HBAR Whales Gobble Up the Dip as Retail Panics—Is a Massive Rally Imminent?

While retail traders hyperventilate over short-term price action, HBAR whales are quietly feasting—loading up bags at what could be the bargain of the year.

Smart money moves vs. emotional trading: Who do you think will win this time?

The herd's bearish sentiment often marks the perfect contrarian signal—just ask anyone who sold Bitcoin during the 2018 'crypto winter.' Now history might be repeating itself with Hedera's native token.

Meanwhile, Wall Street 'experts' still can't decide if crypto is a scam or the future of finance—maybe because their bonuses depend on maintaining that sweet, sweet ambiguity.

Next resistance level? The whales probably already know.

Whales Accumulate, Netflows Validate

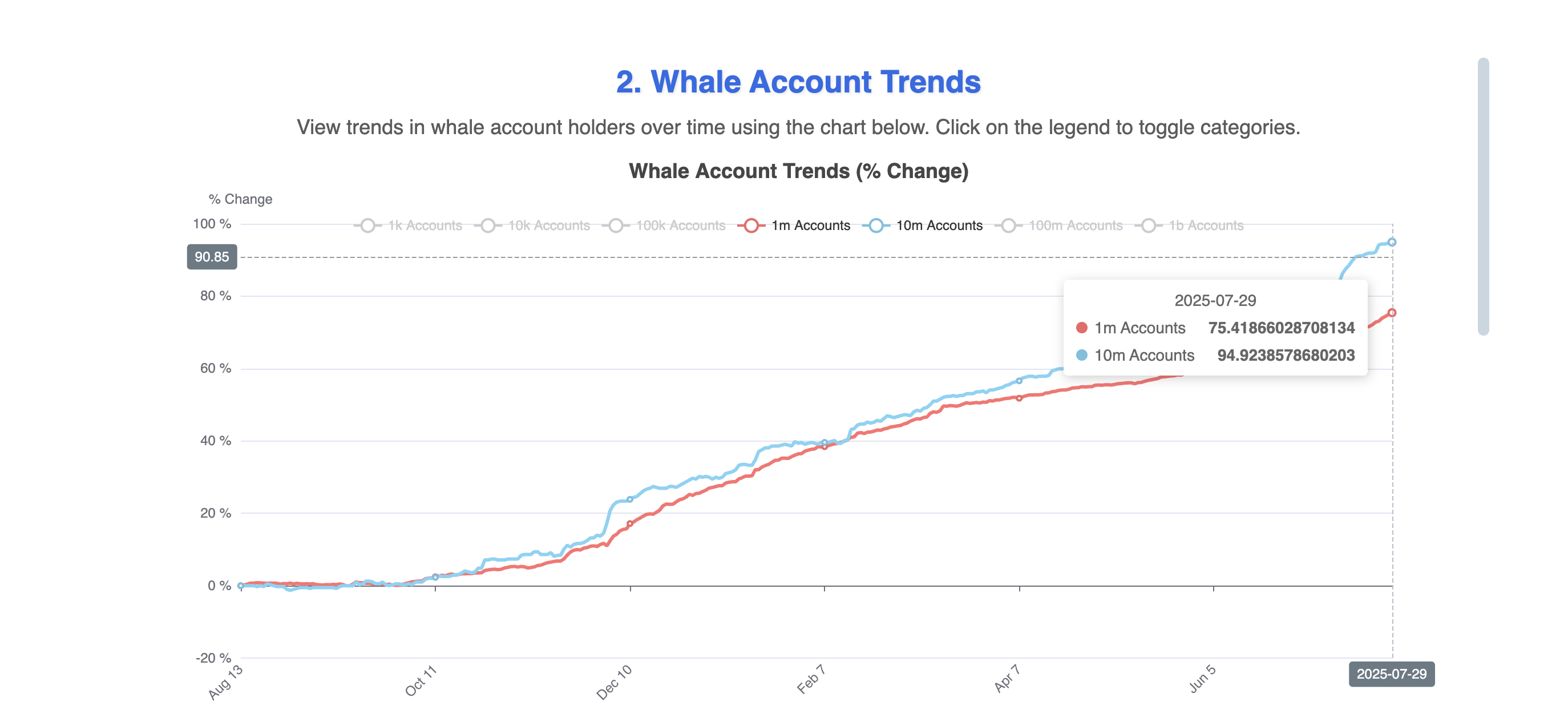

HBAR price may be down from its $0.30 high, but big players are seeing it as a buy-the-dip opportunity. Since July 20, the number of wallets holding at least 1 million HBAR has jumped almost 5%, and those with 10 million or more are up almost 4.5%. That kind of activity from whales usually signals quiet accumulation, not panic.

: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily crypto Newsletter here.

What confirms this move? Spot exchange netflow.

The spot netflow chart suggests that in July, exchanges have predominantly seen HBAR outflows, hinting at growing accumulation.

This metric tracks how much HBAR is entering or exiting exchanges. A strong outflow trend means holders are withdrawing tokens, less likely to be sold. In simple terms, whales are buying and moving coins off-exchange, which often sets up bullish conditions.

OBV Momentum Aligns With Whale Buying

The On-Balance Volume (OBV) chart adds another LAYER of validation. OBV measures the cumulative volume flow, essentially tracking whether volume is coming from buyers or sellers. A rising OBV during a price climb shows real buying support.

For HBAR, OBV has been trending higher since early July, and even after the recent dip, it hasn’t cracked. That’s key. The whale buying and netflow behavior wouldn’t mean much if volume wasn’t backing it.

But OBV confirms it: the demand behind the scenes is still very much alive. This strengthens the accumulation narrative and hints that the dip may be running out of steam.

HBAR Price Holds Key Support, But Needs a Trigger

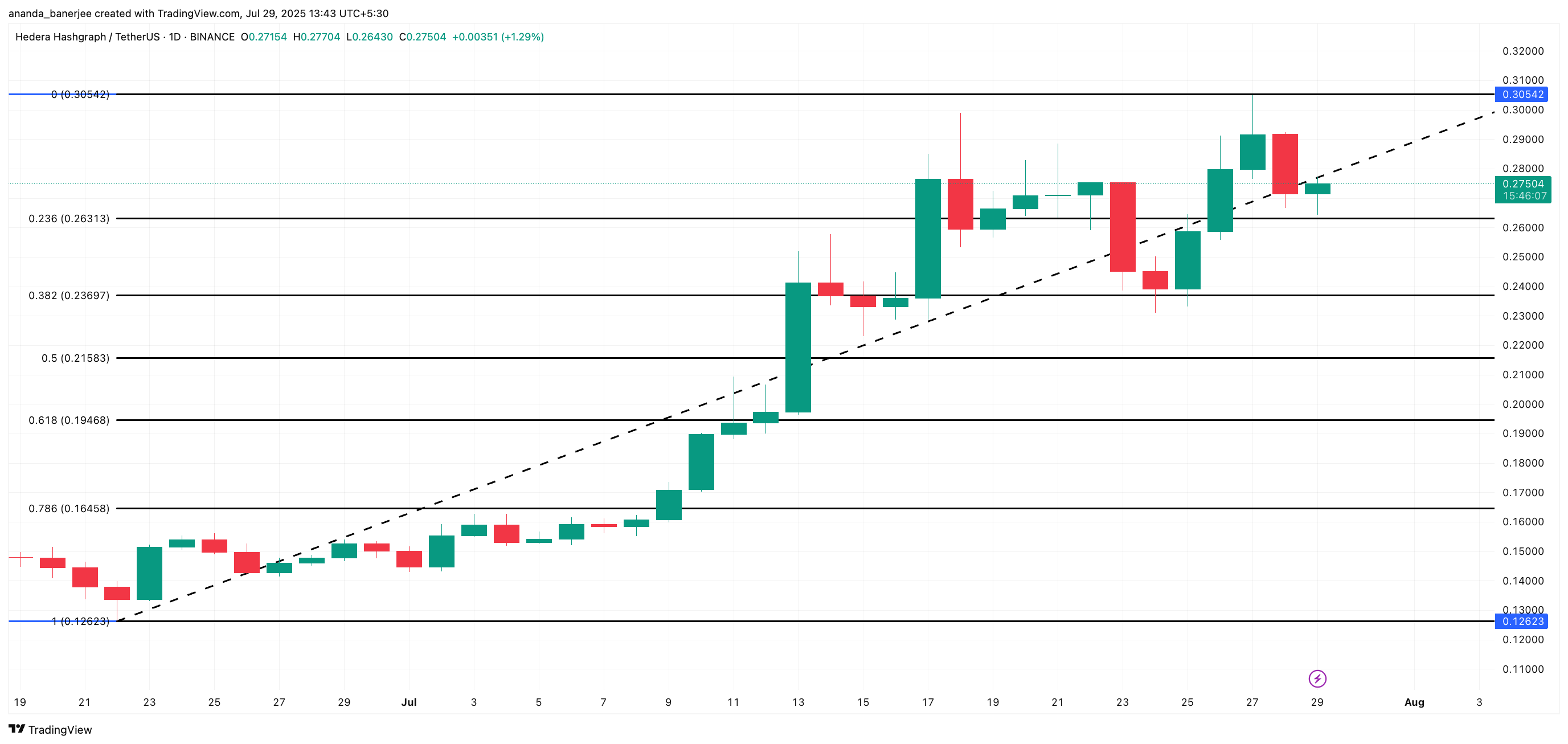

HBAR is currently holding just above the 0.236 Fibonacci retracement at $0.26, a level it must protect. Above this, a breakout beyond $0.30 is possible if momentum returns, led by increased whale positioning and outflows. However, $0.26 remains the key support, and a dip under that renders the bullish hypothesis weak.

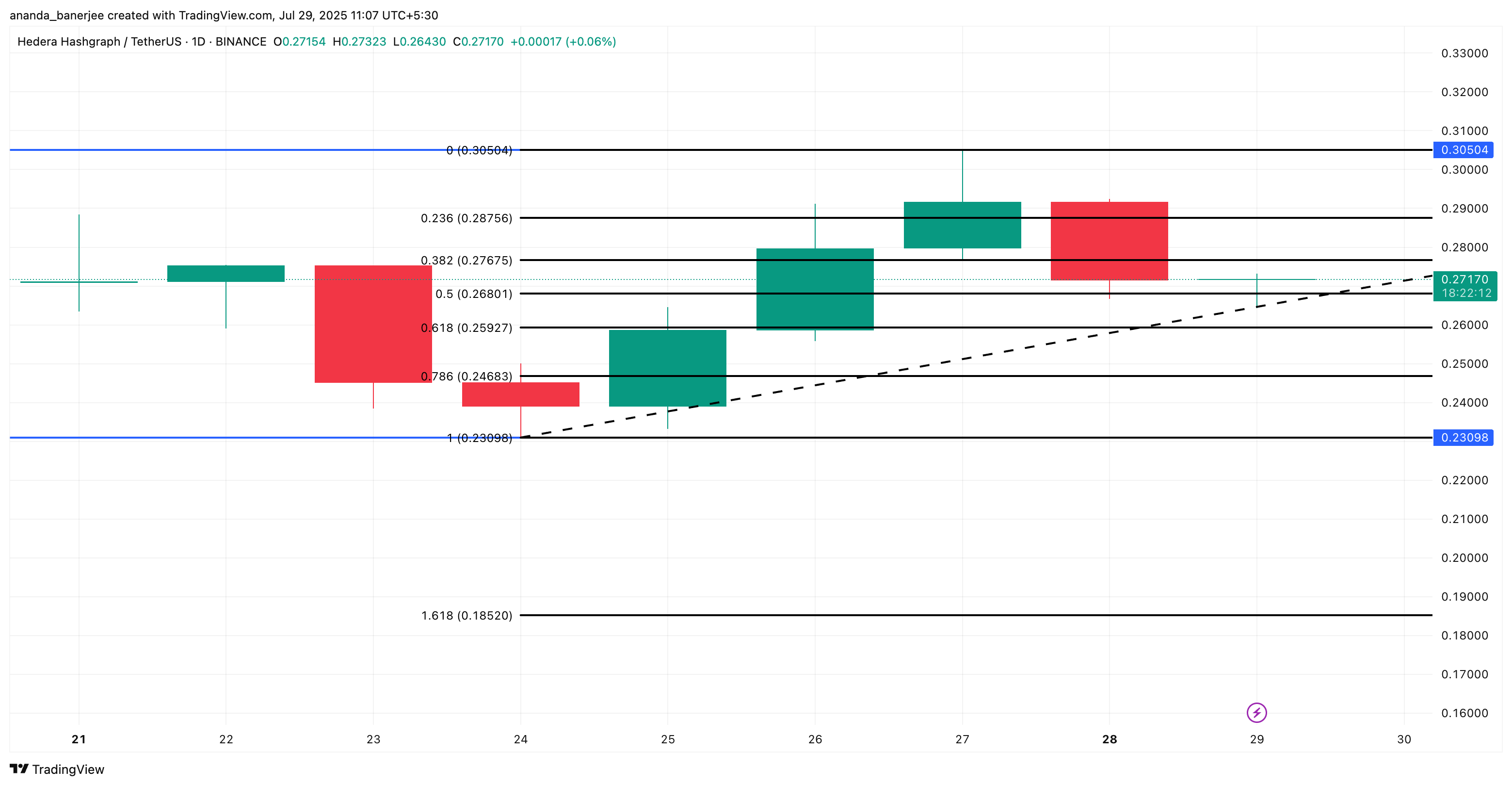

While the above chart captures the broader swing, from $0.12 to $0.30, a bird’s eye view of the chart also reveals a few key levels that HBAR might need to break in order to inch towards the 5-month high.

Per the shorter swing chart, $0.28 remains a key level for HBAR to break. And the $0.26 level serves as the key support, aligning with the bigger swing or the primary chart.

All signs point to strength beneath the surface; whales are buying, supply is draining, and OBV hasn’t broken down. Yet, price hasn’t popped. That suggests the market’s waiting on a trigger, possibly a shift in retail sentiment.