AERO Surges 4% in Market Rally—Can It Defy the Weekend Selloff Curse?

AERO's leading the charge with a 4% pump—classic Friday optimism or sustainable momentum?

Market rallies love a weekend reality check. Traders are watching to see if this altcoin can dodge the usual Saturday slump.

Pro tip: Never trust a green candle placed by hedge funds before their Hamptons brunch.

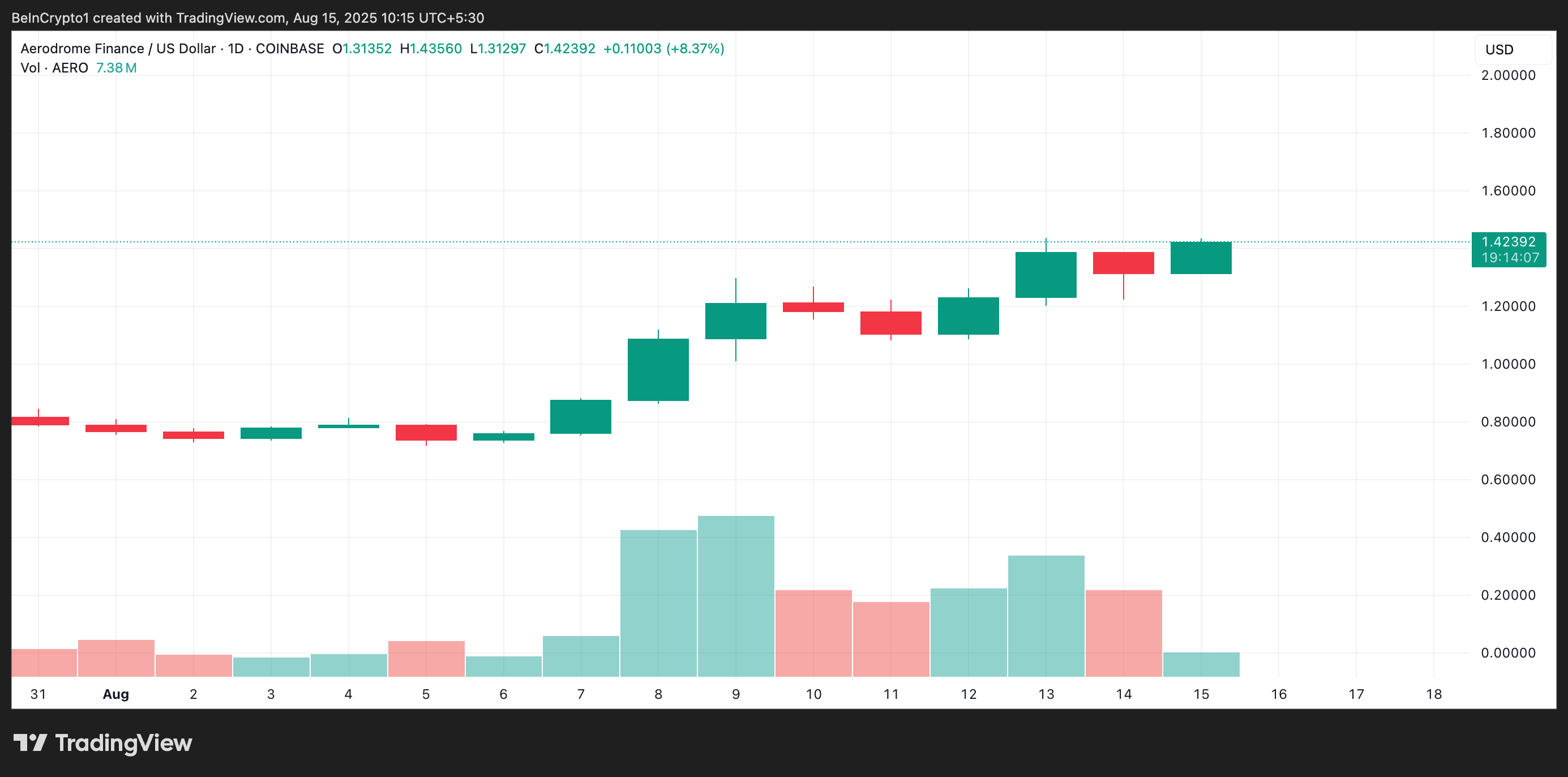

AERO’s Rally on Thin Ice as Trading Activity Drops

AERO’s 4% daily rally is accompanied by a 23% dip in its trading volume, totaling $162.41 million as of this writing. This forms a negative divergence, indicating that a few market participants support the upward move.

: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily crypto Newsletter here.

When an asset’s price rises while trading volume falls, it signals a weakening rally. In healthy, sustainable uptrends, price gains are usually backed by increasing volume, which reflects strong buying interest and broader market conviction.

However, as with AERO, declining volume during a rally indicates that the price uptick is driven by short-term speculative trades rather than genuine demand. This leaves the altcoin more vulnerable to sudden pullbacks if selling pressure emerges.

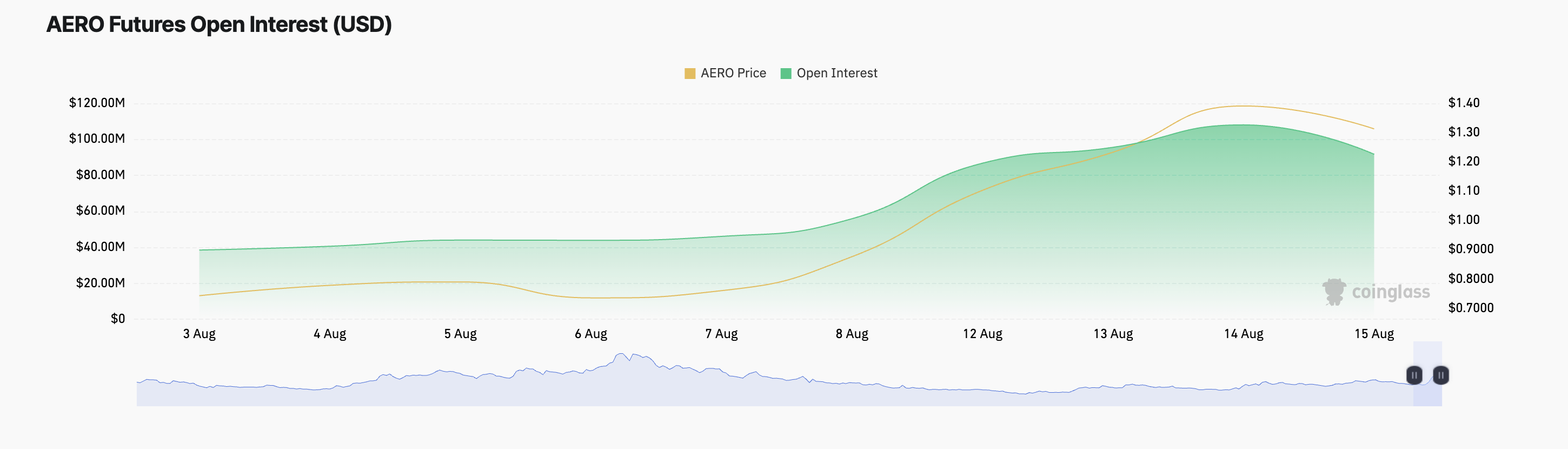

Moreover, the drop in AERO’s futures open interest adds weight to the bearish outlook. According to Coinglass, the token’s futures open interest currently stands at $97 million, down 16% in the past 24 hours.

Open interest measures the total value of outstanding futures contracts that have not yet been settled. Rising open interest alongside a price increase signals that new money is flowing into the market, indicating strength.

Conversely, a decline in open interest during a price rally means that traders are closing positions rather than opening new ones, suggesting reduced conviction in the move.

This trend also confirms that AERO’s attempted rally over the past day is being supported by a shrinking pool of traders, raising the risk that the rally could fade in the coming session.

Will Bulls Break $1.56 or Bears Drag It to $1.08?

AERO currently trades at $1.42, holding above the support floor at $1.31. The altcoin risks testing this price floor if bearish sentiment continues to climb. Failure to defend this position could trigger a deeper decline toward $1.06.

However, if the bulls regain dominance and real demand for AERO resumes, its price could extend its rally to $1.55. A breach of this level could open the door for a rally toward $1.85.