$40 Million Meltdown: The Brutal Lesson Behind AguilaTrades’ Bitcoin Long Gone Wrong

Another hedge fund learns the hard way: crypto giveth, and crypto taketh away—with extreme prejudice.

When leverage meets volatility, even 'sure bets' bleed.

AguilaTrades just joined the hall of fame for spectacular crypto implosions—proof that nine-figure portfolios can evaporate faster than a meme coin's utility.

Bonus jab: Somewhere, a Wall Street boomer sips bourbon and mutters 'told ya so' into his Bloomberg terminal.

From Recovery to Ruin: AguilaTrades Suffers Catastrophic Losses on Hyperliquid

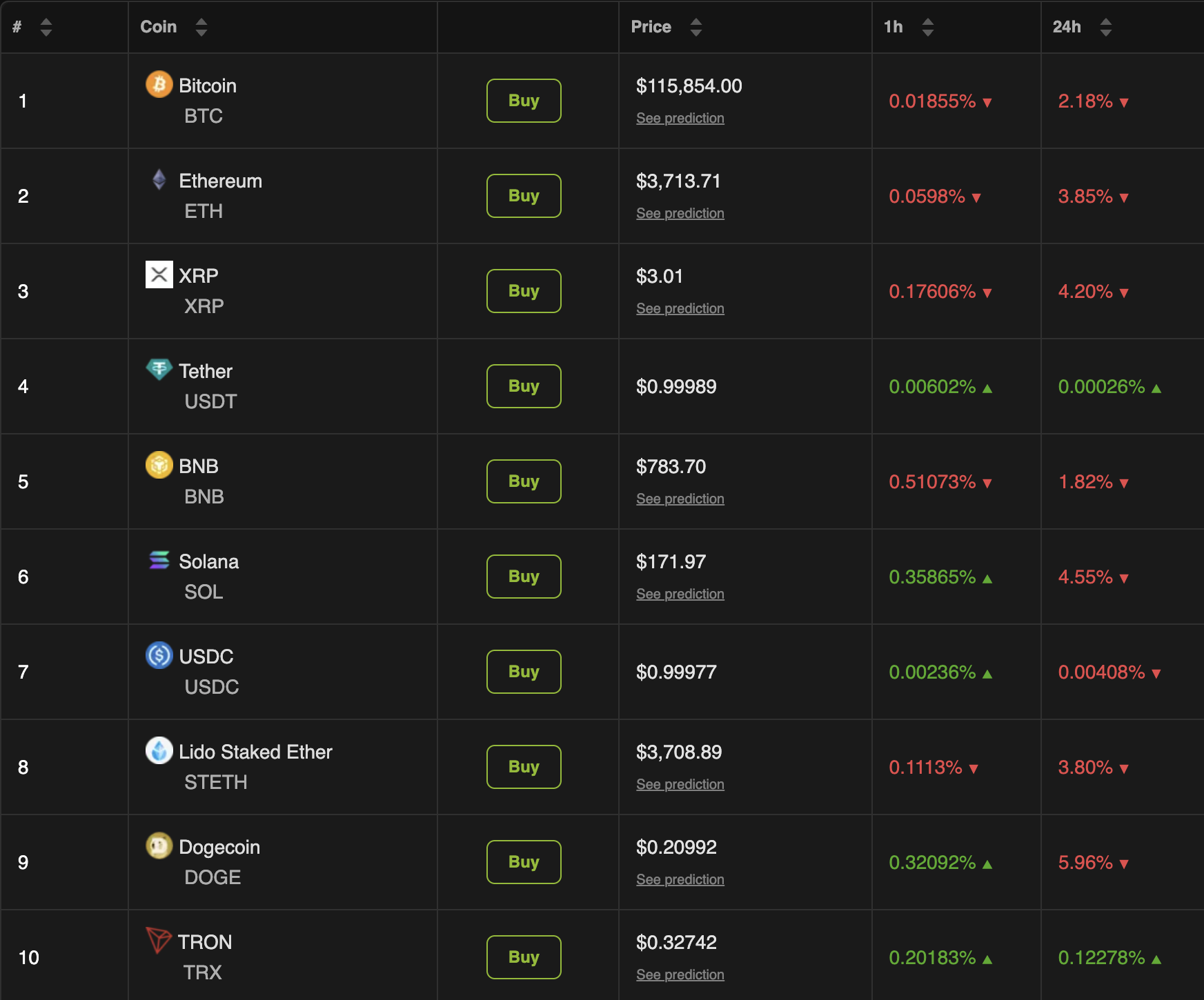

BeInCrypto Markets data revealed that over the past 24 hours, the crypto market has dipped 6.9% to $3.83 trillion. 80% of the top 10 coins have recorded losses. Bitcoin has dropped 2.8%, while Ethereum (ETH) has suffered a 3.8% decline.

Amid this, those who bet on the market rising suffered massive losses, with around $630 million in liquidations recorded in the past 24 hours. Coinglass data showed that most liquidations ($570.68 million) stem from long positions.

For bitcoin specifically, long positions worth $141.93 million were liquidated, compared to short positions worth $7.4 million.

Lookonchain, a blockchain analytics platform, revealed on X (formerly Twitter) that AguilaTrades’ long Bitcoin position was also liquidated.

“AguilaTrades has been fully liquidated, wiping out almost all of his funds on Hyperliquid,” the post read.

This was a massive blow for the trader, who recently recovered all his losses. BeInCrypto reported that AguilaTrades’ bets resulted in losses totalling $32.7 million in late June, building up to as high as $35 million by July.

However, in mid-month, the trader managed to turn around his $35 million losses. Yet, these gains were short-lived. On July 25, the trader was liquidated for 720 BTC valued at around $83.3 million.

“From being down $35 million+, then clawing back to a $3 million profit, he’s now back even deeper in the red with $36 milllion+ in losses,” Lookonchain posted.

On July 31, OnChainLens reported that AguilaTrades experienced four consecutive liquidations but later raised his BTC position slightly. Now, with the latest blow, his losses are nearing $40 million.

“Once a top CEX trader, AguilaTrader lost nearly $39 million after being wrecked on-chain. Every long and short got counter-traded. A brutal reminder: public PnL = public target,” crypto influencer, Zia ul Haque, wrote.

In addition to AguilaTrades, another high-risk trader, James Wynn, also faced a series of liquidations.

“James Wynn’s Pepe long position in another wallet also got hit with a cascade of liquidations, with total losses exceeding $1 million, and only $14,850 left in the account,” the blockchain analytics platform added.

Wynn’s losses follow his earlier win. BeInCrypto highlighted that the trader made over half a million in profit last week, his largest gain since May 25.

In contrast, some traders have capitalized on the market conditions. Lookonchain noted that a trader (0xCB92) went short on ETH with 20x leverage. The trader’s decision earned him a profit of over $3.7 million.

Whale 0x720A exited Hyperliquid with a profit of $13.6M, then stopped perps trading and bought 3,322 $ETH($12.84M) spot.https://t.co/0hewUqchdv pic.twitter.com/T0A2uyjGUi

— Lookonchain (@lookonchain) July 31, 2025Thus, the disparity highlights the high-stakes nature of Leveraged trading on platforms like Hyperliquid, where small price movements can lead to significant gains or catastrophic losses.