July’s Crypto Showdown: Did Binance Traders Stack More Bitcoin or Ethereum?

The battle for bag supremacy just got spicy. While Wall Street hedgies were busy shorting meme stocks, Binance users made their move—picking sides in crypto's ultimate hodl-off. Here's how the chips fell.

The Bitcoin bunker mentality

Digital gold kept its shine as the OG crypto maintained dominance. No surprises here—when markets get shaky, traders still sprint to Satoshi's creation like it's a nuclear bunker.

Ethereum's DeFi edge

But Vitalik's playground didn't go quietly. With gas fees finally behaving (for once), the smart contract giant reminded everyone why it's more than just Bitcoin's nerdy cousin.

The verdict? A split decision that proves crypto's two-horse race is alive and kicking—much to the chagrin of bankers still trying to explain NFTs to their golf buddies.

Ethereum on the Decline, Bitcoin on the Rise: Binance’s Proof of Reserves Report

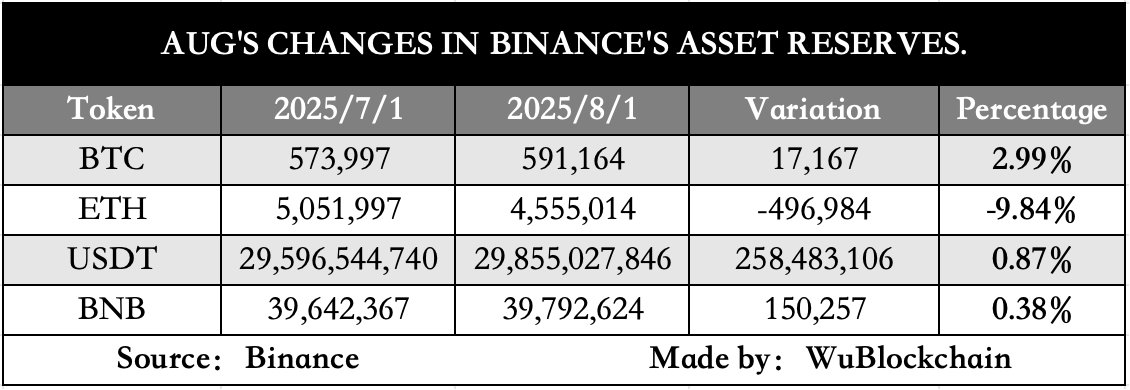

Binance data revealed that users held around 591,164 BTC on the exchange as of August 1, a 2.99% increase from the previous month.

This indicated that users either deposited more Bitcoin or kept a larger portion of their existing Bitcoin on Binance, resulting in an increase of 17,167 BTC. Similarly, balances of Tether (USDT), BNB (BNB), and XRP (XRP) on the exchange also saw growth.

In contrast, users have been reducing their Ethereum holdings on the exchange over the last three months. From June 1 to July 1, Ethereum balances declined by 5.34%.

The decrease was even more significant from July 1 to August 1, with a 9.84% drop, bringing the total to 4.55 million ETH, a reduction of 496,984 ETH.

However, this does not necessarily suggest a loss of interest in Ethereum. When users withdraw assets from an exchange, it can signal increased confidence. Such withdrawals often reflect a long-term holding strategy rather than short-term trading activity.

“BTC + USDT reserves rising = dip buying in full force. ETH supply drop = users moving ETH off exchange, likely to stake or hold,” analyst Cas Abbé wrote.

While retail users adjusted their portfolios, institutional ETH accumulation surged. Data from the Strategic ETH Reserve website highlighted that between June and July, entities increased their holdings from 916,268 ETH to 2.3 million ETH.

In fact, BeInCrypto reported that by the end of July, the reserve had crossed $10 billion.

“ETH treasuries have bought 1% of all ETH in circulation in just two months, double the pace of bitcoin (BTC) buying by corporate treasuries,” Standard Chartered’s Head of Digital Assets Research, Geoff Kendrick, told BeInCrypto in late July.

Players like BitMine Immersion Technologies and SharpLink Gaming are leading this charge, spending billions of dollars to acquire ETH. Moreover, investor confidence in the second-largest cryptocurrency is also quite high.

Ethereum outperformed everything this decade, even Bitcoin and the NASDAQ.$ETH is on another level. pic.twitter.com/b2pvsHY6Be

— Ak47♛ (@HolaItsAk47) August 6, 2025Recently, Fundstrat co-founder and BitMine Chairman, Tom Lee, called Ethereum the ‘biggest macro trade for the next decade.’ Lee also said in a recent interview that there’s a chance, that Ethereum could ‘flip’ Bitcoin in terms of network value.

“The upside case for ETH is actually higher than let’s say Bitcoin did 100x you know could Ethereum do 100x….I think that that could happen because there is probably a non a significant probability that Ethereum could flip Bitcoin as well in terms of network value….if someone thinks Bitcoin’s at a million, then imagine what it means for Ethereum because it is not just Wall Street financializing onto the blockchain, but it’s also part of the US focus on AI dominance, right?,” he remarked.

These remarks indicate a growing preference for ETH due to its varied use cases. Furthermore, they highlight Ethereum’s role as a foundational asset for Web3, reinforcing its appeal to long-term investors.