Stellar (XLM) Bull Flag Breakout Loses Steam—Is the Rally Over?

Stellar's bullish momentum hits a wall as the XLM bull flag pattern shows signs of fatigue. Traders eye key support levels—will the network's real-world utility save it from a deeper pullback?

The Breakdown:

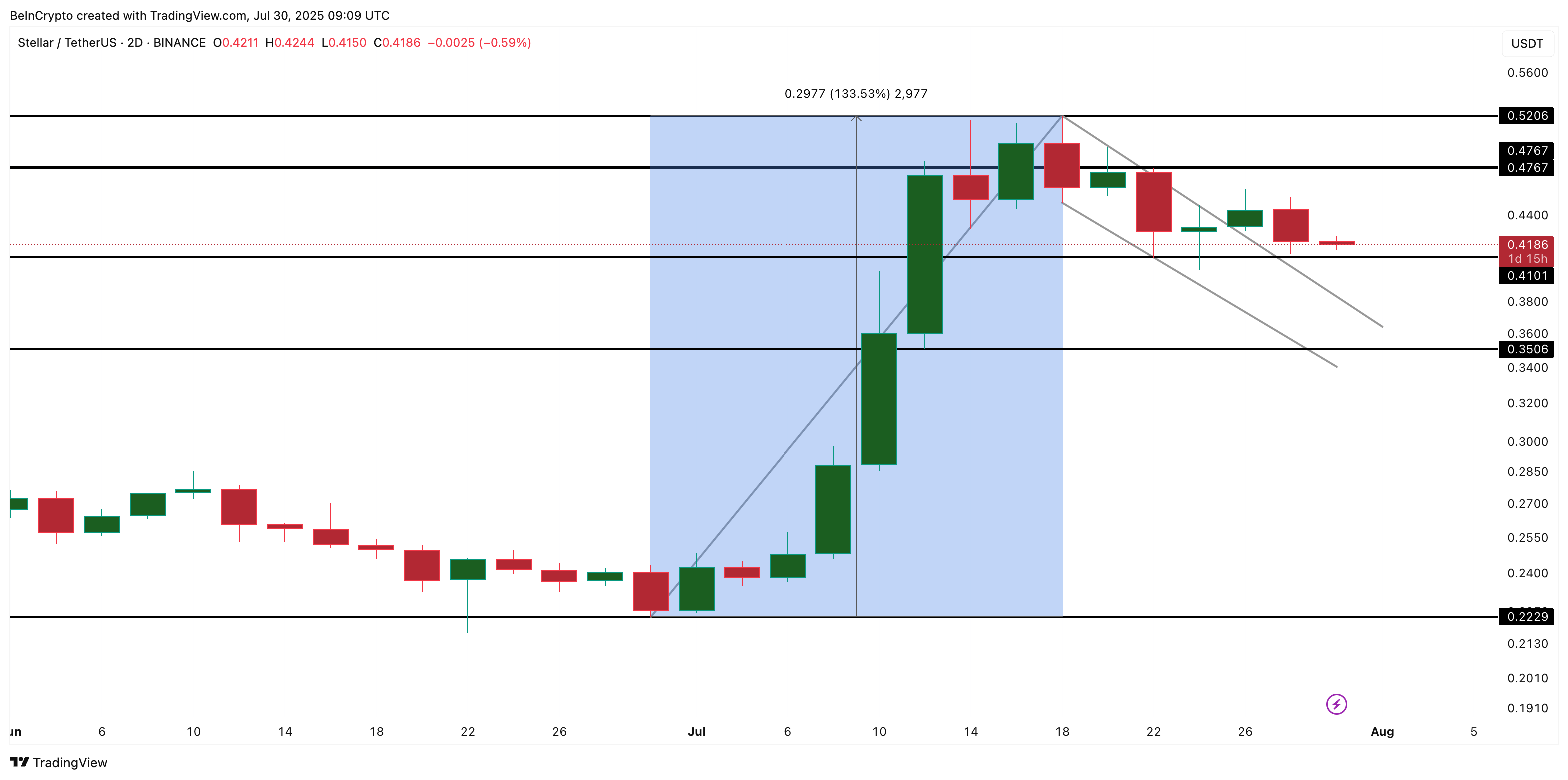

After a promising breakout, XLM's price action wobbles like a crypto rookie facing their first leverage liquidation. The bull flag—a classic continuation pattern—now risks morphing into a bearish reversal unless buyers step in.

Why It Matters:

Stellar’s enterprise-focused blockchain has dodged meme coin mania, but even fundamentals can’t override trader psychology. Watch the $0.35 zone—break that, and the ‘institutional darling’ narrative gets another reality check.

The Bottom Line:

In a market where ‘number go up’ beats white papers every time, XLM’s fade reminds us: even the most utilitarian tokens bow to technicals. (And yes, that’s your cue to check your stop-loss—unless you enjoy donating to the crypto casino.)

Net Flows: The Only Tailwind is Losing Strength

Exchange net flows have played a big role in XLM’s recent rally. Earlier this month, more coins were leaving exchanges than entering, reducing available supply and fueling upward momentum.

Over the past week, that trend has weakened noticeably, with net outflows sliding closer to neutral levels. The lack of sustained withdrawals hints that long-term holders aren’t adding fresh buying pressure anymore, leaving the breakout without much support.

: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily crypto Newsletter here.

Weak Money Flow Adds to Concerns

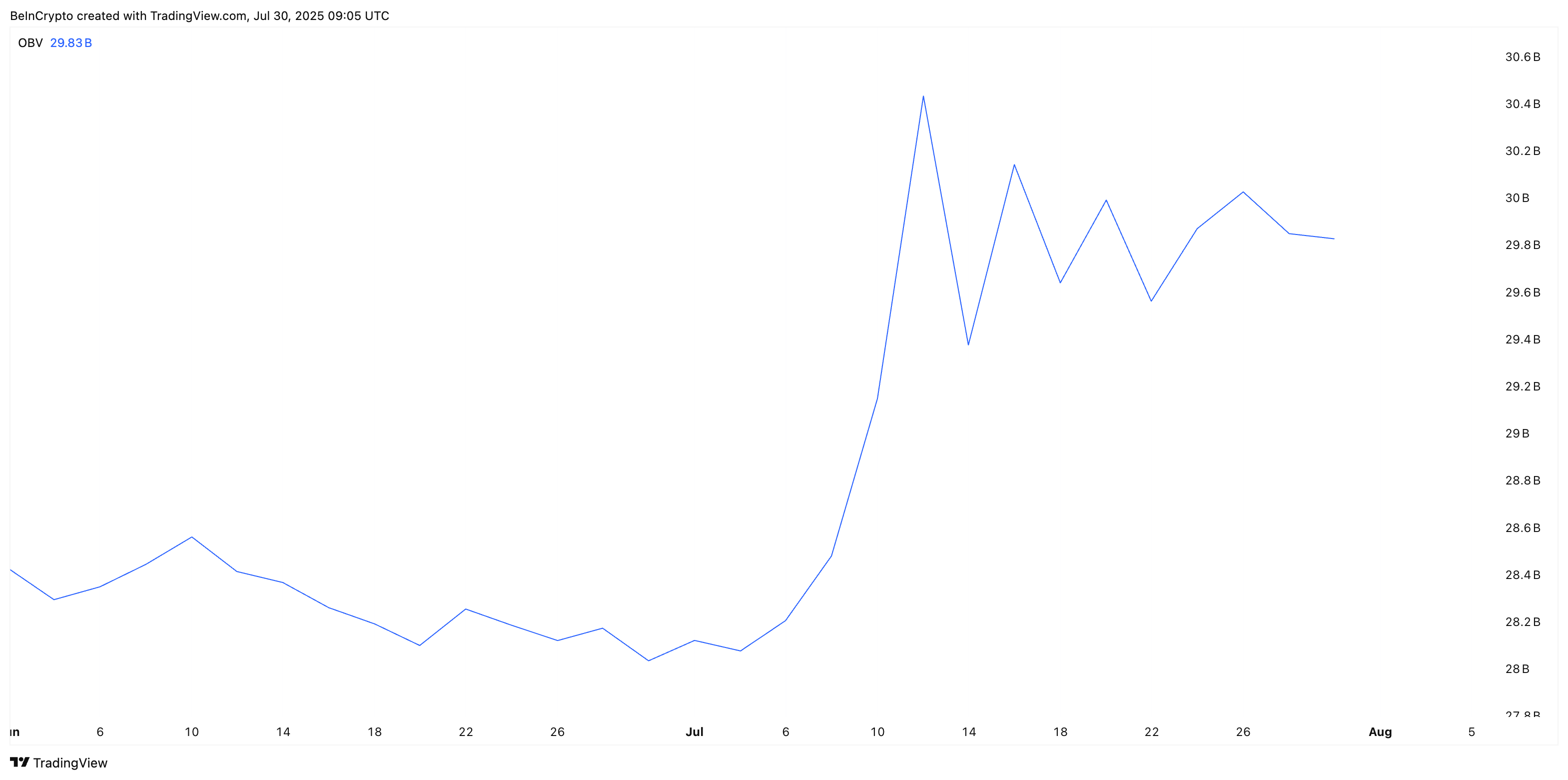

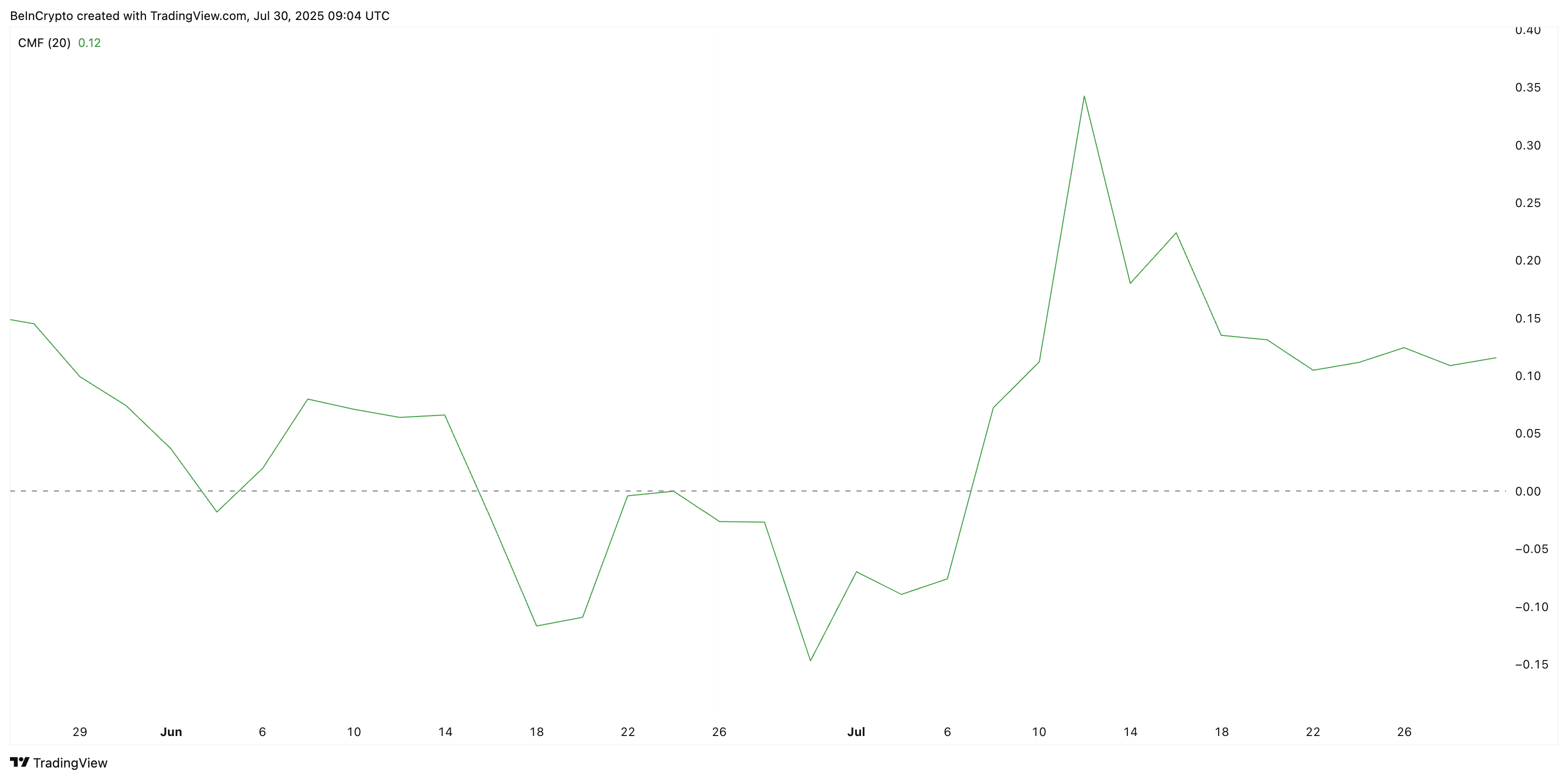

Volume data on the two-day timeframe reinforces this fading momentum. On-Balance Volume (OBV), which tracks cumulative buying and selling pressure, has been drifting lower despite the XLM price breakout, showing that large buyers aren’t stepping in with conviction.

Similarly, the Chaikin Money FLOW (CMF) has dropped sharply, falling from highs around 0.35 in early July to roughly 0.12 now. CMF gauges whether actual money is flowing in or out of an asset, and a slide like this indicates weakening demand.

Both metrics suggest that the bullish breakout may lack the capital backing needed to extend higher.

Stellar (XLM) Price Still Above Flag, but Invalidation Levels Are Clear

The XLM price is currently holding above the bull flag breakout line, trading near $0.41. However, momentum is fragile. A dip below $0.41 would put the stellar (XLM) price back inside the pattern, and a break under $0.35 would erase almost half of the 133% rally that built the flagpole, effectively invalidating the breakout structure.

For bulls to regain control, the XLM price needs a decisive MOVE back above $0.47, backed by stronger inflows and renewed volume. Without that, the recent breakout risks becoming just another failed attempt to push toward new highs.