Non-USD Stablecoins Explode as Markets Soar and Local Adoption Accelerates

Forget dollar dominance—alternative stablecoins are stealing the spotlight as global markets rally and regional adoption hits new highs.

Local Markets Fuel the Fire

From Asia to Latin America, non-USD pegged tokens are gaining serious traction. Traders and businesses are ditching traditional dollar-based options for homegrown alternatives that better serve local economies and regulatory frameworks.

Market Momentum Builds

Rising crypto valuations are pushing demand for stable assets—but not all stablecoins are created equal. Investors are diversifying beyond USDT and USDC, seeking exposure to euro, yen, and emerging market-pegged tokens that offer hedging advantages and local settlement efficiency.

Adoption Beyond Speculation

Real-world usage is driving this surge. Payment processors, remittance services, and even local governments are experimenting with non-USD stablecoins for everyday transactions—because nothing says financial innovation like creating digital versions of existing fiat currencies with extra steps.

This isn't just a flash in the pan—it's a fundamental shift in how global crypto markets operate. Dollar dominance? Maybe not so stable after all.

Non-USD Stablecoins on the Rise

Dollar-based stablecoins are highly prominent for obvious reasons; they represent the largest token platforms. President TRUMP even wants to include them in US fiscal policy, prompting new integrations.

Still, non-USD stablecoins have also been growing, and some new analysis illustrates this:

Non-USD stablecoins aren’t just a side story anymore.

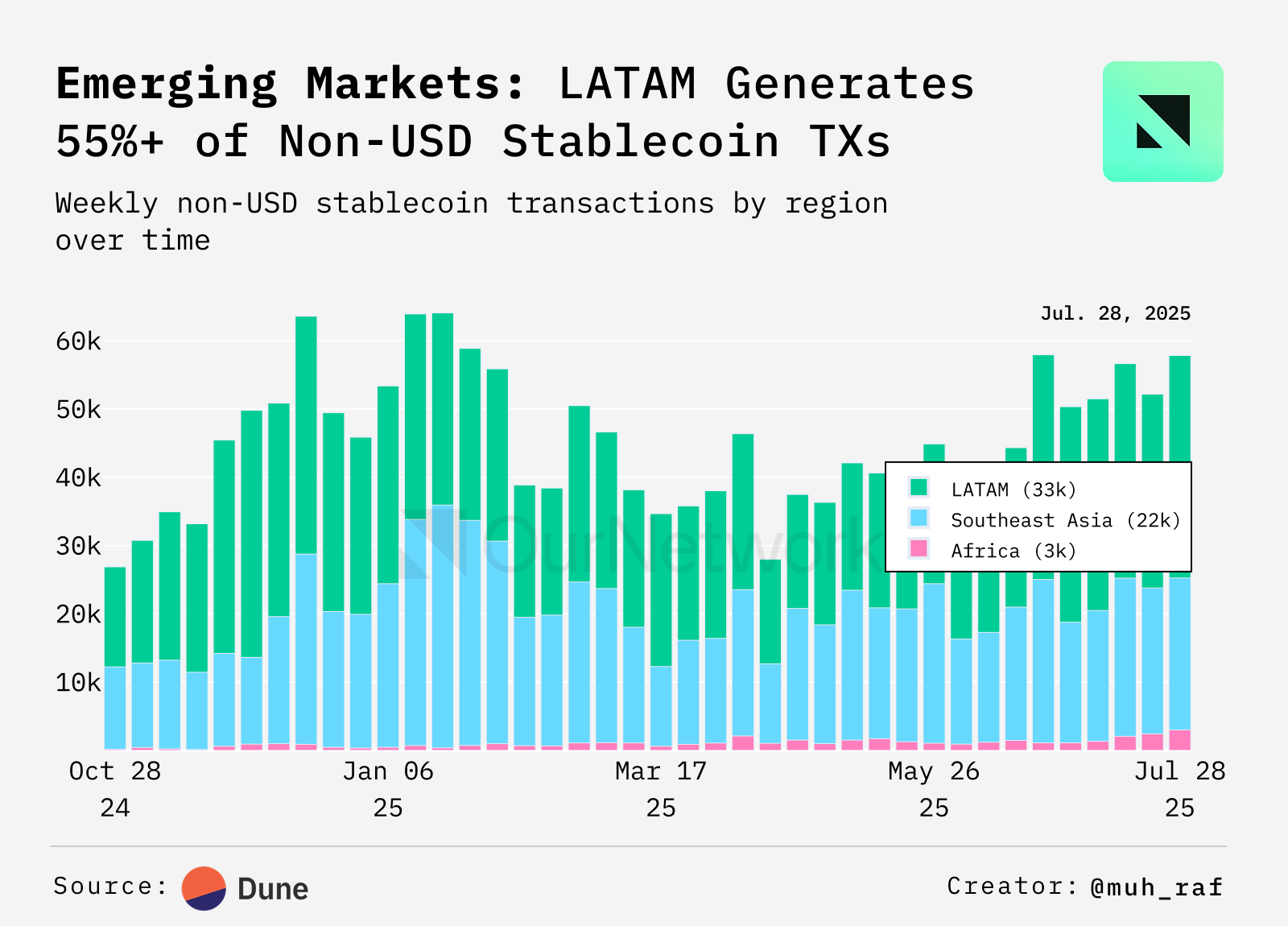

From Q4 2024 to August 2025, 23 different non-USD stablecoins across Southeast Asia, LATAM, and Africa pushed 20k+ weekly transactions, with peaks above 60k in early 2025.

> The biggest drivers: SGD- and BRL-pegged… pic.twitter.com/cxMgHmP8u1

Stablecoins based on the Euro have drawn a lot of attention and partnerships, especially due to MiCA regulations. Asia, too, has been growing as a region, and China is even considering a new stablecoin despite its anti-crypto policies.

Latin America, however, is currently the biggest adopter of non-USD stablecoins, thanks to Brazil leading the way.

On-chain data shows that non-USD stablecoins grew consistently in H1 2025; 23 such assets enjoy more than 20,000 weekly transactions. Latin America represents 55% of this entire market, representing more activity than Southeast Asia and Africa combined.

Multiple New Potential Opportunities

Additionally, Polygon is the preferred blockchain for these non-USD stablecoins, representing a whopping 70% of this market. For most of the last year, it has hosted more than 4,000 active addresses every week, blowing competitors like Base, BNB, and ethereum out of the water.

If the market keeps growing, this niche could significantly boost Polygon.

There are some key reasons why this bullish scenario might play out. Over the years, the crypto community has put a lot of hope on practical use cases like cross-border remittance payments. Major cryptocurrencies like Bitcoin and Ethereum have transformed into store-of-value assets, rather than payment methods.

Although outreach programs repeatedly try to encourage local BTC adoption, regular usage remains low even in the most pro-crypto jurisdictions. Non-USD stablecoins, however, may have an advantage here.

These assets can’t have speculative value, and conducting everyday payments in local currency may be more practical than converting to USD.

Additionally, they take better advantage of crypto’s decentralized capabilities, bucking the overwhelming centralization trend in today’s market.

Still, compared to the gargantuan size of platforms like Tether and Circle, 20,000 weekly transactions seem very small. Non-USD stablecoins have a long way to go if they’re going to impact the broader markets.

However, this niche use case is powering practical adoption, which may give it a distinct advantage in the long run.