Stablecoins Overtake SOL in Mass Adoption as Crypto Pivots to Real-World Utility

Move over, speculative assets—stablecoins are eating SOL's lunch. The market's demand for dollar-pegged tokens now outpaces even Solana's high-speed blockchain, signaling a tectonic shift toward practical crypto use cases.

No more 'number go up' hype

Forget moonboys and memecoins. Traders and institutions are voting with their wallets, flocking to stable assets that won't evaporate overnight. Meanwhile, SOL's once-unstoppable rally now looks like just another altcoin rollercoaster.

The irony? Wall Street's favorite crypto criticism—'it's not real money'—gets demolished by... crypto replicating real money. Maybe the suits were right about everything except who'd build the better mousetrap.

Why Stablecoins Are Winning as Crypto Matures

After years of being viewed as speculative tools or “toys for tech enthusiasts,” the crypto market is undergoing a structural shift. The latest data shows that the number of wallets holding stablecoins has officially exceeded those holding Solana’s SOL token.

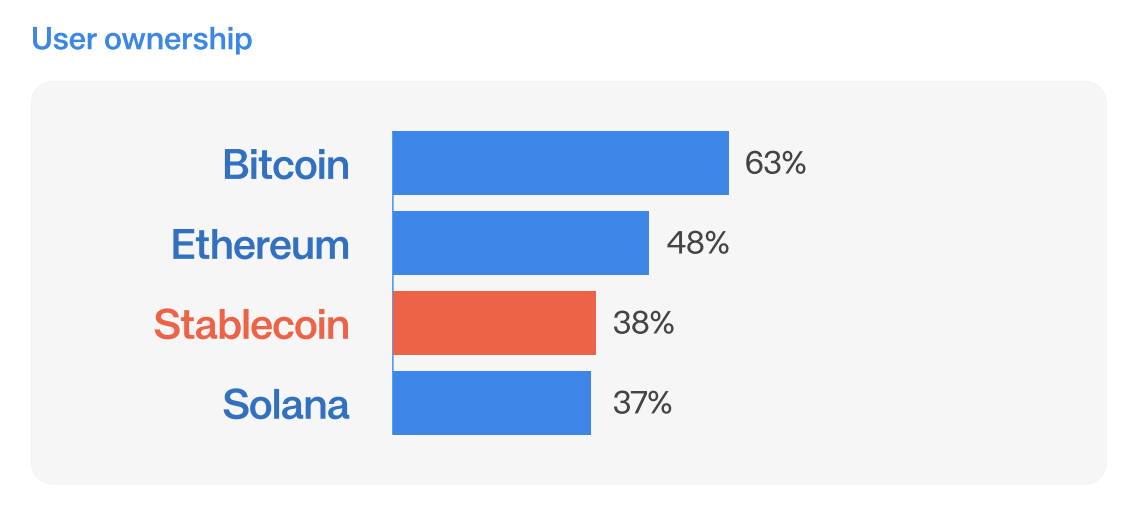

Specifically, stablecoin now accounts for 38% of all wallets, while SOL represents only 37%.

This appears to signal a shift in investor priorities, from holding highly volatile digital assets to using more stable digital assets. In other words, crypto is entering a phase of practical application.

Stablecoin has become an essential part of the Web3 ecosystem. Unlike other narratives, stablecoins don’t rely on market cycles. They prove to be a real product-market fit and are easy to use for mainstream users. They enhance cross-border payments, e-commerce, and DeFi and dominate value storage in the expanding digital economy.

A key factor fueling the rapid growth of stablecoins is the shifting regulatory environment, particularly in the US. The Genius Act has triggered a new wave of stablecoin issuance from banks, asset funds, and even major tech firms.

Chainlink stated that a new “stablecoin issuance boom” is being launched, driven by regulatory momentum and growing interest from traditional finance.

“US stablecoin legislation is kicking off a stablecoin issuance boom from banks, asset managers, & tech companies,” chainlink stated.

However, not everyone is fully optimistic. JPMorgan recently argued that the forecast of a $2 trillion stablecoin market by 2028 is “overly optimistic”, with a more realistic figure closer to $500 billion.

However, a survey of 295 global institutions shows 49% use stablecoins for payments, with 41% in testing or planning phases.

“Stablecoins have become unquestionably the alternative, dollarbased, payments rail for the global south. Especially for use cases in treasury management, payouts and pay-ins between the Global South countries and the Global North. This alone WOULD be a major breakthrough, but the coming of the GENIUS Act could be a tipping point where stablecoins gain legitimacy in the G20” Simon Taylor, head of strategy at Sardine, shared.

Although more Layer-1 platforms like Solana, Tron, and BNB Chain are joining the stablecoin race, ethereum remains the dominant “home” in terms of both volume and transaction value. Still, high gas fees and limited scalability remain major barriers.

This opens the door for high-performance blockchains to gain market share ahead.