Bitcoin’s 2025 Bull Run Charges On—Analyst Confirms Altseason Is Approaching Fast

Bitcoin’s 2025 rally isn’t just holding strong—it’s setting the stage for a full-blown altcoin explosion. Market analysts remain bullish as momentum builds and investor sentiment swings firmly toward risk-on mode.

Signs of Altseason Brewing

Small and mid-cap tokens are beginning to outperform. Trading volume is spiking, social chatter is frenzied, and even your uncle who still thinks 'blockchain' is a workout trend is asking about Ethereum. Classic markers of an altseason are here—though whether it’s genius or gambler’s logic depends who you ask.

Institutional Hold Tightens

Big money isn’t blinking. Funds continue stacking SATs while derivatives markets flash green. The “number go up” theology feels almost religious at this point—even the usual Wall Street skeptics are quietly rebalancing into crypto ETFs. Funny how double-digit returns soften even the hardest traditionalist stance.

Timing the Tops and the Drops

Nobody rings a bell at the top, but everyone’s sure they’ll hear it. Right now, the music’s still playing. If history’s any guide—and in crypto, it barely ever is—the real altseason party is just getting started. Just don’t be the one left holding the bags when the DJ leaves.

Bitcoin’s current range and support

Atlas noted that Bitcoin is trading between $102,000 and $115,000, with potential sweeps down to $105,000 or even $102,000 before continuation. The key threshold remains $100,000 support – as long as this level holds, the bull cycle stays intact. A breakdown below would shift the structure, but probabilities still favor further upside.

Macro backdrop and liquidity triggers

The macroeconomic landscape explains why bitcoin hasn’t yet exploded to fresh highs. Atlas highlighted tariffs feeding inflation and keeping policymakers cautious. However, Powell’s Jackson Hole confirmation of September rate cuts has restored confidence, with FedWatch odds for a cut surging to 91%. This liquidity injection, he argues, is the green light markets have been waiting for.

BTC dominance rolls over as ETH strengthens

Bitcoin dominance peaked earlier in the summer and is now rolling over. Atlas pointed to Ethereum’s strength through ETF inflows, staking demand, and real-world asset (RWA) hype. Altcoins are holding key supports instead of collapsing, a sign of resilience compared to past corrections. This rotation signals that the final growth phase is underway.

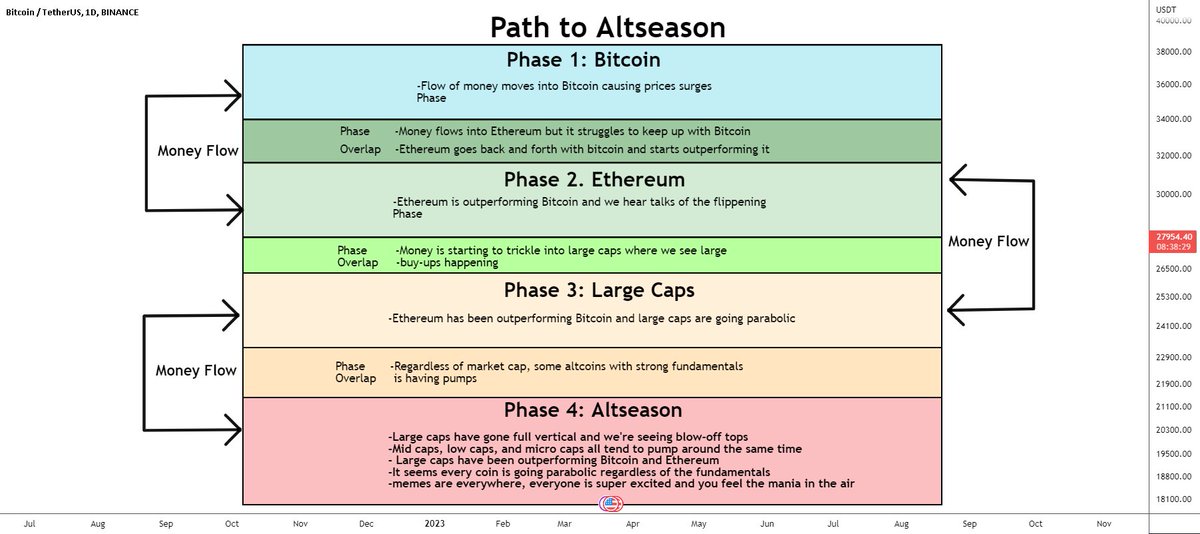

Path to altseason

Atlas broke down the classic FLOW of capital in bull markets:

- Phase 1: Bitcoin leads.

- Phase 2: Ethereum outperforms.

- Phase 3: Large-cap alts pump.

- Phase 4: Full altseason with widespread parabolic moves.

Historically, 2017 and 2021 both delivered 30–40 day altseasons after Bitcoin topped. The same structure is now repeating almost week by week, according to Atlas.

READ MORE:

What comes next?

Atlas cautioned that cycles don’t end quietly. True tops usually arrive with mania and euphoria, neither of which is visible yet. Retail inflows remain muted, suggesting this rally has room left. He expects 2–3 sharp dips before altseason’s blow-off, advising traders to scale into fear and scale out into strength.

With BTC still below its all-time high against gold, ETH outperforming, and altcoins holding strong, Atlas concludes the bull run remains intact. The final rotation into altseason may be on deck heading into Q4 2025.

![]()