🚀 ChatGPT 5 Drops, Solana’s Seeker Phone Goes Live & US Tariffs Shake Crypto: This Week’s Biggest Moves

AI meets blockchain as OpenAI’s ChatGPT 5 launch sends shockwaves through crypto—Solana’s Web3-ready Seeker smartphone steals the spotlight with its ‘anti-bank’ ethos. Meanwhile, US tariff hikes trigger a trader exodus to decentralized exchanges.

Solana’s Hardware Gambit

The Seeker isn’t just another gadget—it’s a middle finger to Apple Pay. Pre-loaded with dApps and a self-custody wallet, it’s betting big on crypto natives ditching traditional finance. Early pre-orders suggest they might be right.

Washington’s Crypto Cold War

New US tariffs slapped on Chinese tech imports sent Bitcoin miners scrambling. Some relocated rigs overnight; others just hedged with Coinbase futures—because nothing says decentralization like relying on a publicly traded CEX.

The Week’s Unspoken Truth

While everyone hyped ChatGPT’s crypto integrations, the real story? AI trading bots now front-run retail investors 73% faster. Stay poor, plebs.

ChatGPT-5 Launch

AI crypto coins’ traders should consider watching the launch of ChatGPT-5 after the model’s training is completed.

pic.twitter.com/sYI4hYfHfx

— ChatGPT (@ChatGPTapp) July 30, 2025ChatGPT 5 is expected to have enhanced reasoning and multimodal capabilities, delivering a unified, deeply capable AI experience. More closely, it will feature significant upgrades in reasoning and task optimization, setting a new benchmark in generative AI evolution.

The model is expected to integrate OpenAI’s most advanced architecture, so AI crypto coins may benefit from the launch.

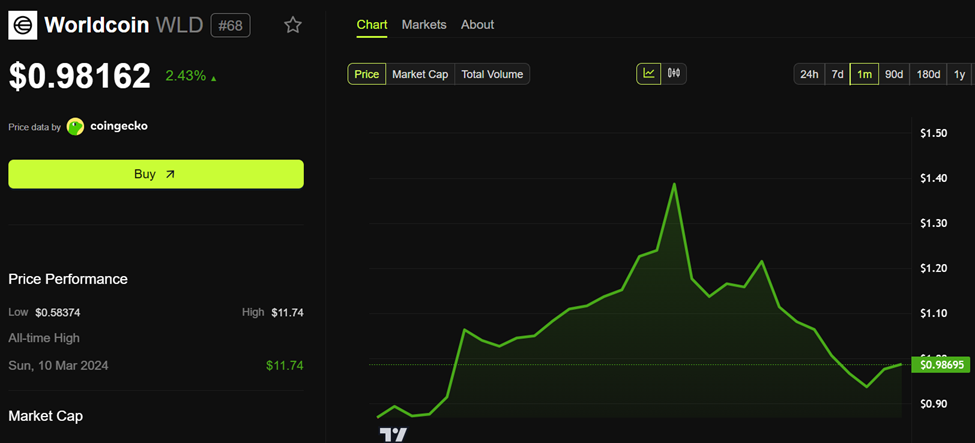

Among the AI coins likely to witness ChatGPT-5-related volatility is Worldcoin (WLD). As of this writing, WLD was trading for $0.9816, up by nearly 3% in the last 24 hours.

Other AI coins likely to witness volatility include the Artificial Superintelligence Alliance (FET), Render Token (RNDR), The Graph (GRT), and Bittensor (TAO).

FET and AGIX, previously Fetch.ai and SingularityNET, could benefit from AI automation and marketplace hype.

Meanwhile, RNDR could benefit from advanced rendering needs, GRT from data indexing demand, and TAO from decentralized AI interest.

Retail enthusiasm and media coverage may drive price surges, but corrections are possible post-hype, aligning with the buy-the-rumor and sell-the-news situation.

Notably, traders should stay vigilant, as such events are expected to attract scammers pedaling purported ChatGPT-5 meme tokens.

Coinbase To Integrate Base DEXs into its App

Another headline is Coinbase exchange’s MOVE to integrate Base DEXs (decentralized exchanges into its super App. With this in the pipeline, Aerodrome DEX is a key highlight, following a June 12 announcement from the network.

“We will be integrating DEXs from Base directly into the main Coinbase app, enabling Coinbase users to access and trade millions of assets on-chain. Aerodrome’s best-in-class trading execution will soon be coming to millions of Coinbase users. The world is coming on-chain,” Aerodrome wrote in a post.

This is expected to be bullish for AERO, as the potential volume flowing through Aerodrome WOULD be massive.

Meanwhile, Base chain creator Jesse Pollak sees the integration as an avenue to give every builder on the network a distribution scheme.

the thing I'm most excited about with @coinbase listing all @base assets via DEX is that it gets rid of the "ins and outs" dynamic of listings

every base builder deserves distribution

Notably, Aerodrome is among the largest protocols on Base, accounting for a significant portion of the chain’s DEX volume and with $518.63 million TVL (total value locked).

DeFi App’s HOME Buy Back Proposal

Another crypto news item to watch is the end of the DeFi App’s HOME buyback proposal. With DIP-004 live, HOME buybacks are kicking off, igniting a potential cycle of value and rewards.

Defi App is back with a Vengeance![]()

Releasing an app, buybacks, Over $3M for yappers. and $HOME pumping…

Here's everything you need to know about S2 defidotapp![]() pic.twitter.com/1ABh3ugD2m

pic.twitter.com/1ABh3ugD2m

![]()

With 80% of DeFi App revenue recycled straight into HOME buybacks, the strategy supports future drops, factions, and ecosystem plays. This mechanism could align a token with product growth.

As of this writing, HOME was trading for $0.0349, up over 7% in the last 24 hours. The surge comes amid Optimism that the buyback will reduce HOME’s circulating supply, boosting demand.

Solana’s Seeker Smartphone Shipping

In September 2024, solana unveiled Seeker, promising an upgraded smartphone from the previous version, Saga. The device is expected to be more affordable and feature-rich, targeting a broader audience than Saga.

“We want to make it as easy as possible for whatever the next narrative [in crypto] is, whatever the next use case is — there can be a dozen apps offering that same use case in our store within days,” Solana Labs General Manager Emmett Hollyer said.

Seeker also offers hardware upgrades, crypto-specific tools, and app store features for token and DApp growth.

Aligning with the Solana Mobile hackathon, Seeker is due for shipping starting today, Monday, July 4, after entering the testing phase in March.

Seekers have entered the testing phase. Shipping starts Summer 2025.

You’ll be able to confirm/update your shipping address soon. Stay tuned for more info. pic.twitter.com/E1Xa64V9uK

Beyond the device, markets also monitor potential crypto airdrops, after Saga buyers turned $600 into $2,000+ just from allocations alone.

US to Raise Tariffs

Bitcoin will also be in the limelight this week as the US moves toward raising tariffs on almost all countries on Thursday, August 7.

Trump Order Pushes Tariffs Start Date To August 7—Rates Set For 67 Countries And EUhttps://t.co/YA5MgbsNne pic.twitter.com/TRFVSraSbY

— Forbes (@Forbes) August 1, 2025It follows recent modifications and US President Donald Trump’s executive order to impose new tariffs on a number of its trading partners that will take effect on August 7.

Imports into the US from dozens of countries and foreign territories are subject to so-called ‘reciprocal’ taxes ranging from 10% to 41%.

Given the influence of US economic signals on Bitcoin, the pioneer crypto could witness volatility. Trump’s tariffs create global trade uncertainty, driving up costs for businesses and consumers.

While Bitcoin is decoupling from tariff news, the pioneer crypto has emerged as a hedge against inflation and market volatility, positioning the BTC price for impact on Thursday.

$107 Million Ethena (ENA) Unlocks

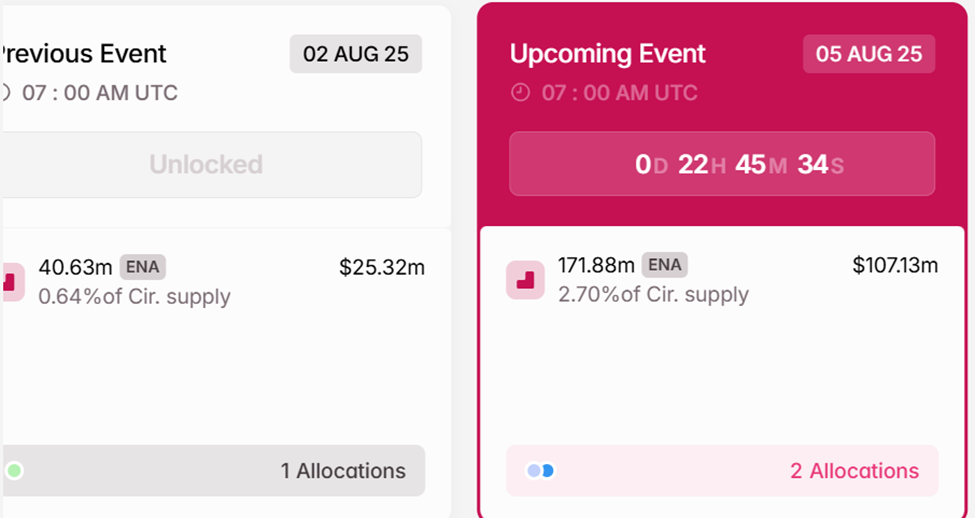

Closing the list of top crypto news this week is the $107.13 million worth of ENA token unlocks on Tuesday, August 5, from the Ethena ecosystem.

On Tuesday, 171.88 million ENA tokens will be unlocked, constituting 2.7% of the token’s circulating supply. Data on Tokenomist.ai shows these tokens will be allocated to core contributors and investors, putting the ENA price at the cusp of a supply shock.

With a history of large token unlocks driving prices down, the Tuesday token unlock event could see Ethena Price correct the 12% gains recorded Monday, as traders buy the rumor.

As of this writing, ENA was trading for $0.6238, up by 11.98% in the last 24 hours.