

|---|---|

| Geopolitical Drama | 40% of reserves sit in "high-risk" jurisdictions |

| Cost Creep | Energy accounts for 25-30% of production costs |

| Valuation Stretch | Some stocks already price in $4,000/oz gold |

Golden Opportunities Ahead?

Here’s where it gets interesting. With central banks still hoarding gold (they bought 800+ tonnes in H1 2025 per World Gold Council), miners offer Leveraged exposure without futures complexity. My take? The sector’s matured from a casino to something resembling a dividend aristocrat - just with more explosives involved.

FAQs

How long can miners outperform gold?

Historically, outperformance cycles last 12-18 months. But today’s disciplined cost structures may extend the run.

Which miner has the best dividend?

Agnico Eagle’s 4% yield edges out peers, though Newmont’s buyback power is unmatched.

Are junior miners worth the risk?

Only for those with iron stomachs - their 3x volatility makes bitcoin look stable.