Whales on the Move: Why Bitcoin is Flooding Into Binance – Weekly Whale Watch

Crypto's big players are making waves again—this time, parking Bitcoin on Binance in what looks like a high-stakes game of hot potato. Is it accumulation? Liquidation? Or just whales being whales?

The Binance magnet: Exchange wallets are swelling as institutional players and OGs shift BTC en masse. No one’s blinking—yet.

Timing tells all: Moves coincide with Bitcoin’s tight range—classic whale behavior before volatility strikes. History rhymes, but wallets don’t lie.

The cynical take: Nothing unites crypto’s elite like a centralized exchange when profits are on the line. Decentralization can wait until after the trade settles.

Bitcoin Whales Are Capitalizing

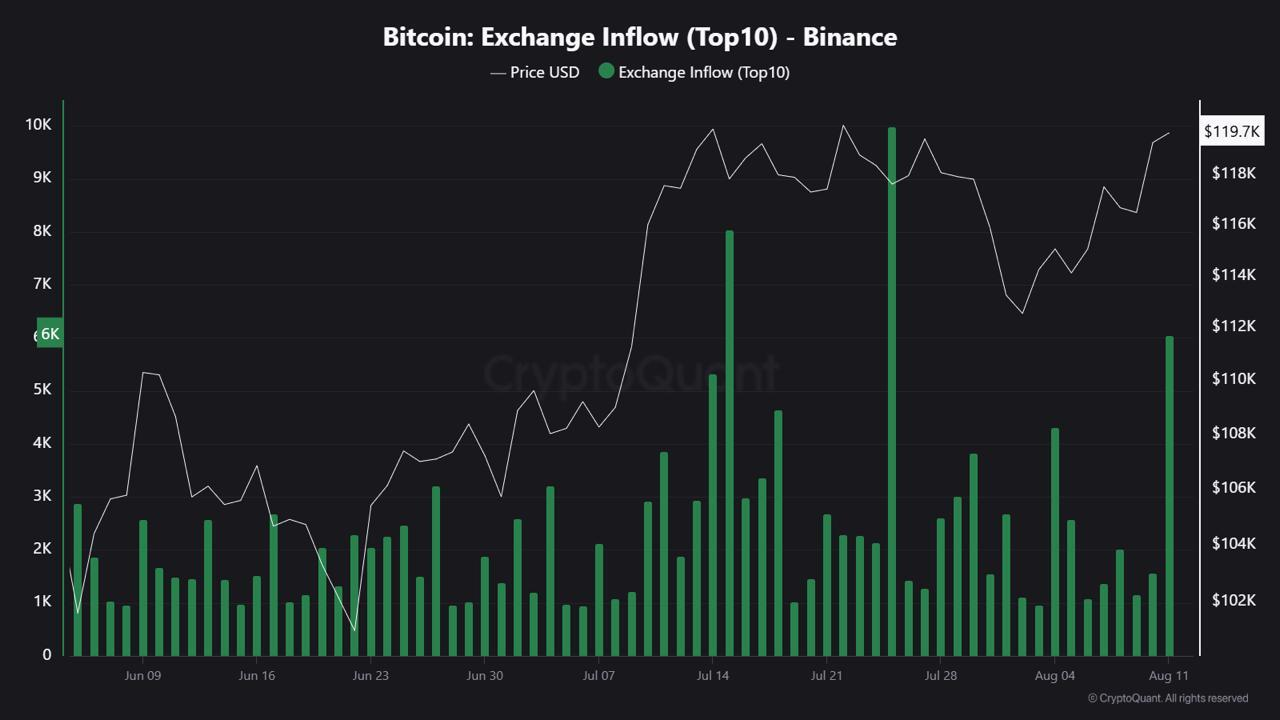

In the past 24 hours, Binance has seen a massive increase in Bitcoin deposits, with 6,060 BTC, worth approximately $722 million, added to the exchange’s balance. This surge primarily comes from whales, according to CryptoQuant’s data.

Analyst JA Maartunn from CryptoQuant notes that recent economic reports, including the US Jobless Claims, PPI, and Retail Sales, are influencing whale behavior.

“It likely a reaction to the increaseed prices and positioning ahead of this week’s economic events,” Maartunn told BeInCrypto.

The rise in Bitcoin’s balance on Binance suggests that whales are taking action amid uncertain economic data. Such behaviors tend to impact the price negatively, as large transactions often signal a shift in sentiment.

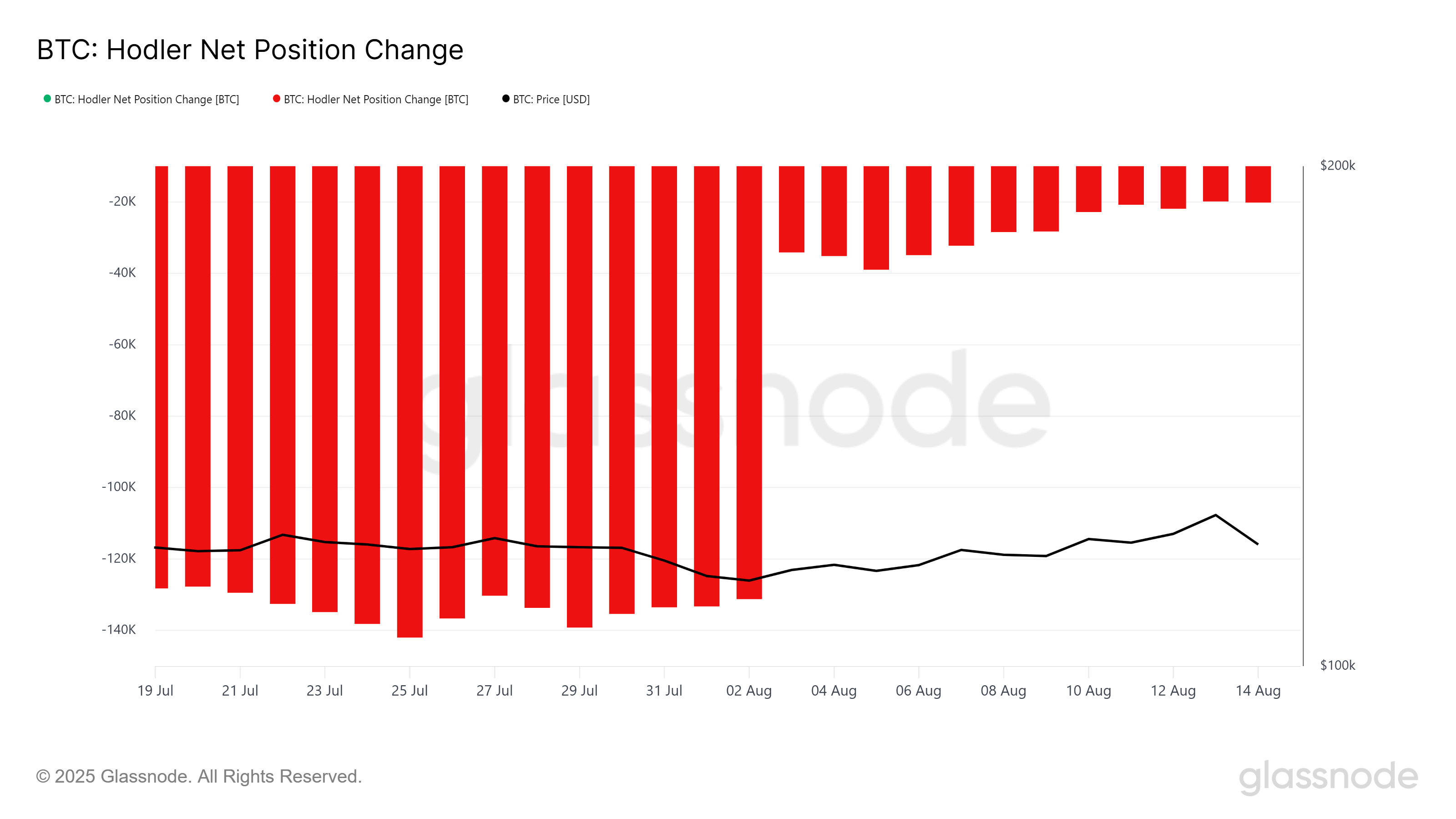

The HODLer Net Position Change is a key metric that tracks the behavior of long-term holders (LTHs). Recently, the HODLer Net Position Change has been moving away from the bearish zone, signaling a decline in selling pressure.

This shift in HODLer behavior is a positive signal, suggesting that major bitcoin holders are staying committed to their positions. Despite the recent ATH and subsequent dip, LTHs are holding firm, which could help stabilize the market and support a potential recovery. This resistance to sell could ultimately contribute to a move back toward higher price levels, such as $122,000.

BTC Price Is Holding On

Bitcoin’s price is currently trading at $119,186 after slipping below the key $120,000 level. The price fell from the recent ATH of $124,474, showing some volatility. Despite this decline, Bitcoin is maintaining support above $119,000, suggesting that the recent dip could be a short-term correction.

Given the mixed market sentiment, Bitcoin could potentially reclaim $120,000 as a solid support level. If the bulls manage to maintain this level, Bitcoin might be able to recover from the recent dip and push towards $122,000.

However, if selling pressure intensifies, Bitcoin’s price may fall through the $117,261 support level. A deeper drop could take the price to $115,000 or lower, which WOULD invalidate the bullish outlook and indicate further market weakness.