3 Altcoins Set to Explode in August 2025’s Final Week

Markets churn as institutional money plays musical chairs—but these three altcoins just might outperform the traditional finance dinosaurs.

BNB: Exchange Token Powerhouse

Binance's native token keeps defying regulatory headwinds. Recent chain upgrades slash transaction costs while new partnership announcements keep coming weekly. The ecosystem expands while traditional banks still debate whether crypto accounts need 27-page disclosure forms.

Ethereum Killer Nears ATH

This scalable smart contract platform bypasses Ethereum's gas fee problems entirely. Developer activity spikes 200% month-over-month as institutional validators pile in. Mainnet upgrade scheduled for Thursday could trigger massive position stacking.

AI-Powered Dark Horse

Machine learning meets decentralized trading. Protocol uses predictive algorithms to outperform human traders—and does it without the seven-figure Wall Street bonuses. Trading volume tripled since last Fed meeting as algo-strategies crush emotional decisions.

Watch these three as August closes. They're rewriting finance while traditional institutions still use fax machines.

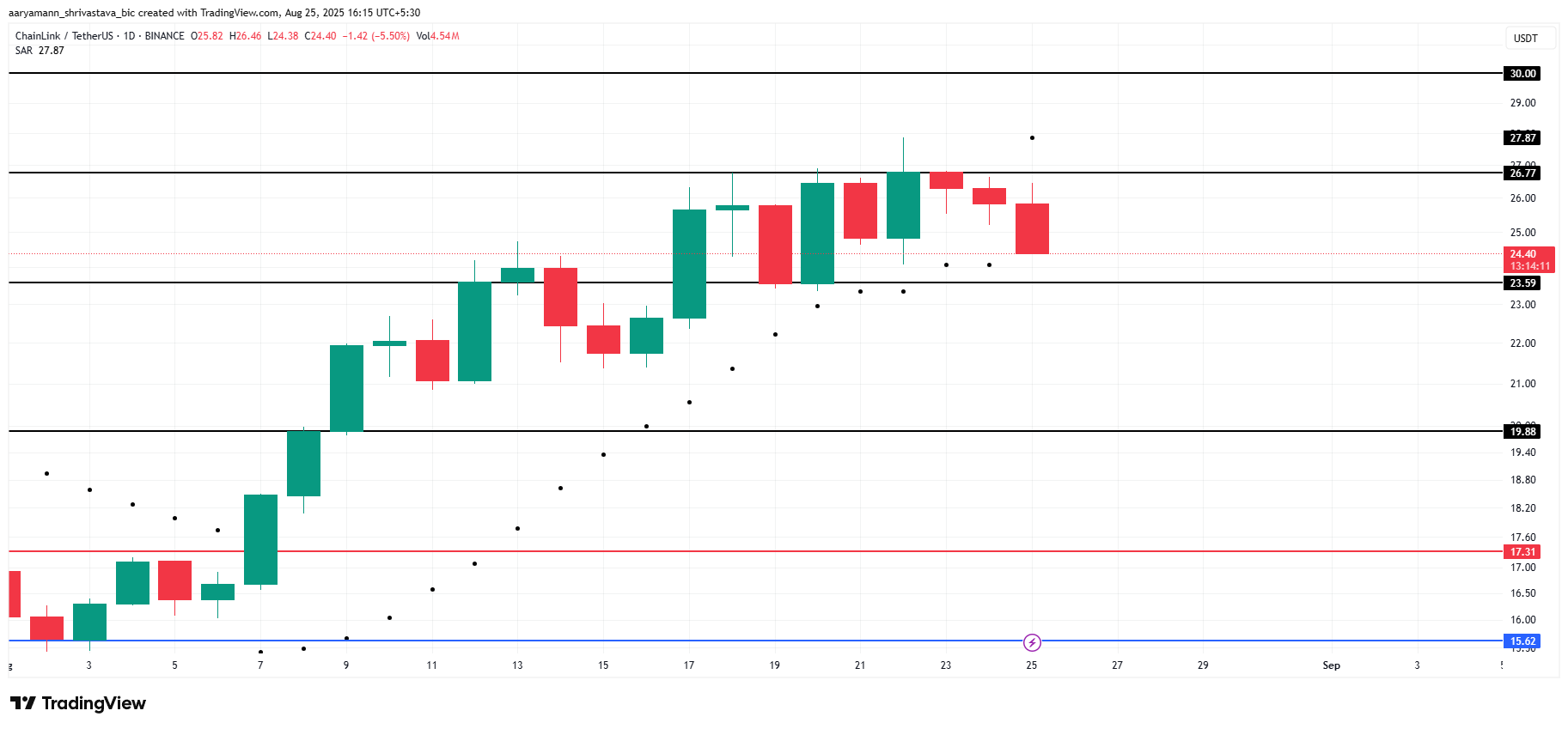

Chainlink (LINK)

LINK is currently priced at $24.4, experiencing a downtrend. The Parabolic SAR indicator above the candlesticks confirms the bearish sentiment, signaling potential continued downside. However, the market could shift if positive catalysts or investor sentiment change in the NEAR future, prompting a potential reversal in the trend.

Chainlink recently announced a significant partnership with SBI Group, one of Japan’s largest financial conglomerates. With over $200 billion in total assets, this collaboration will focus on tokenized funds, real-world asset tokenization, and stablecoins. This strategic alliance positions LINK to benefit from new use cases, potentially boosting the altcoin’s market value.

Sign up for Editor Harsh Notariya’s Daily crypto Newsletter here.

The partnership could help LINK maintain support at $23.5, with the potential for a bounce back to $26.7. If successful, the positive news may help stabilize the price and attract additional investor interest. However, if the announcement fails to deliver expected results, the alcoin might breach $23.5 and decline to $19.8, signaling further bearish pressure.

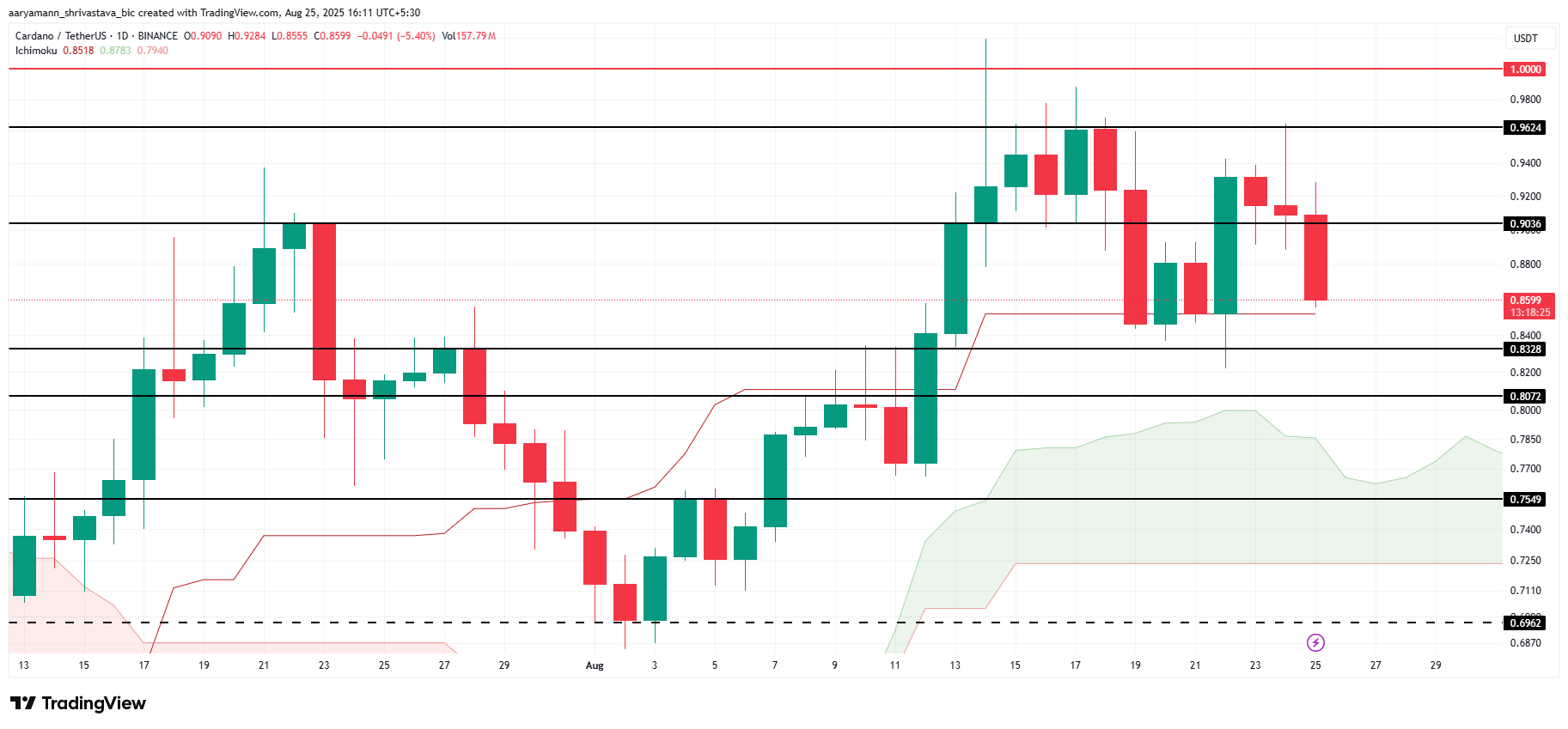

Cardano (ADA)

Cardano’s price is currently $0.85, holding steady above the $0.83 support level. The Ichimoku Cloud shows a bullish outlook, suggesting positive momentum for ADA. Investors are keeping a close eye on price movements, with potential for further gains if market conditions remain favorable for the altcoin.

A key catalyst for potential price growth is the upcoming audit report of Input Output Global’s ADA holdings. Charles Hoskinson, Cardano’s founder, requested the audit to address transparency concerns after allegations of $600 million in misappropriated ADA. The report could play a crucial role in boosting investor confidence and market sentiment.

If the audit report meets investor expectations, ADA could see a price increase, potentially pushing it to $0.90. Successfully securing this level as support may pave the way for further gains, reaching $1.00. Such a move WOULD solidify Cardano’s position and help avoid a drop below the $0.83 support level.

Curve DAO Token (CRV)

CRV is currently priced at $0.828, holding above the critical support of $0.822. Despite the recent decline, the altcoin has seen a loss of the 50-day EMA. This technical shift suggests potential bearish pressure, but market conditions could quickly change depending on upcoming factors, including halving events.

A possible reversal is anticipated as CRV’s halving settles in, which could reduce supply and trigger price gains. As fewer coins enter circulation, demand could push the price higher, potentially targeting $0.93 or even $1.03.

If CRV fails to recover, it risks slipping below $0.82, which would expose it to further downside risk. A decline below this level could push the price down to $0.70, invalidating the current bullish outlook and reinforcing bearish sentiment.