ZORA at ATH Crossroads: Bull Fatigue or Bear Takeover?

ZORA's meteoric rally hits a wall—traders now face the ultimate crypto conundrum: profit-taking panic or just a healthy pullback?

Signs of exhaustion emerge as the token cools from its record high. The charts whisper 'overbought,' but the degens still whisper 'buy the dip.'

Technical indicators flash warning signals while perpetual funding rates stabilize—classic standoff between paper hands and diamond-handed true believers.

Meanwhile, shorts pile up like Wall Street bankers at a tax haven. Will this be another 'V-shaped recovery' narrative or the start of a proper crypto winter? Only your portfolio manager's sweaty palms know for sure.

ZORA Whales Exit as Token Nears Peak — Is a Correction Coming?

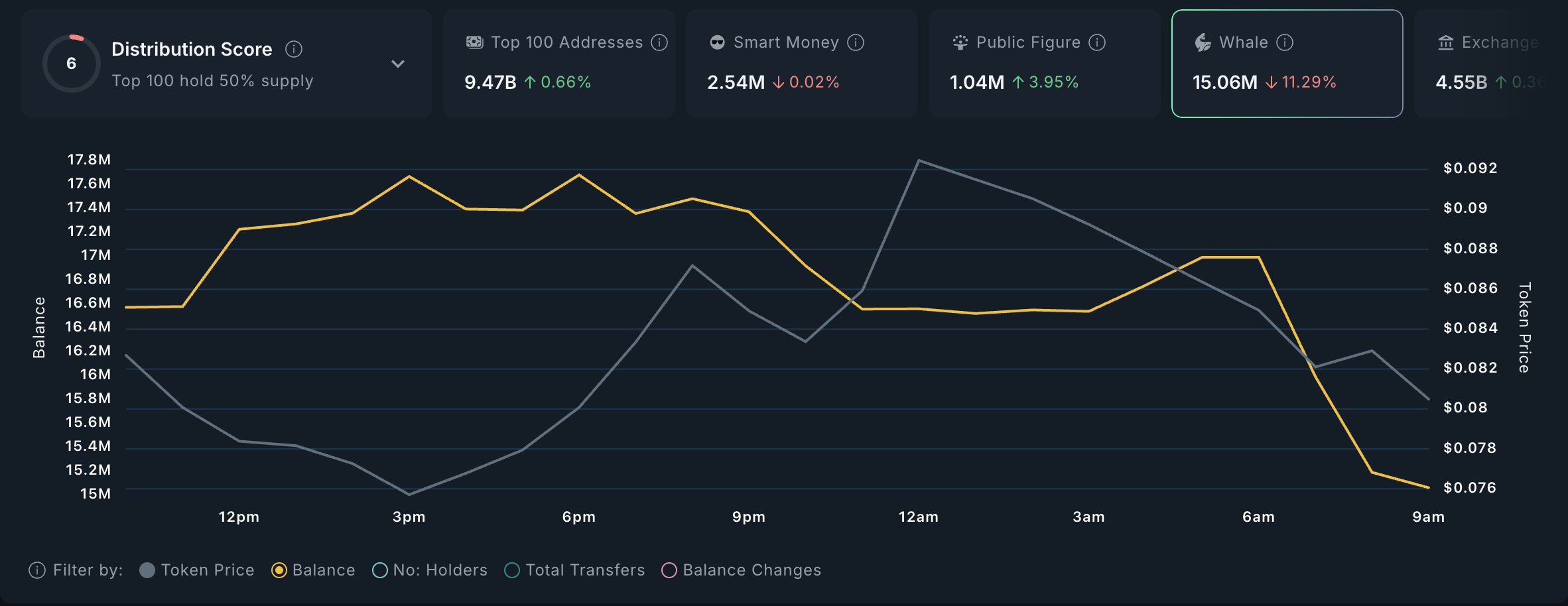

Data from Nansen reveals a sharp decline in ZORA’s large holder activity over the past 24 hours.

According to the on-chain data provider, the balance held by high-value wallets—those holding over $1 million worth of ZORA—has dropped by nearly 11% in a single day, signaling a notable shift among key stakeholders.

: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily crypto Newsletter here.

The sudden pullback comes after ZORA’s rally to its all-time high of $0.105. With rising market volatility and uncertainty creeping into the broader altcoin space, whales appear to be trimming their exposure while the token’s price remains high.

This wave of profit-taking from whales could also set off a domino effect among retail traders. With confidence in the short-term trend weakening, smaller holders may be inclined to follow suit, worsening the downward pressure on ZORA’s price.

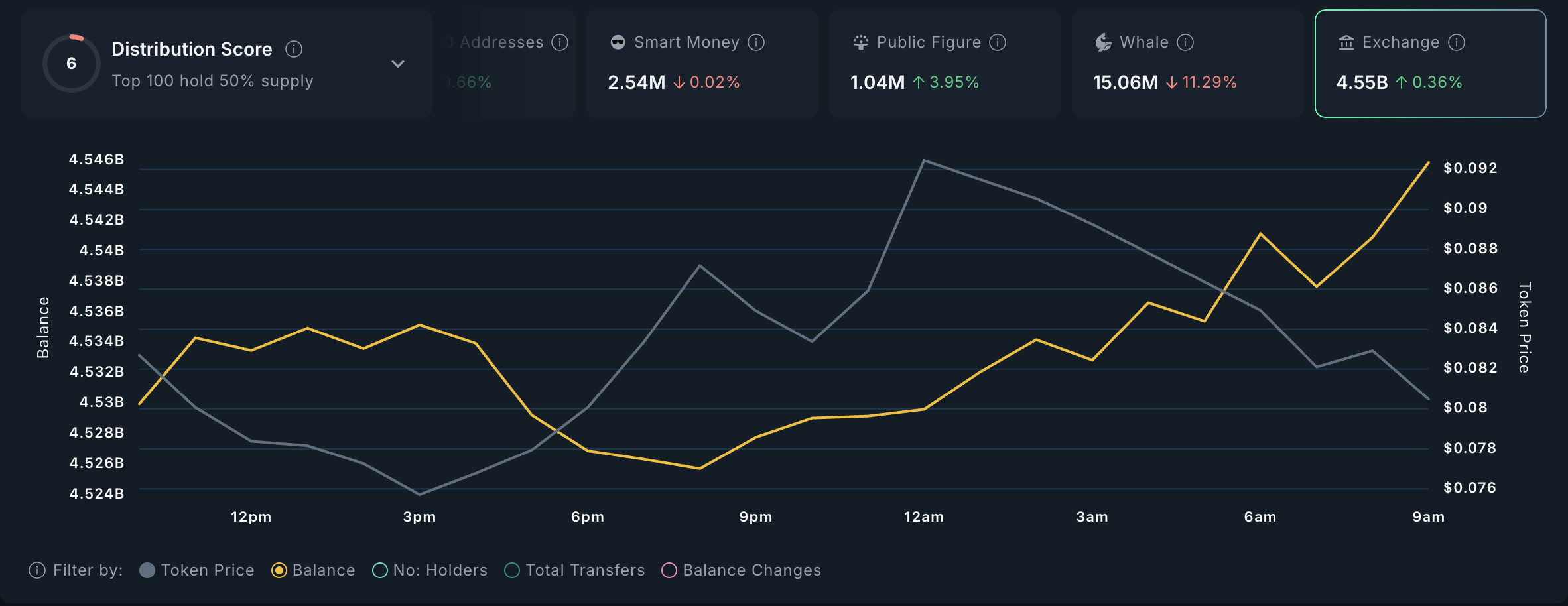

Furthermore, ZORA has noted a modest 0.36% uptick in its holdings across exchanges over the past day. This suggests a rise in the number of tokens sent to trading platforms since ZORA recorded an all-time high.

ZORA Exchange Activity. Source: Nansen

When an asset’s exchange inflow spikes, it is often a sign that holders are preparing to sell. The rising inflow combined with the dip in whale activity and declining buy-side momentum adds to bearish pressure, increasing the likelihood of a ZORA price correction in the short term.

ZORA Weakens as Sellers Take the Lead

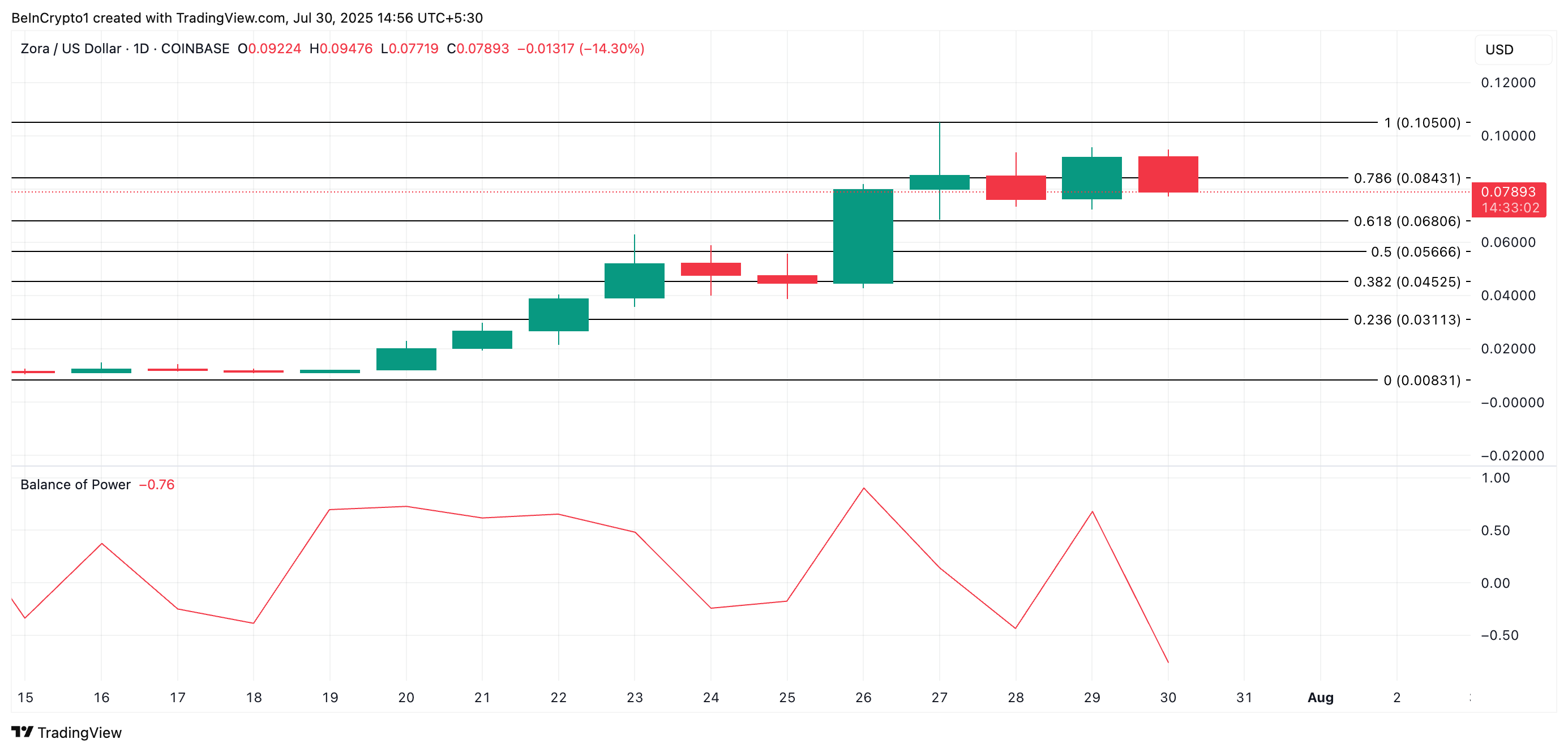

From a technical perspective, ZORA’s Balance of Power (BoP) indicator is negative at press time, highlighting the clear decline in buying pressure. At press time, the momentum indicator, which measures buying and selling pressures, is at -0.76

This suggests that the bulls are losing control, and sellers are beginning to dictate market direction.

If this continues, ZORA’s price could plummet to $0.068.

On the other hand, a rise in buy-side strength could trigger a breach of the resistance at $0.084 and a rally back to $0.105.