GameSquare’s $5M CryptoPunk Gamble: Are NFTs the New Corporate Treasury Assets?

GameSquare just dropped $5 million on a CryptoPunk—and Wall Street is losing its mind. Is this a visionary bet on digital assets or a Hail Mary pass from a company chasing hype?

From JPEGs to balance sheets

Move over, Bitcoin. NFTs are muscling into corporate treasuries, with GameSquare’s eight-figure purchase sparking fierce debate. TradFi veterans scoff while crypto natives cheer—but everyone’s watching the experiment unfold.

The new diversification playbook

Forget bonds and gold. Forward-thinking firms now see NFTs as alternative stores of value. Volatile? Absolutely. But in an era where ape JPEGs outpace S&P returns, maybe the suits finally cracked open a crypto whitepaper.

GameSquare just rewrote the CFO handbook—whether that’s genius or recklessness depends on which side of the generational wealth gap you’re standing on.

NFT Insiders Strongly Support the Idea of NFT Treasury Companies

GameSquare’s decision is bold. It places NFTs on the same level as other recent reserve crypto assets like Bitcoin, Ethereum, and Solana.

Garga, CEO of Yuga Labs — the company behind the Bored APE Yacht Club collection — predicted that NFT treasury companies will become a trend. He also expressed a desire to see an APE-focused treasury company.

“The world isn’t ready for NFT treasury companies, but they are coming anyway,” Garga said.

Matt Medved, a member of the Digital Art Council at Art Basel, echoed his expectations. Medved believes the NFT market cap is small but still has massive growth potential. Other NFT investors also argue that NFTs hold a unique advantage — their strong cultural and social elements.

“But I think there’s way more to it. This won’t be just a cold finance strategy like what Michael Saylor is doing. It will involve real social dynamics,” NFT investor Loki said.

Notably, the market is witnessing a sharp rise in NFT trading volume in July. A recent report from BeInCrypto noted that the floor prices of CryptoPunks and Moonbirds have surged, signaling a potential comeback of the NFT season.

July NFT Market Sees Trading Volume Spike

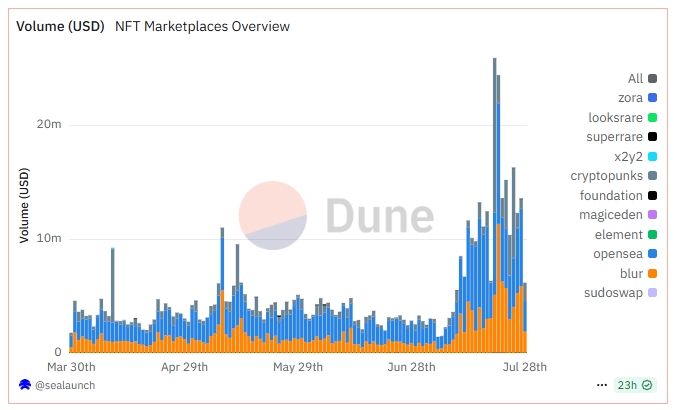

According to data from Dune, NFT marketplace volumes exploded in July. On some days, trading volume reached $26 million, with the daily average above $10 million.

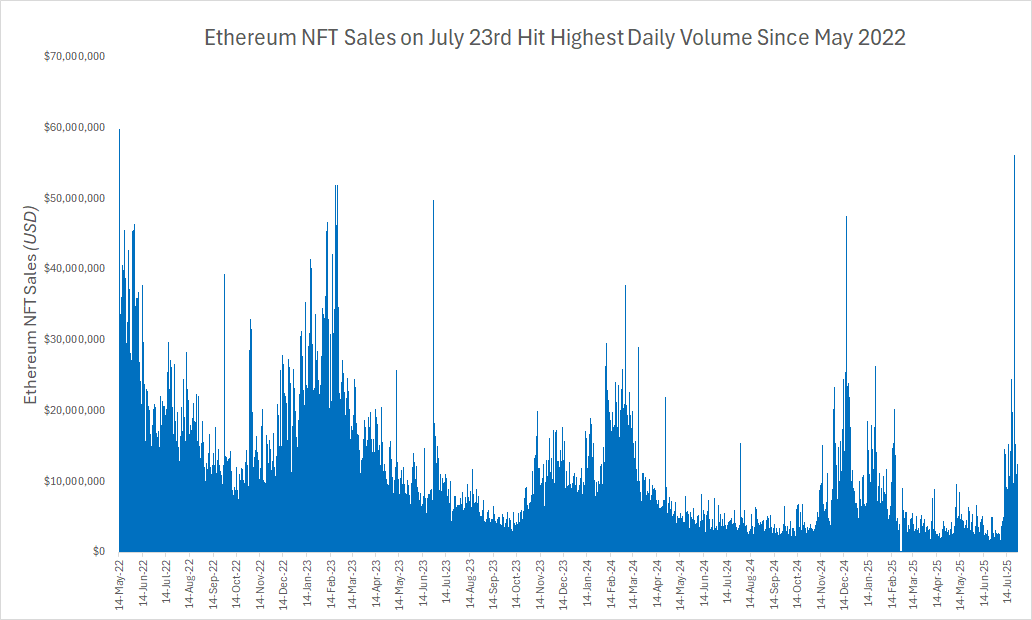

Additionally, Nathan Frankovitz — an analyst at VanEck — cited data from CryptoSlam, noting that ethereum NFT trading volume on July 23 spiked to the highest level since May 2022.

This data shows renewed interest in NFTs, creating favorable conditions for businesses to consider these assets as part of their strategic reserves.

GameSquare may be the first signal, but it’s still too early to call it a full-blown trend.

If this movement gains momentum, the most promising NFT collections likely to benefit WOULD include Pudgy Penguins, CryptoPunks, and Bored Ape Yacht Club. According to OpenSea, these collections account for most of the liquidity in the NFT market.

The Value of NFTs Remains Controversial

Even though NFT industry leaders believe that NFT treasury companies could revolutionize corporate finance — similar to how MicroStrategy used Bitcoin — the intrinsic value of NFTs remains hotly debated, even within the crypto sector.

Anatoly Yakovenko, co-founder of Solana, bluntly criticized NFTs and memecoins in a recent discussion on X (formerly Twitter).

“I’ve said this for years. Memecoins and NFTs are digital slop and have no intrinsic value. Like a mobile game loot box. People spend $150B a year on mobile gaming,” Yakovenko said.

Skepticism goes beyond NFTs themselves. Using crypto as a strategic reserve has faced doubt since its early days.

Like Bitcoin-reserve companies, NFT treasury firms could issue bonds to purchase NFTs, inflating NFT and stock values. Then, retail investors would buy shares in companies holding high-value NFT portfolios. Those companies would recycle that capital. The cycle could break if capital inflows weaken and NFT prices crash.

Therefore, assets used for strategic reserves must demonstrate sustainable growth. Historically, this is where NFTs fundamentally differ from Bitcoin.