Saylor Doubles Down: MicroStrategy’s Bold Bitcoin Bet After Record $1B Purchase

Another day, another nine-figure dip into the crypto kool-aid.

MicroStrategy just dropped its third-largest BTC buy ever—$1 billion worth—and Michael Saylor's grinning like a man who knows something Wall Street doesn't. Or maybe he's just high on that corporate treasury HODL life.

The playbook: Convert depreciating fiat into 'digital gold' while traditional investors still think ETFs are innovative.

The punchline: With 205,000 BTC now on its books, MicroStrategy's basically a leveraged Bitcoin ETF with extra steps—and a CEO who tweets through the dips.

Wall Street analysts remain 'cautiously optimistic' (read: sweating through their spreadsheets). Meanwhile, Saylor keeps stacking sats like the apocalypse is nigh—or like he's got a 10-year time horizon while everyone else stares at quarterly reports.

Strategy Keeps Buying Bitcoin

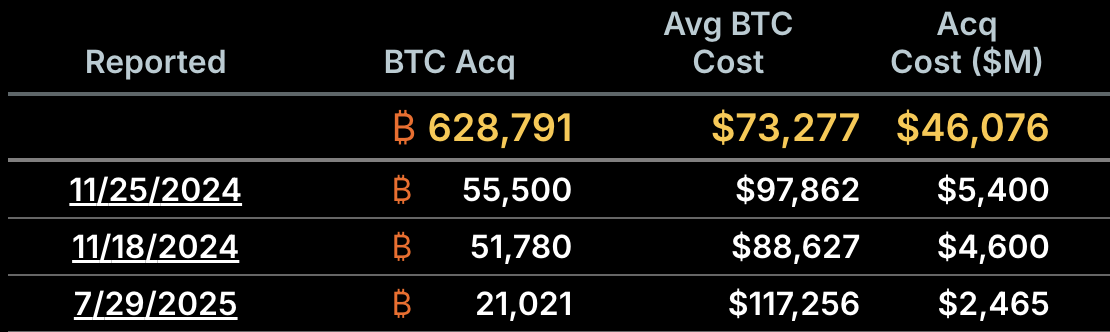

Strategy has been a pioneer with its Bitcoin treasury technique, specifically becoming the world leader of corporate crypto acquisition.

After months of consecutive stock offerings and ambitious purchases, the firm made its third-largest buy by US dollars last week. Outpacing the firm’s biggest moves in 2025, this signaled a firm commitment.

Strategy’s latest Bitcoin acquisition is quite impressive for a few reasons. First of all, this happened towards the tail of a highly profitable quarter for the firm, which followed a bleak posting in Q1 2025.

Strategy continued buying before its new net income was fully realized. Second, Bitcoin’s price momentarily fell shortly after this purchase, for unrelated reasons.

What’s Next for MicroStrategy’s Bitcoin Strategy?

To explain his unorthodox moves, Strategy Chair Michael Saylor agreed to an interview to discuss this ambitious Bitcoin purchase.

His comments were very enthusiastic, brushing off any minor price setbacks as usual.

“This is digital capital. If you’re using traditional treasuries as capital, you’re underperforming the S&P 500 by 10% a year. You’re burning money. If you’re using Bitcoin, you’re outperforming the S&P by something like 40% a year. The more capital you raise [and] hold, the faster you create shareholder value,” Saylor claimed.

In essence, Saylor downplayed the possible risks of Strategy’s Bitcoin purchases, envisioning a scenario where retail traders will continually buy stock to reap higher gains.

Rather than claiming that the firm will hodl its assets forever, Saylor offhandedly mentioned wanting to custody BTC for 21 years. Meanwhile, these stock sales generate massive yields.

Also, Saylor was asked if he’d consider investing in any altcoins, and he praised the TON ecosystem in response. He saluted TON’s technical innovations and enthusiastic community, but Saylor is firmly in the BTC maximalist camp.

Whatever happens next, Saylor isn’t getting off this train any time soon. He spoke of Strategy investors’ desire to use Bitcoin to achieve 2x gains, but claimed it has much more potential.

For now, the company will remain a standard-bearer of corporate confidence in BTC through thick and thin.