Bitcoin’s Third Profit-Taking Wave Is Here—What It Means for Your Portfolio

Bitcoin just triggered its third major profit-taking wave—and the market's reacting like a caffeinated trader on margin.

Here's the breakdown:

The Take-Profit Tango

Whales are cashing out at resistance levels again. Not panic selling—just disciplined profit-taking after another leg up. Textbook bull market behavior.

Liquidity Games

Exchanges are seeing deposit spikes as short-term holders lock in gains. Meanwhile, OTC desks report institutions accumulating every dip below $70K. The rich get richer—some things never change.

What's Next?

History says we're due for consolidation before the next breakout. But with spot ETF flows still positive and miners hodling strong, this looks like healthy digestion—not distribution.

Pro tip: Watch the futures basis. When leverage flips negative, that's your buy signal.

*Another day, another chance for retail to sell low and buy high.*

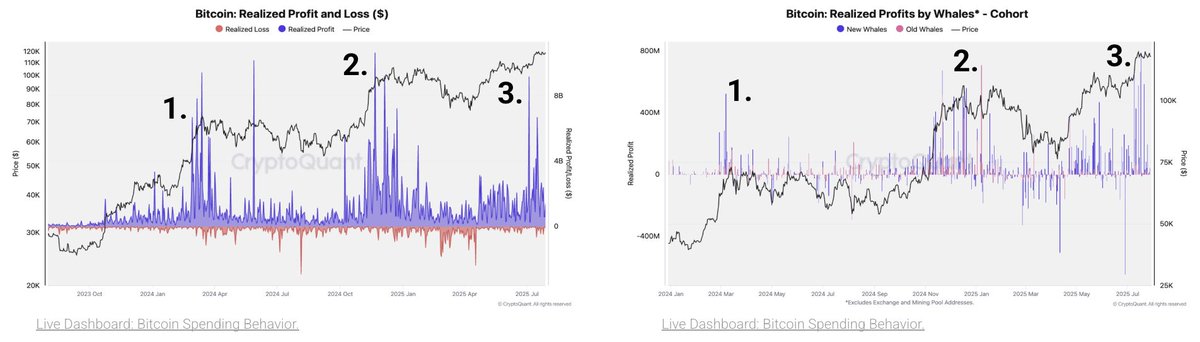

The Market in a Short-Term Distribution Phase

Following the recent market correction, Bitcoin trades around the $115,000 zone. According to CryptoQuant, Bitcoin is entering its “third major profit-taking wave” of this bull cycle.

CryptoQuant noted that the primary profit-takers are new whales who have accumulated recently and are now sitting on significant gains.

In addition, the market continues to see some early-era whales from the Satoshi timeline selling off. The account ai_9684xtpa on X confirmed that several old wallets from Bitcoin’s early days are again moving BTC and selling after years of dormancy.

These wallets often draw attention due to their potential psychological impact on the market, even though their size remains small relative to the total circulating supply.

Long-Term Sentiment Remains Positive

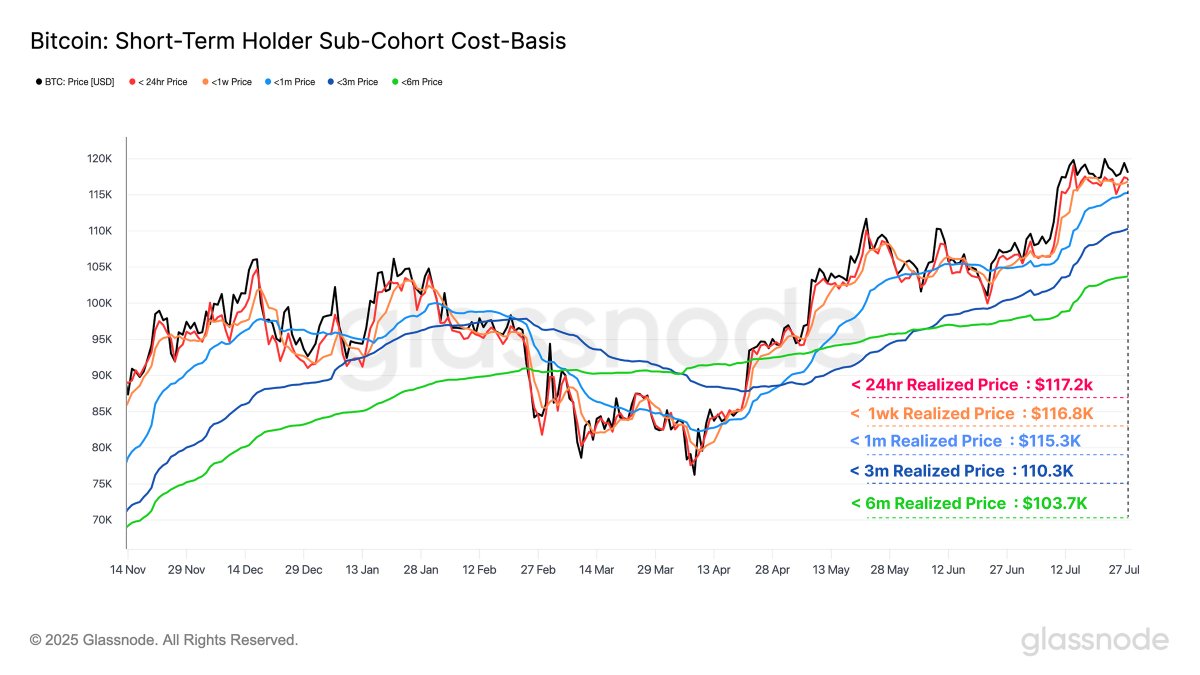

Alongside the short-term wave of profit-taking, the market still presents several noteworthy bullish indicators. Data from Glassnode shows that Bitcoin’s current price is above the short-term holder (STH) cost basis range—a key factor in forming strong support zones if the market pulls back.

Meanwhile, Coin Bureau quoted Bernstein’s analysis, saying that the crypto bull run is still early. This perspective reinforces the confidence of long-term investors, especially as institutional capital continues to flow into the market through ETFs and platforms like Coinbase and Robinhood.

CryptoQuant also noted that new investor dominance is rising but still has room before reaching extreme levels. This indicates that the current cycle attracts a large influx of new participants, rather than revolving solely around veteran holders like in previous cycles.

Given the strong price increases over recent months, some analysts warn that bitcoin may require a correction period to rebuild buying momentum.

“July marked a transition from trend to consolidation. Elevated speculation and profit-taking are dragging on momentum, signaling that BTC may need a reset or sideways grind before the next breakout attempt,” said analyst Willy Woo.

Additionally, on-chain data from Santiment showed that whales have accumulated around 0.9% of Bitcoin’s total circulating supply in just the past four months. This suggests that long-term confidence remains intact despite technical pullbacks.