Worldcoin Soars as Project Doubles Down on Quantum-Resistant Security

Worldcoin rockets upward—quantum security pledge sends bullish signals through crypto markets.

Breaking the Encryption Barrier

Worldcoin isn't just talking quantum security—they're baking it into their protocol's DNA. This isn't some distant roadmap promise; it's active development happening now. The move addresses one of crypto's biggest existential threats head-on.

Market Mechanics at Play

Traders pile in as security upgrades translate to perceived value spikes. Suddenly, holding WLD means betting on long-term viability—not just short-term gains. The timing couldn't be sharper with quantum computing advances accelerating globally.

Because nothing makes crypto investors froth like promising to protect their bags from sci-fi threats—even if half can't explain quantum computing beyond 'it's like really fast math.'

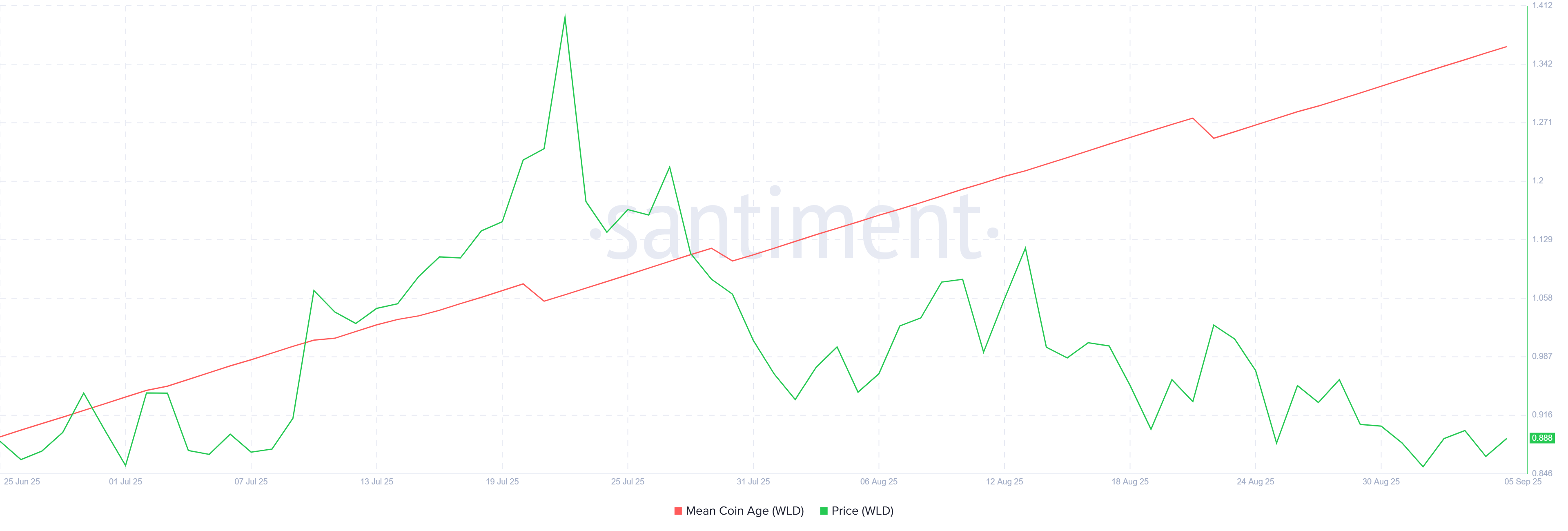

Worldcoin Holders Remain Bullish

Long-term holders (LTHs) are showing renewed conviction, with data from the MCA highlighting a clear preference for accumulation over selling. This behavior reflects increasing confidence in WLD’s future, particularly as major institutions endorse its security-focused developments.

The steady incline in the MCA suggests that committed holders are not only preserving but also expanding their stakes. Such behavior strengthens the foundation for WLD’s current recovery.

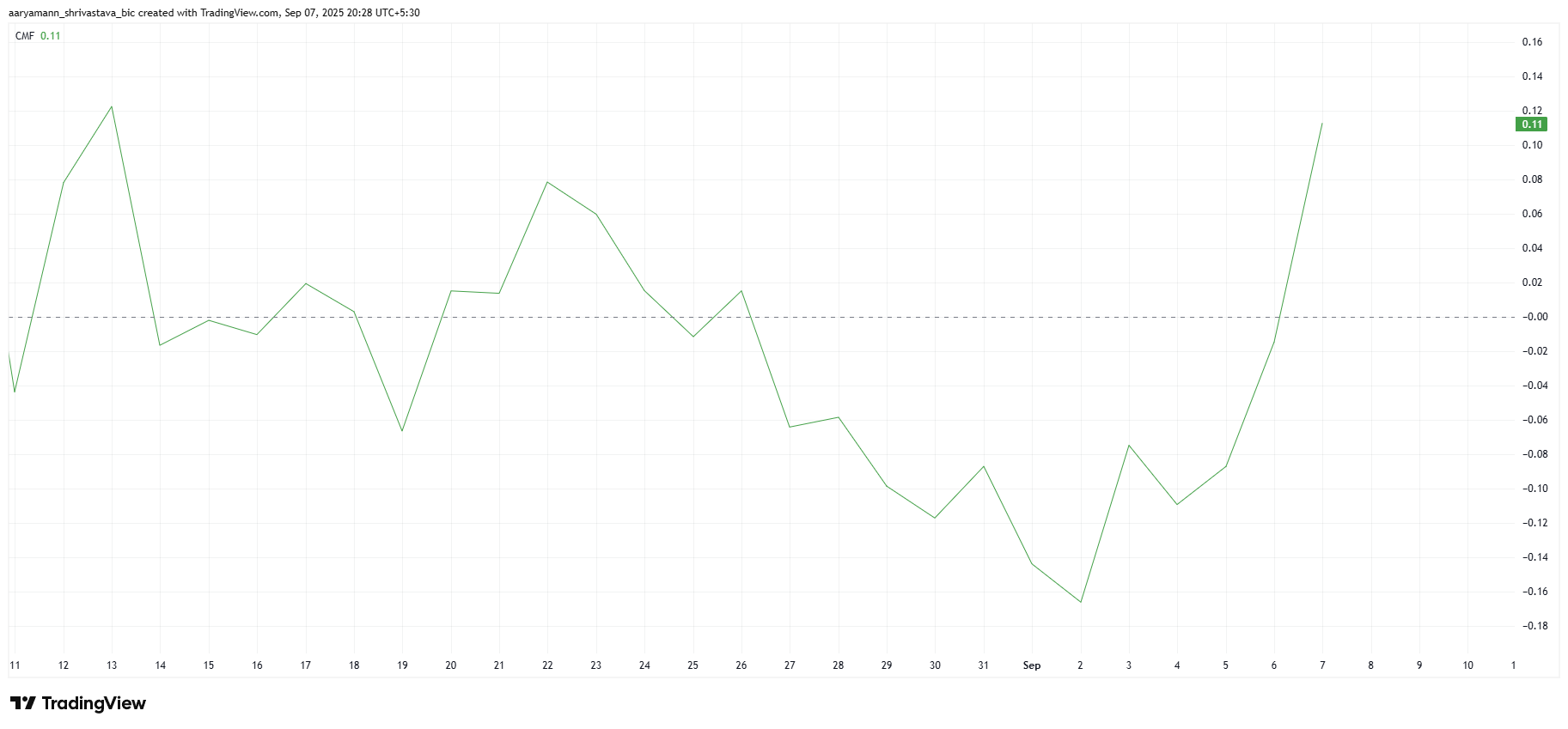

On-chain activity also supports Worldcoin’s broader momentum. The Chaikin Money FLOW (CMF) indicator has recorded a sharp uptick in recent sessions, pointing to strong inflows into the cryptocurrency. A positive CMF signals sustained demand that could extend the rally.

The timing coincides directly with the APMC announcement, which appears to have catalyzed buying interest. By pushing the CMF well above the zero line, the development confirms a bullish stance for WLD in the NEAR term.

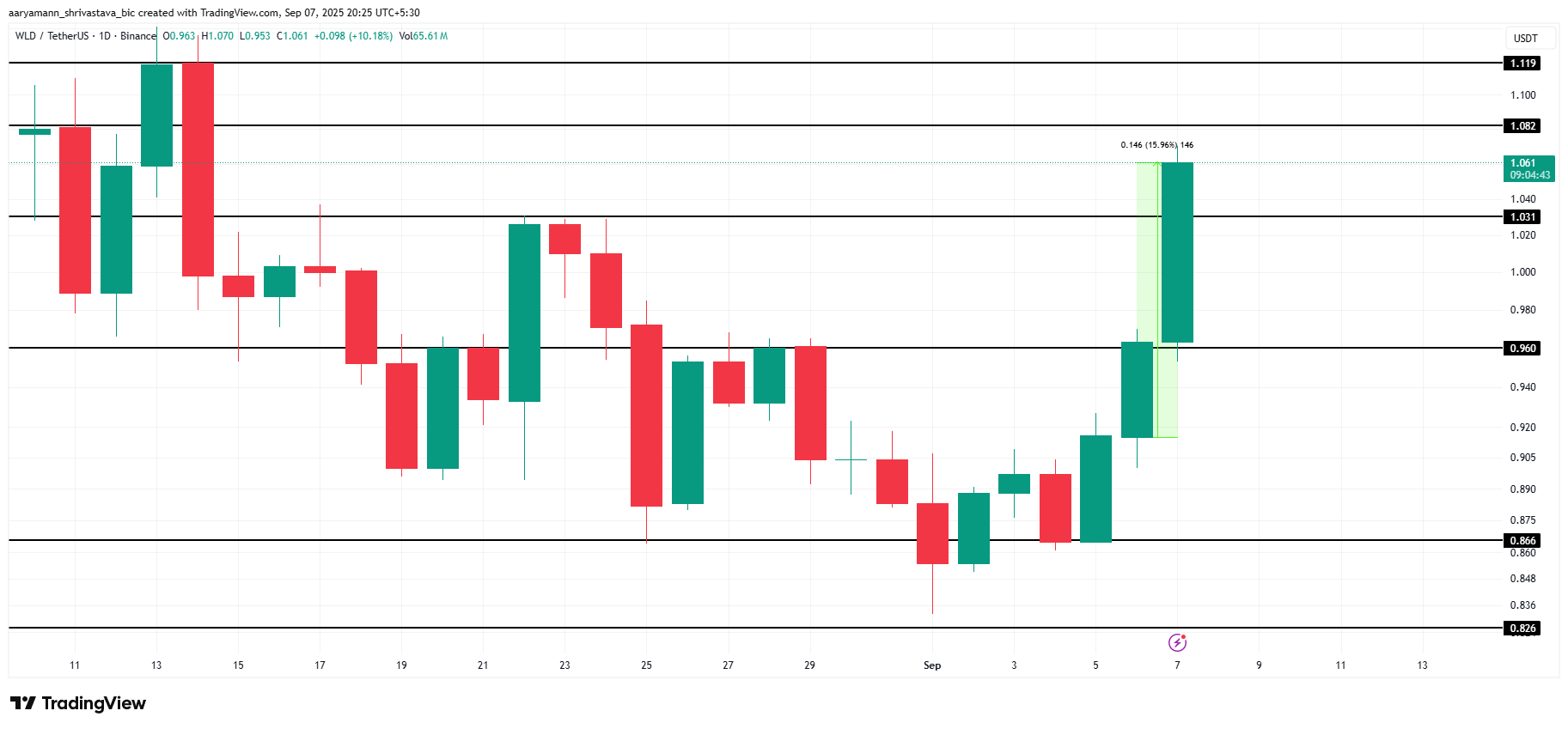

WLD Price Can Continue Rising

WLD climbed by nearly 16% over the last 24 hours, emerging as one of the best-performing altcoins. The altcoin is changing hands at $1.06, with $1.08 acting as a key barrier that may shape its immediate price direction.

The factors mentioned above suggest that WLD could note a successful breakout above $1.08, pushing it toward $1.11, marking a monthly high. This WOULD likely boost investor sentiment and potentially draw further capital into the asset.

On the other hand, profit-taking could reverse the recent rally. If selling pressure builds, WLD may retreat to $1.03 or lower to $0.96, wiping its recent gains and invalidating the bullish thesis.