ENA’s Bull Run Stalls—Negative Funding Rates Signal More Pain Ahead

ENA's rally hits a wall as bearish derivatives data flashes warning signs.

Funding rates dive negative—traders bet against further upside.

Is this a temporary pullback or the start of a deeper correction? Only the market’s infinite wisdom (and leverage) will tell.

Bonus jab: Another day, another crypto asset proving that ‘stablecoin’ is just a suggestion.

ENA Slumps as Sellers Seize Momentum

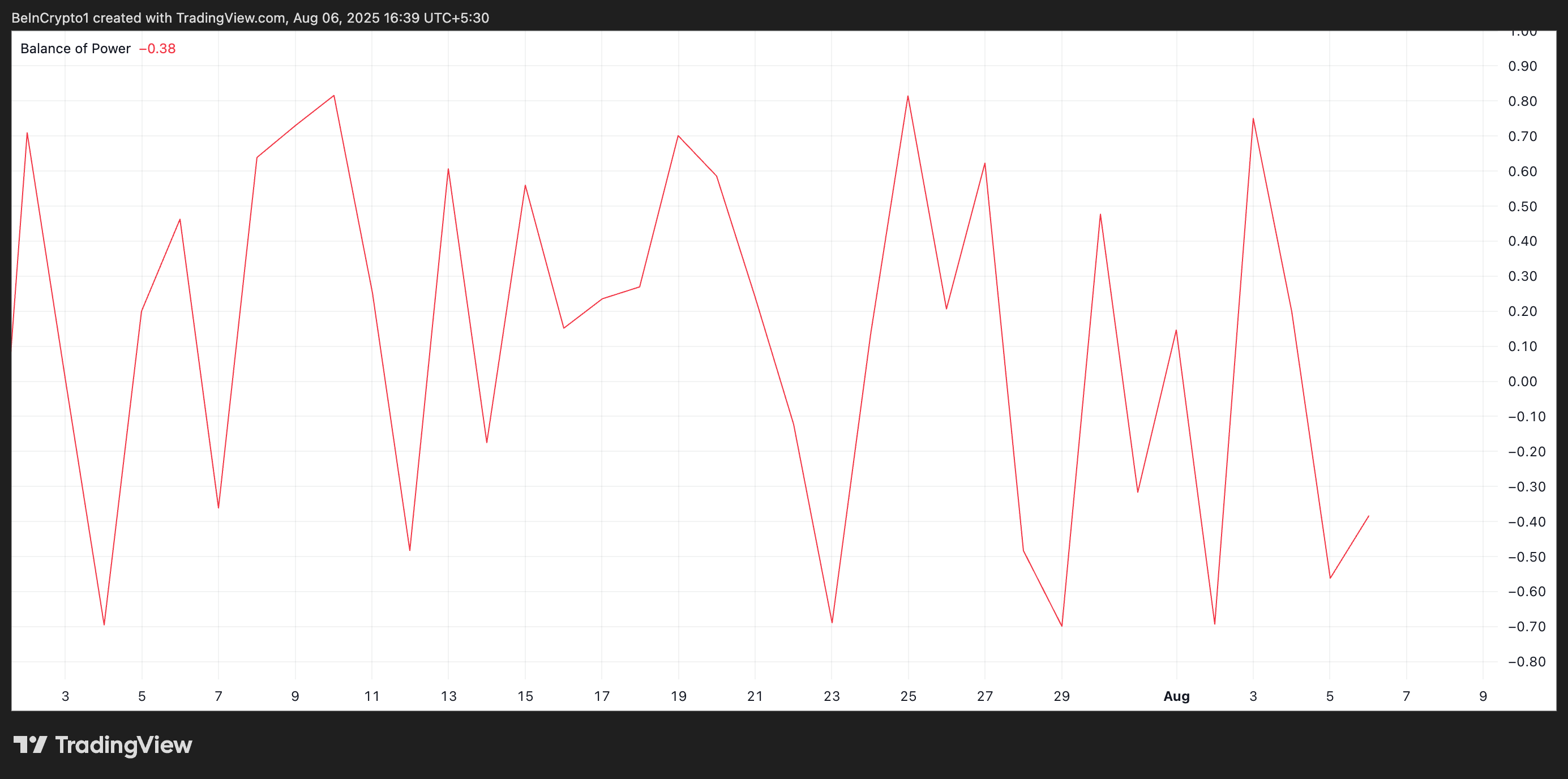

Readings from the ENA/USD one-day chart confirm the bearish tilt in market sentiment. For example, the token’s Balance of Power (BoP) has turned negative, signaling that selling pressure outweighs buying interest. As of this writing, the metric stands at -0.38, indicating negative bias.

: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily crypto Newsletter here.

The BoP measures the strength of buyers versus sellers in the market, showing whether bulls or bears are in control over a given period. A negative BoP reading means selling pressure dominates, with sellers pushing prices lower despite buying attempts.

For ENA, this confirms that bears have seized momentum, increasing the likelihood of further downside.

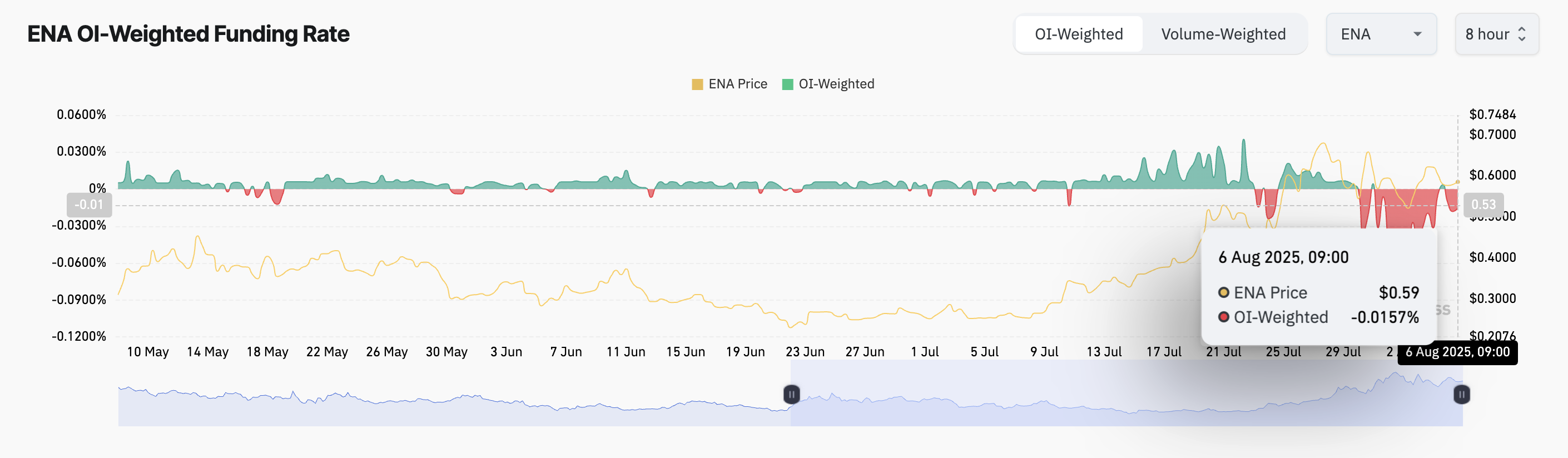

Furthermore, ENA’s negative funding rates across derivatives markets suggest that short positions dominate, strengthening the bearish outlook. At press time, this is at -0.0157.

The funding rate is a periodic payment exchanged between traders in perpetual futures contracts to keep contract prices aligned with the spot market. When the funding rate is negative, short sellers are paying long traders, indicating that most market participants are betting on a price decline.

For ENA, the negative funding rate highlights that bearish sentiment is dominant in derivatives markets, adding weight to expectations of further losses.

$0.41 or $0.64 Could Be Next

At press time, ENA trades at $0.5637, hanging above the support floor formed at $0.4832. If demand fades further, the bulls may struggle to defend this price level, giving way to a deeper decline toward $0.4140.

On the other hand, if buying activity resumes, it could trigger a spike to $0.6451.