Why TON Is Defying the Crypto Downturn—Top Trader Pick for August 2025

While half the market licks its wounds, TON’s chart is flashing green. Here’s what’s fueling the anomaly—and why it’s the only coin hedge funds aren’t dumping (yet).

The anti-fragile token?

No major blockchain network has shrugged off Bitcoin’s 12% slide like The Open Network. Its 24% monthly gain makes it the S&P 500 of crypto—boring, predictable, and weirdly bulletproof.

Telegram’s dark horse

800M messaging app users don’t lie. TON’s integration into Telegram’s payment system turned ‘crypto curious’ normies into involuntary bagholders. Now institutional traders are front-running the retail wave.

The cynical take

Let’s be real—this reeks of VC exit liquidity. But until the music stops, even Wall Street sharks will keep dancing. Just don’t be the last one holding the bag when TON’s ‘utility’ narrative collides with cold, hard tokenomics.

Fresh Capital, Rising Confidence: TON Shines Amid Market Pullback

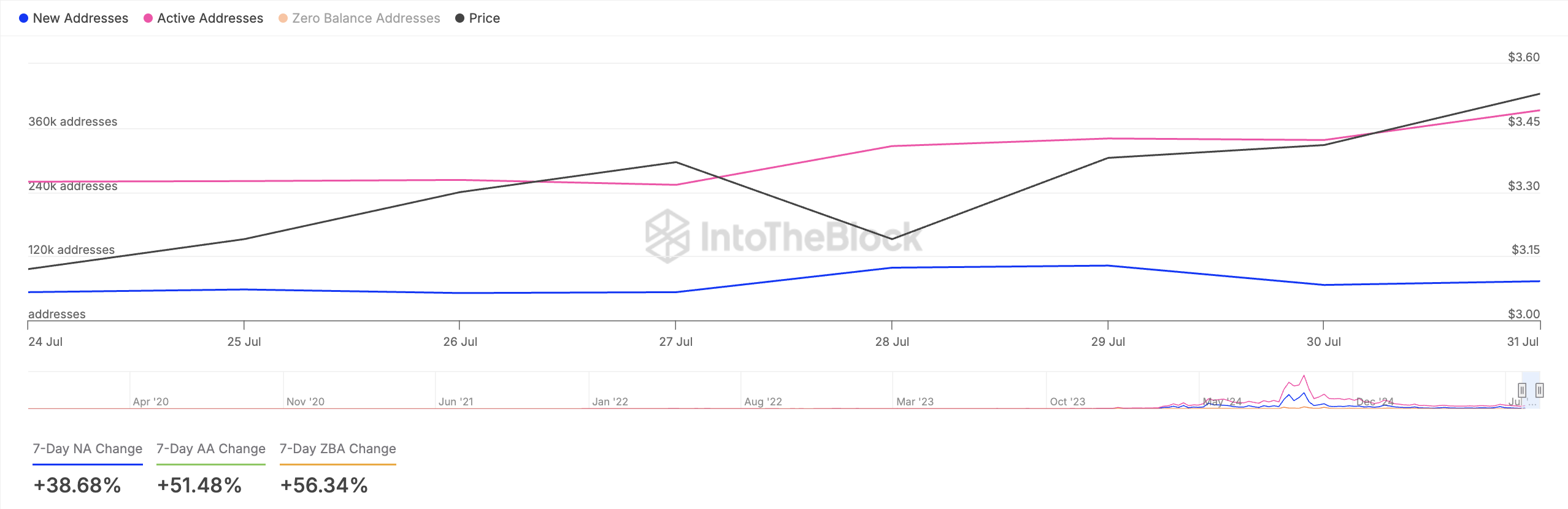

On-chain data reveals a steady uptick in TON’s network activity, signaling rising demand for the asset. The number of new and daily active addresses interacting with the Toncoin network has surged, indicating growing user interest and participation.

Per IntoTheBlock, new demand for TON has risen by 38% over the past seven days, reflecting the support backing its current upward trend. The surge in new demand indicates fresh capital entering an ecosystem, often from first-time users or investors.

This, combined with the 51% rise in daily active addresses during the same period, suggests deepening activity among existing TON holders.

: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily crypto Newsletter here.

The elevated level of on-chain engagement supports the token’s current price resilience, even amid broader market weakness. If this trend holds, TON could record more gains over the next few trading sessions.

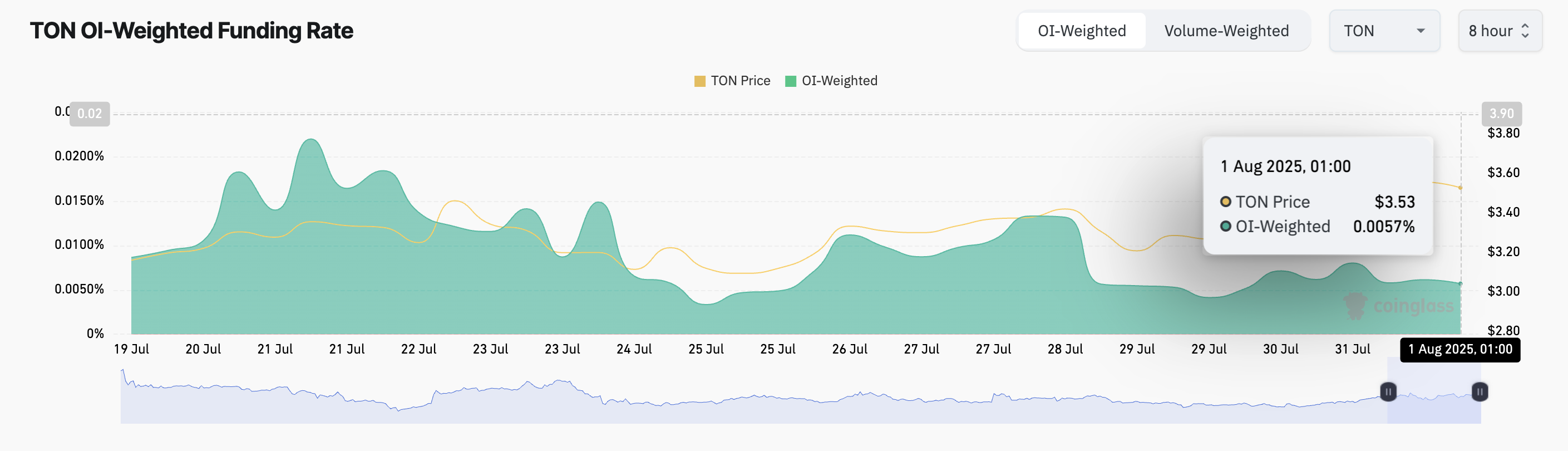

Furthermore, TON’s funding rate has remained positive despite the broader market’s performance over the past day. As of this writing, this is at 0.0057%, indicating the preference for long positions among futures market participants.

The funding rate is a periodic fee paid between long and short traders in perpetual futures markets to keep the contract price in line with the spot price.

A positive funding rate like TON’s means traders are paying a premium to hold long positions, indicating bullish sentiment. It suggests that more investors expect the asset’s price to rise in the NEAR term.

These Crucial Levels Could Make or Break the Rally

While TON’s gains are still modest, its divergence from broader market movements positions it as one that may record more gains over the next few days. If demand remains high, the token’s price could break above the resistance at $3.49 and climb to $3.68.

However, if buy-side momentum wanes, this bullish project WOULD be invalidated. In that scenario, TON’s price could fall to $3.23.