Goldman Sachs Slashes India GDP Forecast Amid Trump’s 25% Tariff Threat - What’s Next for Emerging Markets?

Wall Street's golden child just took a chainsaw to India's growth projections.

Trump's tariff tantrum sparks economic tremors

Goldman Sachs didn't just trim expectations—they executed a full bearish pivot. The trigger? A single tweet from Mar-a-Lago threatening 25% tariffs on Indian goods. Because nothing says 'stable economic policy' like policy-by-Twitter.

Emerging markets brace for impact

While analysts scramble to update their models, Delhi's corridors of power are running damage control drills. The rupee's already sweating, and bond traders are reaching for their antacids.

Bonus finance jab: At least someone's GDP is growing—Goldman's consulting division billing hours on 'tariff mitigation strategies.'

Goldman Sachs’ India Forecast Cut Tied to Trade Tensions and Slowdown

The Goldman Sachs India forecast revision reflects mounting concerns over the India economic slowdown and potential global market impact that could unfold. TRUMP actually criticized India for maintaining tariffs that areand also described them as the most

Goldman Sachs stated:

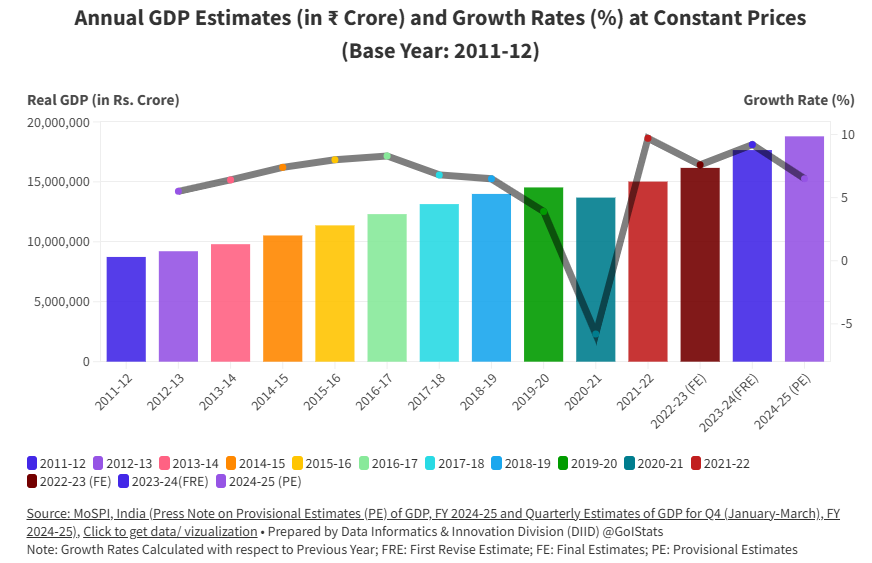

Revised Growth Projections Show Measured Impact

The latest Goldman Sachs India forecast sets real GDP growth at 6.5% for 2025 and 6.4% for 2026. Despite Trump’s 25% tariffs threat, brokerages remain hopeful that final tariff rates may actually settle between 15-20% through negotiations, which could limit the India economic slowdown impact to some extent.

Rural consumption recovery has been sustained, given strong agricultural activity that’s reflected in higher sowing of summer crops along with lower food inflation, which is likely boosting real rural incomes right now.

Monetary Policy Response Expected

Given the revised Goldman Sachs India forecast and growing US-India trade tensions, analysts expect the Reserve Bank of India to cut repo rates by 25 basis points in Q4. The bank has also lowered inflation forecasts by 0.2 percentage points to 3%, supporting the case for accommodative policy measures.

Goldman Sachs noted:

Trump’s 25% tariffs continue to create uncertainty in global markets, though rural consumption recovery provides some cushion against the India economic slowdown concerns that analysts are voicing at the time of writing.