XRP Whale Exodus Sparks Market Jitters – Are Big Players Losing Faith? | Weekly Whale Watch

Whales are fleeing XRP like bankers from a sinking hedge fund—and the market’s taking notes.

The Signal in the Sell-Off

When crypto’s deep-pocketed players move, prices tremble. This week’s whale-sized outflows suggest fading confidence in XRP’s short-term prospects—a bearish omen for retail bagholders.

Liquidity Tsunami or Drip?

Blockchain sleuths spot whale wallets draining faster than a DeFi exploit. Will this trigger a liquidity crunch or just another blip in XRP’s perpetual regulatory purgatory?

The Institutional Calculus

Smart money doesn’t panic—it pivots. These exits could signal strategic repositioning ahead of the next SEC court date or simply profit-taking after July’s dead-cat bounce.

One thing’s certain: in crypto, whales don’t whisper. They dump—and let Twitter connect the dots.

XRP Whale Pattern Mirrors Early 2025 Cycle

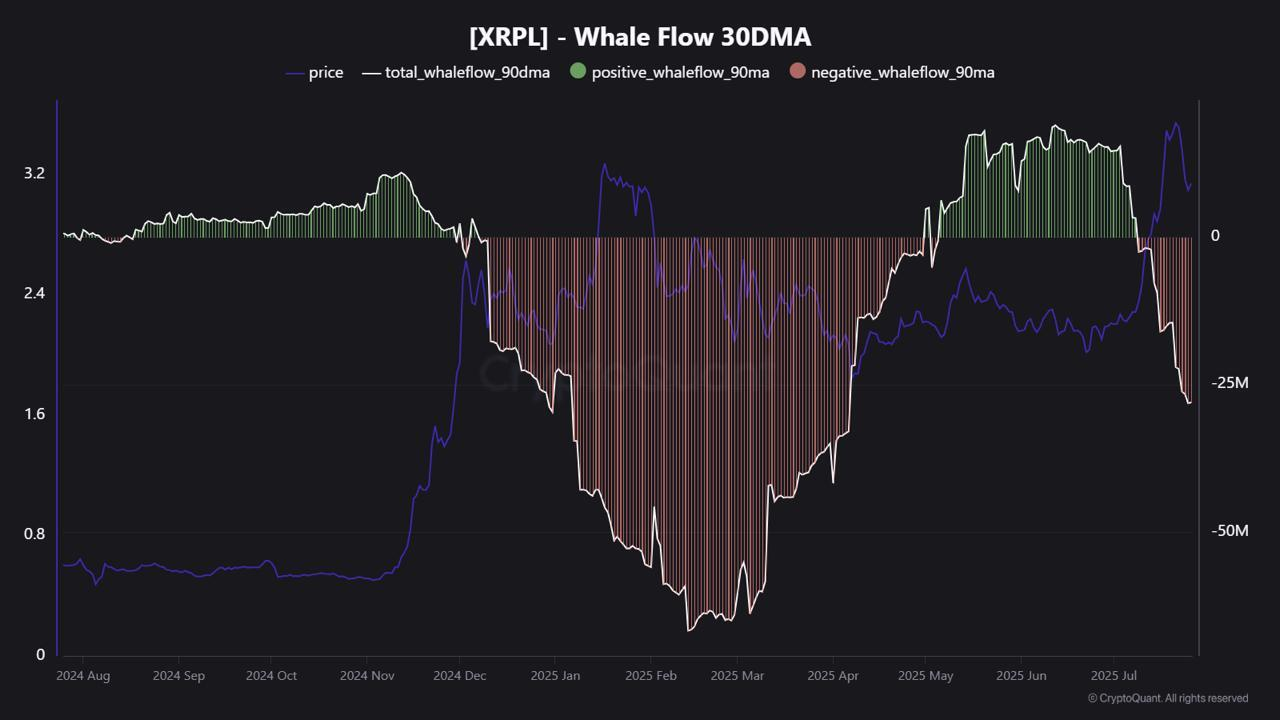

CryptoQuant analyst JA Maartunn highlights the shifting whale behavior. After turning briefly positive in May and June, the 90-day average whale FLOW has now flipped negative again.

This whale selloff resembles the sharp outflow seen earlier this year. In February 2025, XRP whales offloaded tokens at a record pace, averaging.

That earlier distribution coincided with a price correction. A similar scenario may now be unfolding, with whales cashing out at local highs.

Despite rising prices, on-chain momentum is weakening. The disconnect between bullish price action and bearish whale flows raises questions about the sustainability of XRP’s current level

Last week, BeInCrypto reported that Ripple co-founder Chris Larsen transferred $140 million in XRP to exchanges after the altcoin touched a $3.65 all-time high.

On-chain data confirmed the outflows from Larsen-linked wallets. Over 2.81 billion XRP (~$8.4 billion) still remain under his control.

This sale intensified concerns about centralization and insider-driven market moves.

XRP Support Levels at Risk

XRP is trading betweenat press time. However, the growing net outflows suggest that large holders are exiting rather than accumulating.

If this pressure continues, the $3.00 support zone may not hold. Historically, price weakness follows when smart money rotates out.

While previous analysis pointed to a possible breakout above $3.66, the outflow data paints a more cautious picture.

For upward momentum to continue, fresh demand must absorb the ongoing whale sales. Without it, XRP could face another period of consolidation or decline.

Bottom Line

XRP’s short-term trend appears fragile. Despite recent gains, whale activity suggests distribution is underway.

Traders should watch whale flows closely. Without renewed inflows or strong demand, XRP could struggle to maintain its current price.