Shiba Inu’s Summer Rally Cools Off—Whales Bail as Price Takes a Hit

Shiba Inu’s hot streak hits a wall. The meme coin’s summer surge is sputtering—big players are cashing out, and the price is feeling the pinch.

Whales make waves as they exit. When major holders ditch their bags, retail traders get left holding them. Classic crypto.

Where’s the floor? Without whale support, SHIB’s price action looks shaky. But hey, at least the ‘fundamentals’ are still… wait, what fundamentals?

SHIB Bulls Lose Grip as Large Holders Trigger Breakdown

Leading meme coin SHIB has broken below the lower trend line of the ascending parallel channel within which it traded for over a month.

: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily crypto Newsletter here.

Such breakdowns are interpreted as early signs of trend reversals, especially when accompanied by weakening demand and increased selling volume.

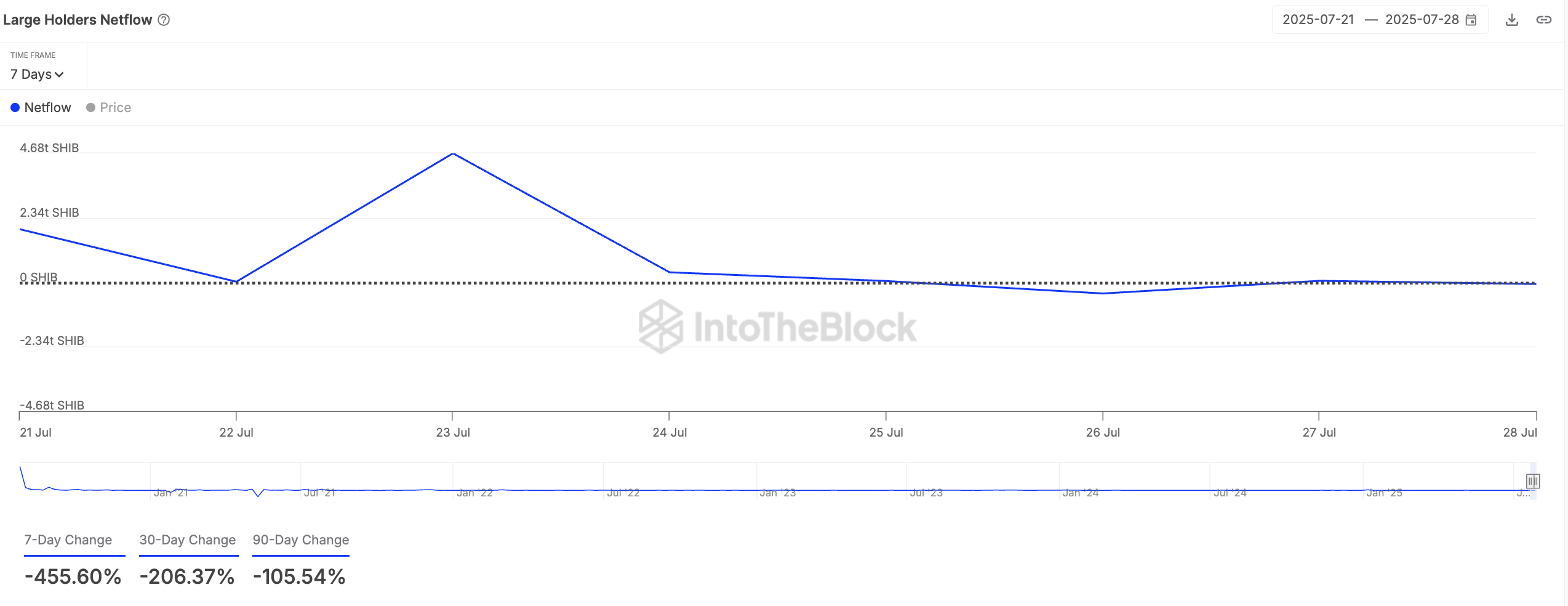

For SHIB, the breakdown coincides with a sharp surge in whale sell-offs. On-chain data from IntoTheBlock reveals a 456% dip in large holders’ netflow over the past week, confirming that major investors are exiting their positions and realizing profits.

Large holders are whale addresses that hold more than 1% of an asset’s circulating supply. Their netflow tracks the difference between the coins they buy and the amount they sell over a specific period.

When an asset’s large holders’ netflow dips this way, more tokens FLOW out of whale wallets than into them. This signals increased profit-taking, often a precursor to price weakness.

In SHIB’s case, the sharp decline in netflow confirms that major investors are offloading their holdings. This reduces market confidence and adds downward pressure on the token’s value.

Futures Market Retreat Hints at Deeper Losses

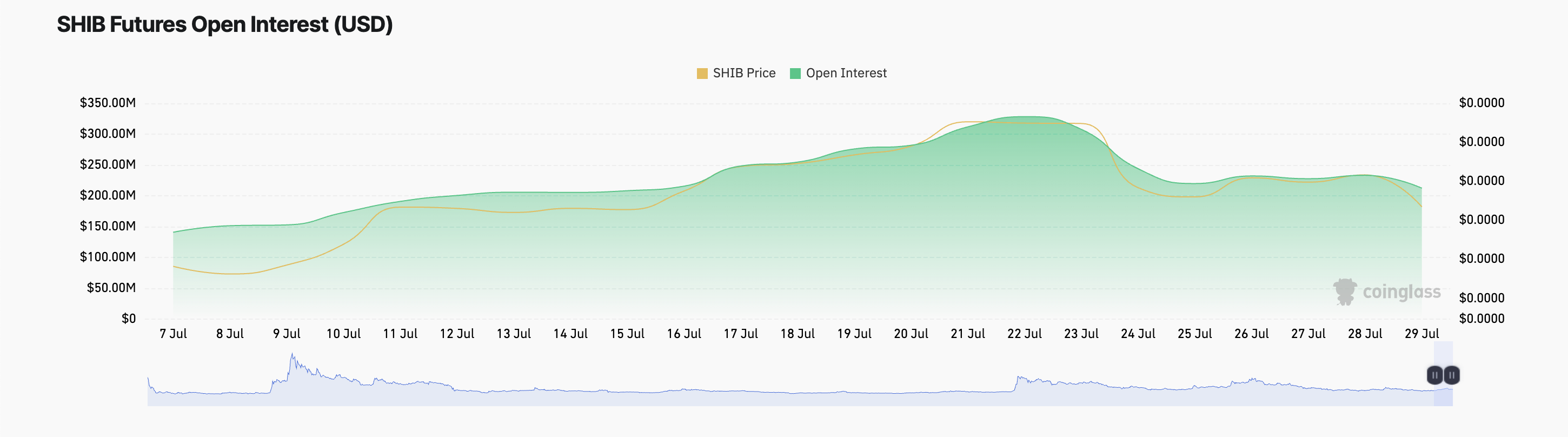

Sentiment in the derivatives market mirrors the weakness seen on-chain. SHIB’s open interest in futures contracts has been steadily declining since July 22, plunging by 35% to stand at $212.48 million at the time of writing.

This sustained drop suggests that traders are increasingly unwinding their positions, with fewer participants willing to bet on the token’s short-term upside.

When open interest falls alongside price, it is an overall sign of cooling momentum. In SHIB’s case, this drop reinforces the bearish outlook and suggests that conviction and capital are leaving the market.

SHIB Bulls Eye $0.00001467, But Whale Activity Clouds the Path

SHIB trades at $0.00001351 at press time, facing strong resistance at $0.00001362. If whale selloffs persist, this price barrier could strengthen and force SHIB’s price to trend downward to the support floor at $0.00001239.

However, if new demand rockets, the meme coin could breach $0.00001362 and soar to $0.00001467.