ETH/BTC at Make-or-Break Level: Is Ethereum Primed to Flip Bitcoin in 2025?

The ETH/BTC pair is coiled like a spring—testing a critical resistance level that could spark the next altseason.

Ethereum's infrastructure dominance vs. Bitcoin's 'digital gold' narrative sets the stage for a volatility surge. Layer-2 adoption and staking yields give ETH fundamental momentum, while BTC maximalists cling to ETF flows.

Watch the 0.06 BTC level—a breakout here historically precedes ETH outperformance. But let's be real: whichever wins, the CEXs will extract rent from both sides.

ETH/BTC Up

The ETH/BTC ratio currently stands at 0.03059. It has fluctuated around its bottom range for nearly a year and is now nearing a key technical resistance level. Every time ETH/BTC hits such lows, it bounces back—a cyclical phenomenon.

An analysis on X also pointed out that this trading pair is approaching resistance at the 0.382 Fibonacci retracement level. This is a point technical traders often interpret as a potential signal for a trend reversal.

In response, another analyst noted that the current market structure of ETH/BTC is very “bullish.”

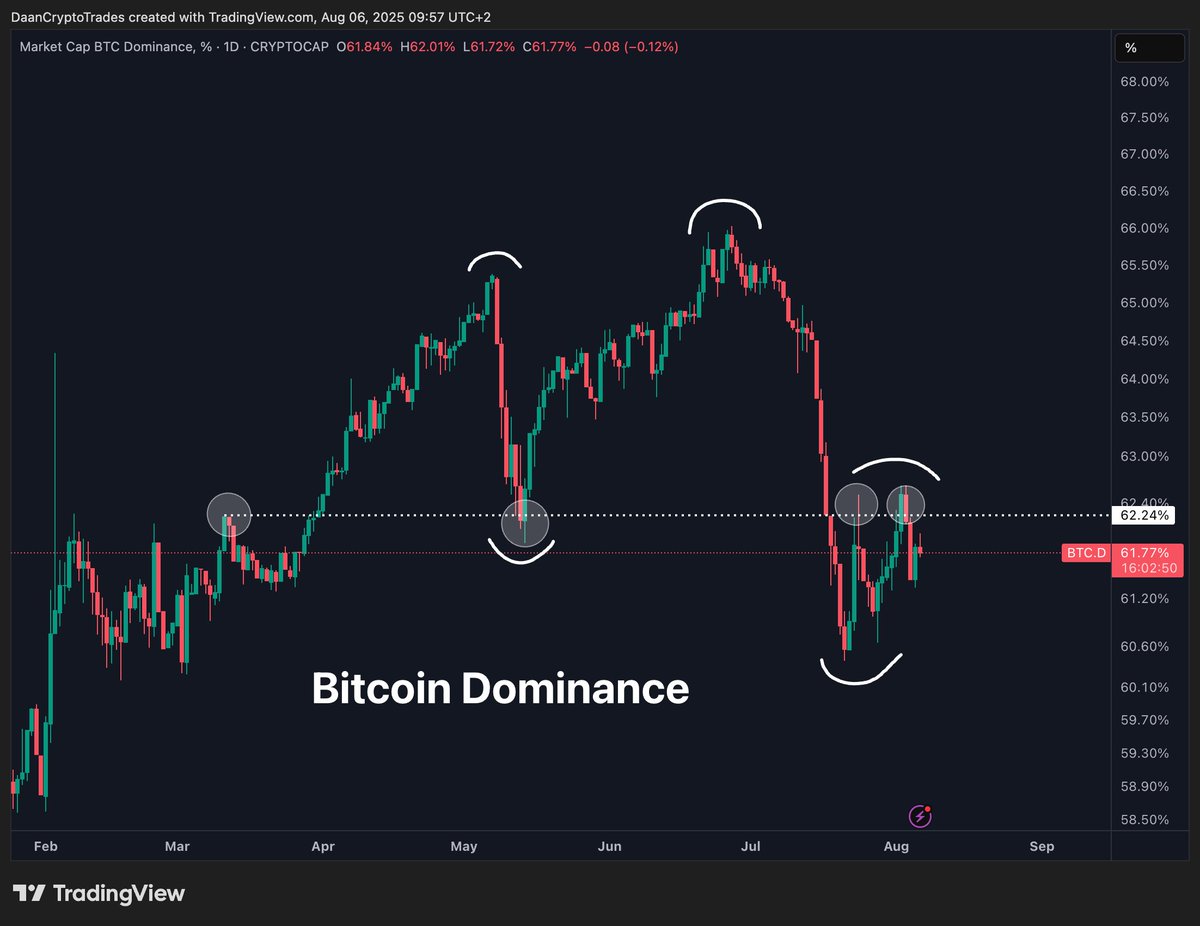

However, for ETH to break out of its sideways trend, another crucial indicator must be closely monitored: bitcoin Dominance (BTC.D). According to MerlijnTrader, BTC.D has started to show signs of weakening, and liquidity is gradually shifting toward altcoins—including ETH.

“Once we see $BTC.D drop and $ETHBTC rise, the real altseason will start,” an analyst on X observed.

That said, the current 62% zone for BTC.D is a sensitive threshold. Analyst Daan cautioned that if BTC.D breaks above this level, the market could swing back in favor of Bitcoin. In that case, ETH might continue to underperform in comparison.

Optimistic Forecasts But Caution

In the current context, veteran analyst Thomas Lee suggested that ETH could reach $16,000—provided that ETH/BTC returns to its 2021 peak (~0.08837). However, this appears to be a long-term price projection.

From another perspective, BitMine BMNR argued that if ETH/BTC maintains the same ratio as in August 2024 (~0.050), then ETH could potentially reach around $5,700 based on BTC’s current price.

“ETH is a far better risk/reward today,” BitMine BMNR remarked.

While many forecasts remain optimistic for ETH, the market appears relatively subdued. According to Polymarket, the probability of ETH setting a new all-time high (ATH) before 2026 is 54%.

At present, ETH is trading around the $3,700 zone. To surpass its ATH from November 2021, ETH WOULD need to grow by approximately 25%.