Ethereum’s Rally Takes a Breather — But On-Chain Metrics Scream ’Buy the Dip’

Ethereum bulls hit the pause button after a blistering rally — but don't pop the champagne just yet, bears.

Technical indicators are flashing their most bullish signals since the 2024 breakout. The network's gas fee structure (still highway robbery, but that's another story) shows accumulation patterns mirroring Q1's 78% surge.

Meanwhile, institutional wallets quietly loaded up during yesterday's 5% pullback. Because nothing says 'smart money' like frontrunning retail FOMO.

Key resistance at $4,800 looks shaky. If ETH holds above its 20-day moving average through Friday's options expiry, we could see another leg up toward all-time highs.

Just remember: in crypto, 'oversold' means 'about to rip' and 'overbought' means 'about to rip harder.' The only indicator that matters? Whether your exchange account can handle the margin calls.

Ethereum Is Showing Signs Of A Rally

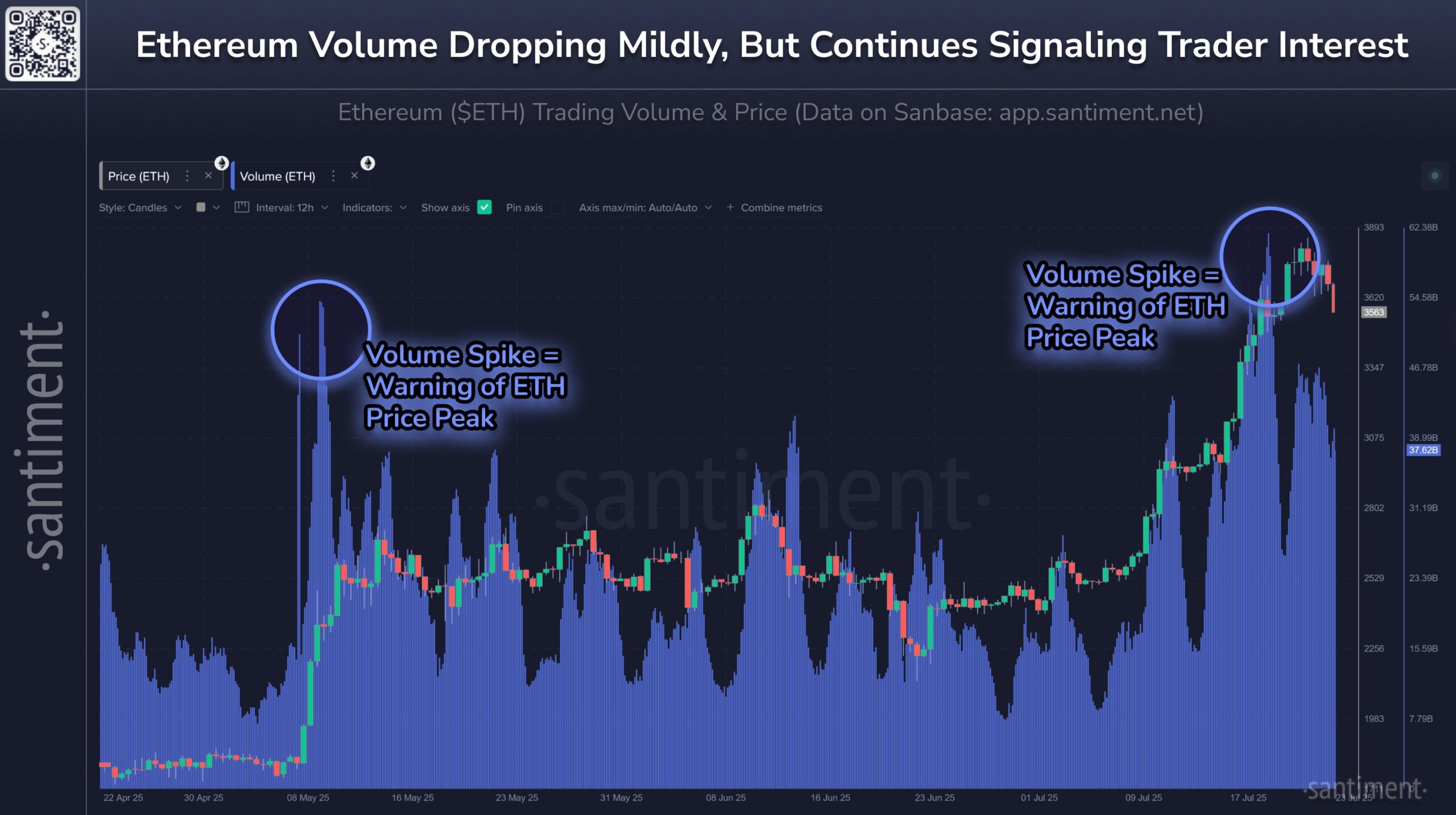

Ethereum’s trading volume is sharply increasing, a signal that retail investors are showing renewed interest. While Ethereum’s price ratio to Bitcoin dropped by nearly 6% this week, the surge in trading volume mirrors a pattern seen in May earlier this year. Such a spike often precedes a local top, but this time it may be different.

Should both trading and social volume decrease for the rest of the week, this could indicate that the market is preparing for another bullish surge. The impatience and profit-taking behavior from retail investors may set the stage for the next upward wave.

: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily crypto Newsletter here.

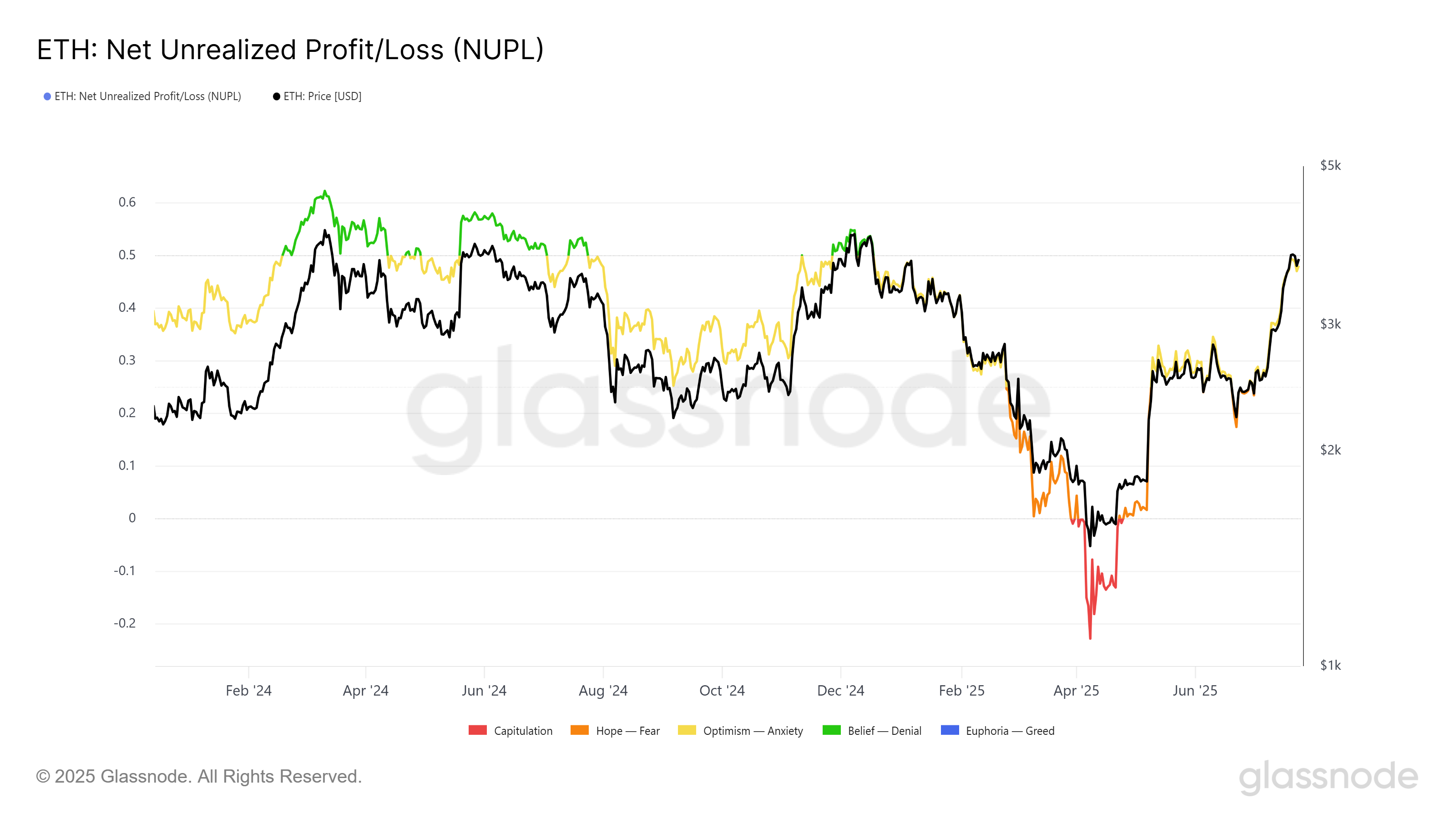

Looking at broader technical indicators, the NUPL (Net Unrealized Profit/Loss) suggests that Ethereum is poised for a significant rally. The NUPL indicator, when reaching a threshold of 0.5, historically has signaled a pause in the uptrend, followed by a sharp rally.

Ethereum is currently nearing this threshold, which, in the past, has marked the beginning of powerful upward price action. As the NUPL indicator continues to rise, it provides a strong historical precedent for Ethereum’s next price rally.

ETH Price Is Treading The Waters

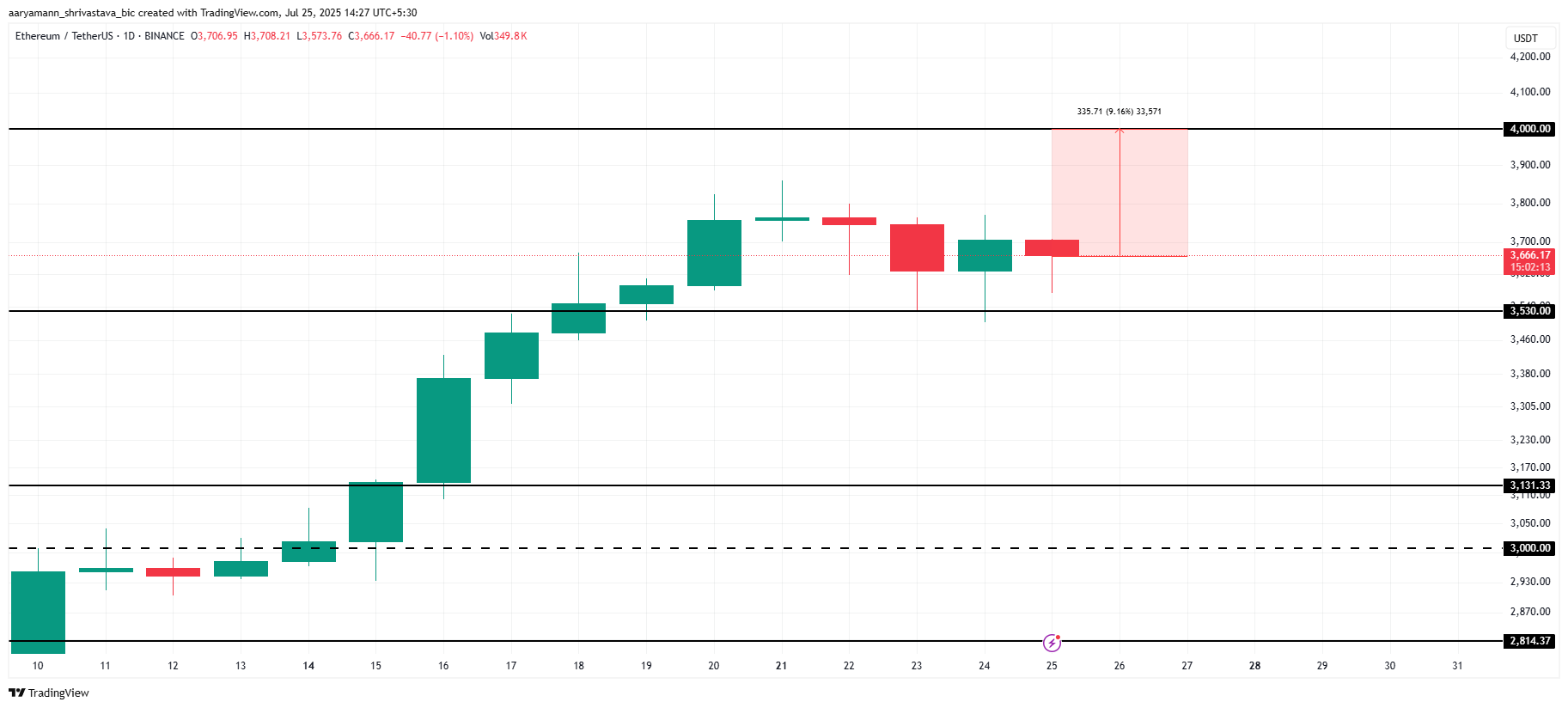

Ethereum is currently trading at $3,666, just 9% away from the critical $4,000 resistance that many investors have been waiting for over the past seven months. The altcoin is expected to continue its upward momentum despite the recent consolidation, with the potential to breach the $4,000 mark soon.

The continuation of the bullish trend is supported by strong market sentiment and technical indicators. As long as Ethereum remains above its key support levels, the price is likely to surge toward $4,000.

If Ethereum can maintain its momentum, a breach of $4,000 could act as a catalyst for further gains.

However, should unforeseen selling pressure arise, Ethereum’s price could slip below the $3,530 support level. In such a scenario, Ethereum may fall to $3,131, invalidating the current bullish outlook. The key will be maintaining support and capitalizing on the retail-driven surge.