Ethereum’s Price Plunge Below $3,000: These Holders Are Capping the Rally

Ethereum teeters on the brink—whale movements signal a looming drop below the psychological $3,000 mark.

Who's Selling Now?

Large holders are quietly building distribution patterns near recent highs, creating textbook resistance. Their profit-taking isn't panic—it's calculated, draining momentum just as retail optimism peaks.

The Domino Effect

Once $3,000 breaks, stop-losses trigger cascading liquidations. Exchanges see mounting sell pressure; leveraged longs face a brutal squeeze. The 'smart money' exits first—always does.

Finance's Ironic Twist

Traditional analysts, who months ago dismissed crypto as a 'bubble,' now cite these same sell-offs as proof of instability. Funny how that works—almost like they profit both ways.

Bottom line: markets cycle. Today's top is tomorrow's buying opportunity—if you've got the nerve to catch the falling knife.

Ethereum Holders Could Cause A Crash

Long-term holders (LTHs) of Ethereum are currently seeing a surge in profits, as indicated by the MVRV Long/Short Difference, which has reached a yearly high. Normally, when this indicator falls deep into the negative zone, it signals that short-term holders (STHs) are gaining profits, making them prone to selling.

However, Ethereum’s indicator is in the positive zone, suggesting that LTHs are enjoying substantial profits. This positive movement generally signals strength but can also indicate that LTHs may consider taking profits, leading to potential selling pressure.

The ongoing profit for LTHs puts Ethereum in a precarious position. As these holders are sitting on substantial gains, their decision to sell could exacerbate downward price movement.

Sign up for Editor Harsh Notariya’s Daily crypto Newsletter here.

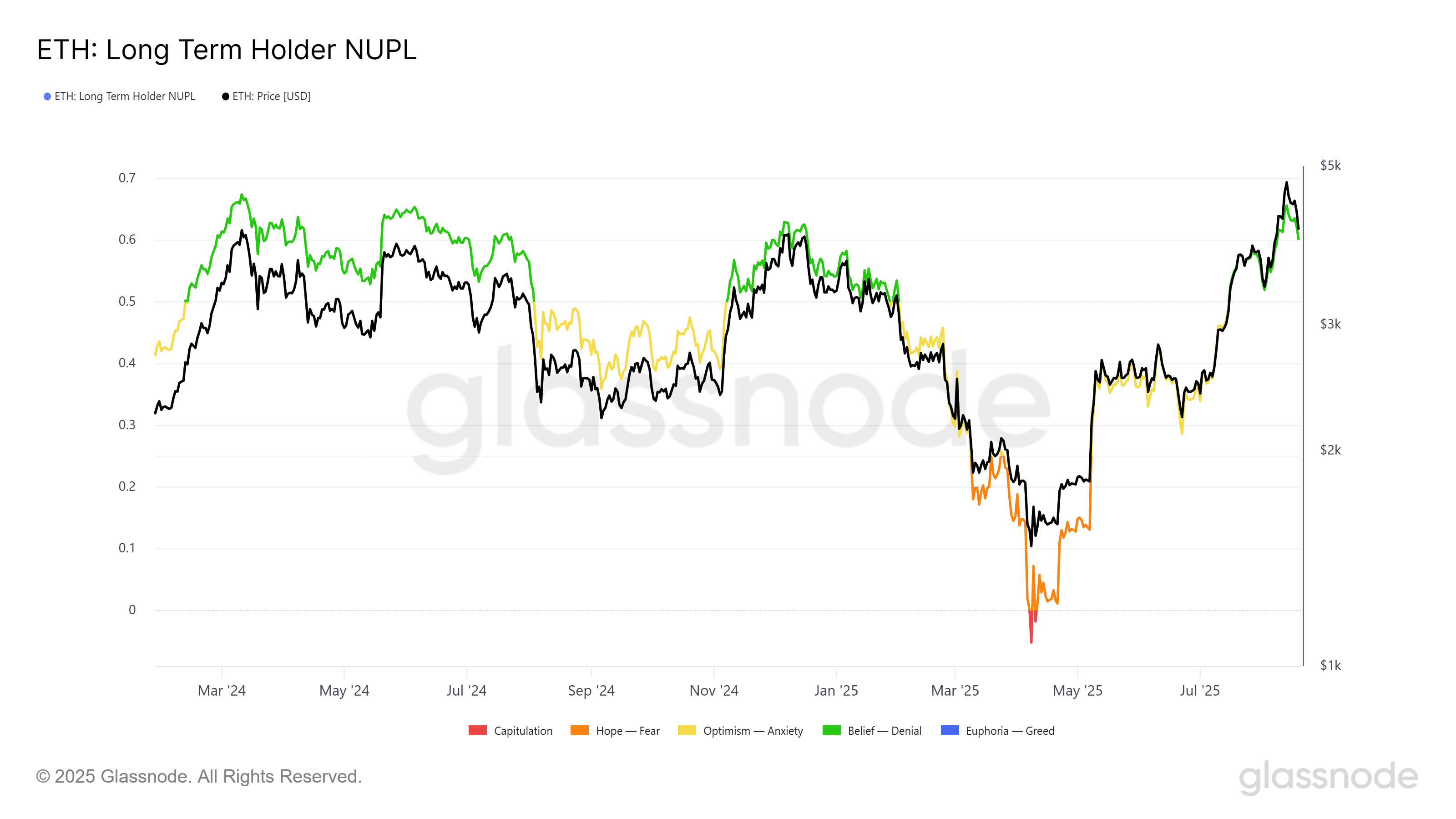

Ethereum’s LTH NUPL (Net Unrealized Profit/Loss) is currently at an 8-month high, reflecting a historical pattern. The NUPL indicator shows the difference between realized profits and losses for long-term holders, and the recent rise suggests significant gains for these holders.

However, historical trends show that when the NUPL crosses the 0.60 mark, Ethereum’s price has faced a reversal. This indicates that Ethereum could experience a price decline if the current trend continues, as the profits noted by LTHs might encourage them to sell.

With Ethereum’s LTH NUPL at an elevated level, there’s an increased likelihood that long-term holders may sell their positions, amplifying the market correction. The past has shown that this is a strong signal for potential price drops, and Ethereum may be poised for a similar scenario.

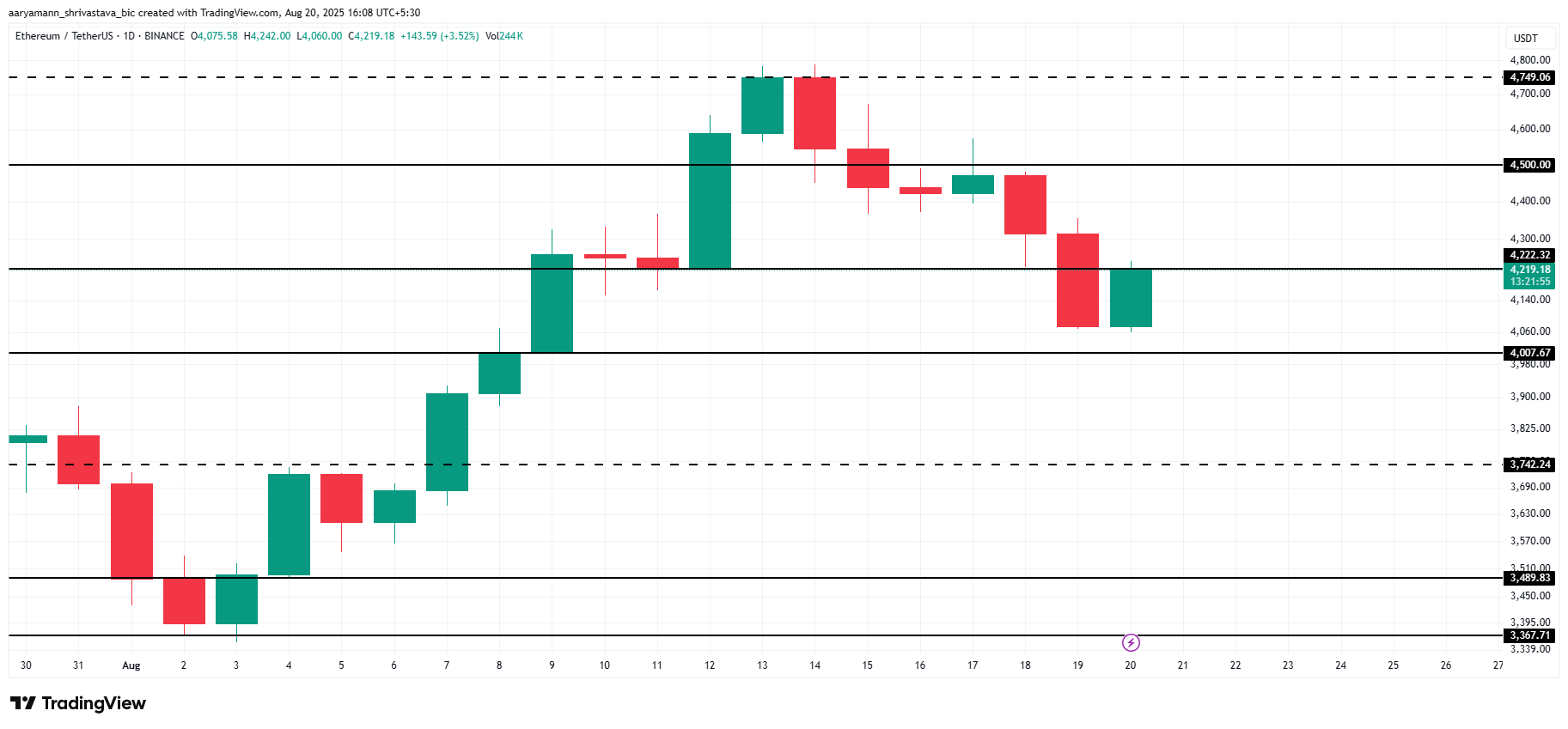

ETH Price May Drop to $3,000

Ethereum’s price has already seen a decline, with the current price at $4,219. If the downtrend continues, it could fall below the key $4,000 level. The larger concern, however, is the potential drawdown caused by long-term holders deciding to sell. If the LTHs start taking profits, it could put significant pressure on Ethereum’s price.

Looking at Ethereum’s past price movements, the NUPL indicator shows that when LTHs created a market top, Ethereum’s price dropped below $3,000, reaching lows of around $2,800. If this pattern repeats itself, Ethereum’s price could experience a similar decline, making $3,000 a critical level to watch.

On the other hand, if Ethereum’s LTHs hold onto their positions and resist selling, the market could see a bounce. If Ethereum manages to reclaim support at $4,222, it could push back toward $4,500, potentially invalidating the current bearish outlook. This WOULD depend on whether the LTHs remain confident and do not trigger further selling pressure.