Short-Term Holders Signal Bitcoin Rebound With Aggressive Buying

Short-term Bitcoin holders just went all-in—loading up on BTC as prices dipped below key support levels. Their aggressive accumulation pattern suggests they're betting big on an imminent rebound.

The Contrarian Play

While institutional players hesitated, retail traders and short-term speculators pounced. They scooped up coins at levels traditional finance would call 'risky'—proving once again that crypto markets dance to a different beat than Wall Street's spreadsheets.

Timing the Bounce

This isn't blind optimism. These buyers typically operate on tighter timeframes and quicker triggers. Their coordinated entry hints at technical signals or sentiment shifts the broader market might've missed—or simply dismissed as noise.

Market Mechanics in Motion

Increased buying pressure from this cohort could trigger short squeezes, force liquidations, and create reflexive upward momentum. It’s the kind of market dynamic that leaves traditional analysts scratching their heads—and fund managers scrambling to explain missed entries.

Because nothing says 'sound investment strategy' like following the crowd that changes its mind faster than a TikTok trend.

Short-Term Holders Are Still Buying the Dip

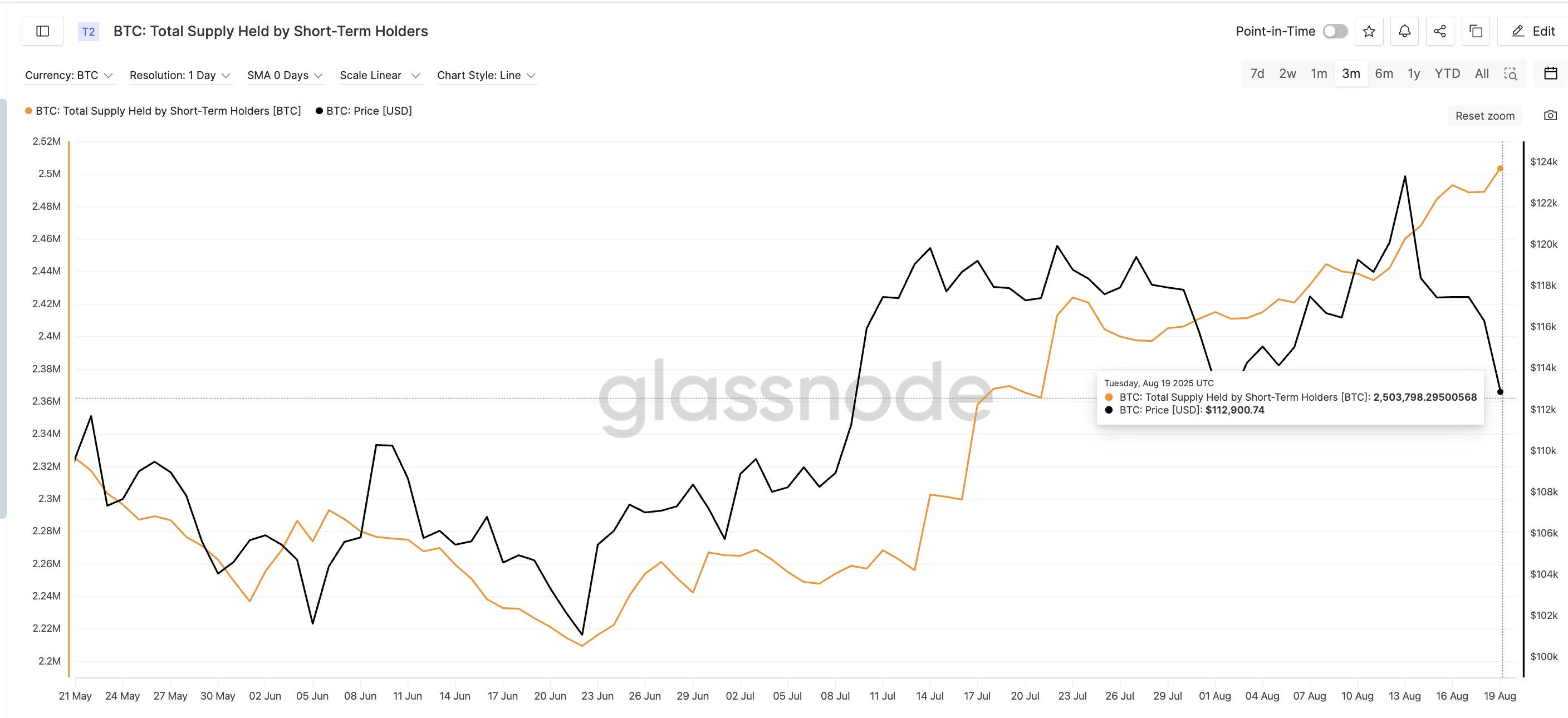

Over the past few days, short-term holders, wallets that acquired Bitcoin within the past 155 days, have increased their supply even as prices dropped. As of now, this group holds 2,503,798 BTC, up from 2,460,514 BTC just seven days back.

That’s an accumulation of more than 43,000 BTC during a sharp price correction from $123,000 to $112,000. Interestingly, the short-term holder supply is now at a 3-month high.

This trend mirrors a similar pattern seen in early June. At that time, when the Bitcoin price fell from $105,900 to $104,700, short-term holders raised their supply from 2,275,000 BTC to nearly 2,287,000 BTC. After that accumulation, the Bitcoin price climbed all the way to $110,000.

This repeat behavior, where new holders increase their exposure during a price dip, is often seen as a show of confidence in a short-term bounce.

: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily crypto Newsletter here.

Selling at a Loss, But Still Buying

At the same time, short-term holders have shown a willingness to take losses for buying new BTC dips, something they rarely do unless they expect a rebound.

The Short-Term Holder Spent Output Profit Ratio (SOPR) dropped to its lowest point in over a month on August 18. This means that, on average, coins spent by this group were sold for less than they were acquired. In simpler terms: they’re selling at a loss.

At press time, the SOPR continues to stay under 1.

SOPR, or Spent Output Profit Ratio, is a metric that compares the price at which a Bitcoin was sold with the price at which it was bought. When the SOPR for short-term holders drops below 1.0, it means this group is realizing losses on average.

This is often seen as a bottoming signal. In early August, a similar SOPR drop (from 1.00 to 0.99) occurred just before bitcoin reversed from $114,000 to a new high near $123,000. Back then, selling at a loss showed that short-term holders had capitulated; a necessary shakeout before a rally could begin.

Even though some holders accept losses, overall supply among short-term wallets is still increasing. This combination, more buyers stepping in while some take losses, suggests a shift in sentiment. It’s not panic selling.

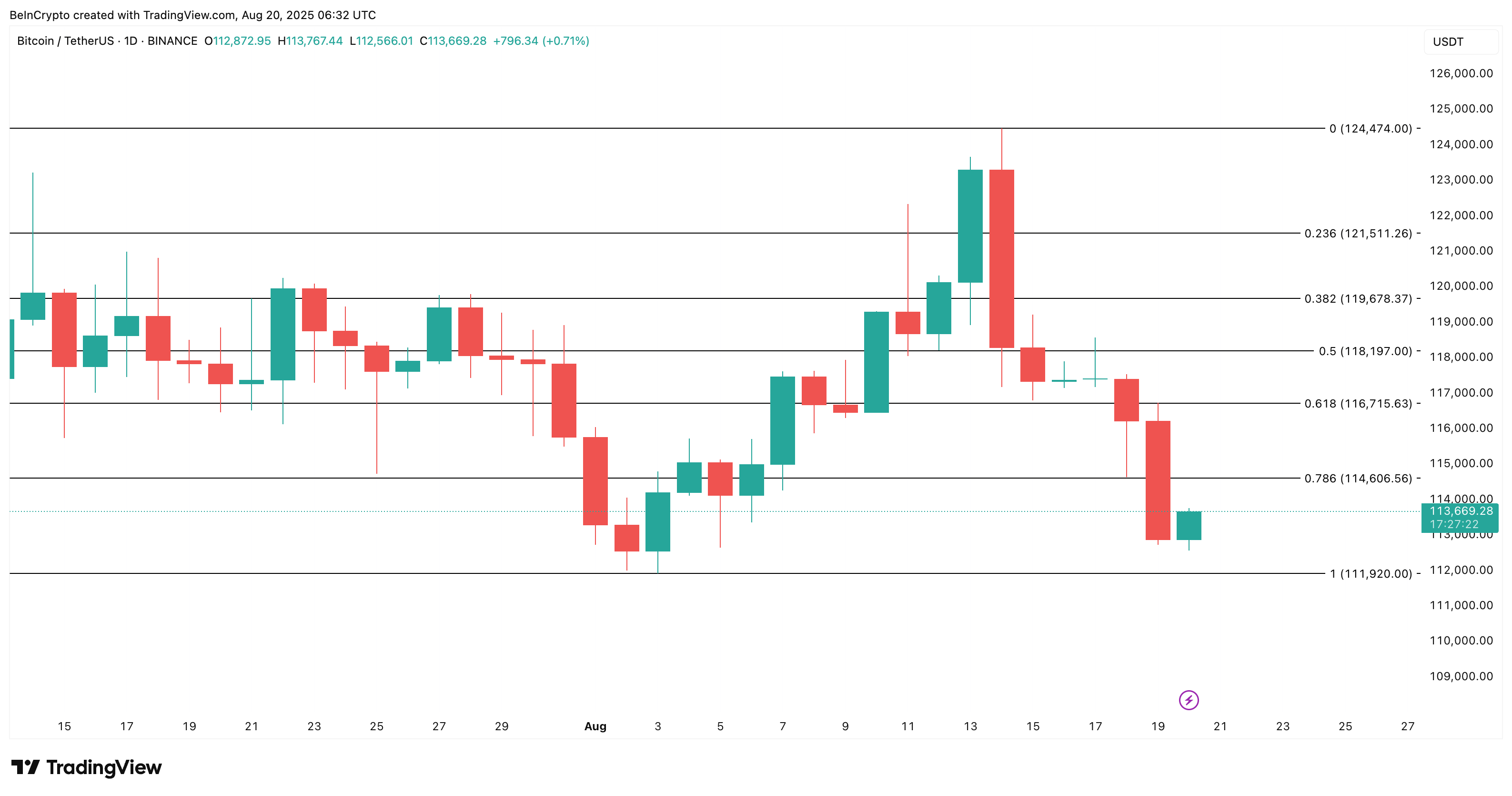

Bitcoin Price Recovery Hinges on One Level

Bitcoin price is still under pressure, but there are signs that a reversal may be taking shape. The price bounced slightly to $113,600 today but remains down 1.3% on the 24-hour chart. The strongest nearby support sits around $111,900. If that level holds, a recovery could begin soon.

On the upside, the immediate resistance is around $114,600. The next significant hurdles lie at $116,715 and $118,197; the latter being a key pivot from previous swing highs. A clean breakout above $118,200 WOULD confirm that momentum is back in favor of the bulls.

When this exact short-term holder setup occurred in the past, rising short-term supply and negative SOPR, it often marked a local bottom. The previous case led to a rally of over $10,000 within days.

If the current pattern repeats, the bitcoin price may be gearing up for another push higher. But if it breaks lower and loses the $111,900 level, a deeper correction could follow, invalidating the bullish hypothesis.