Corporate Bitcoin Adoption Soars: Public Companies Dive Into Crypto This Week

Wall Street meets blockchain—again. Another wave of publicly traded firms just added Bitcoin to their balance sheets, signaling a tipping point for institutional crypto adoption.

Why now? Because even CFOs finally get FOMO.

These aren't your 2017 crypto tourists. These are Fortune 500 players deploying treasury strategies that would make Michael Saylor nod approvingly. No more dipping toes—they're diving headfirst into cold storage.

The kicker? They're doing it while traditional finance clings to its spreadsheets. Banks still can't decide if crypto is 'too volatile' or if they're just salty about being late to the party.

One thing's clear: When corporations move faster than regulators, you know the financial revolution won't be televised—it'll be tokenized.

Bitcoin Adoption Accelerates as Firms Embrace BTC

MicroStrategy (MSTR) remains a notable leader in corporate bitcoin adoption. The firm recently announced plans to issue 5 million Series A STRC preferred shares to raise capital for additional BTC purchases.

The capital is intended for working capital needs and explicitly aligns with a long-term Bitcoin reserve strategy.

Beyond MicroStrategy, other companies are actively adopting Bitcoin on their balance sheets. US-listed Profusa secured a $100 million equity credit line to build a Bitcoin reserve. Similarly, EV startup Volcon acquired over 280 BTC and completed a $500 million private funding round to support further accumulation.

In Europe, Swedish-listed H100 Group increased its holdings to over 510 BTC after purchasing an additional 140 BTC.

Perhaps the most symbolic MOVE comes from Grupo Murano, a major real estate conglomerate in Mexico, which declared Bitcoin a “core strategic asset” with an initial investment of $1 billion. This shows a growing corporate consensus that Bitcoin is more than a speculative tool—it is becoming part of global financial policy.

Market Signals Support Confidence

Recent data shows that public companies’ net purchases of Bitcoin reached $953 million last week alone, with MSTR accounting for over $700 million.

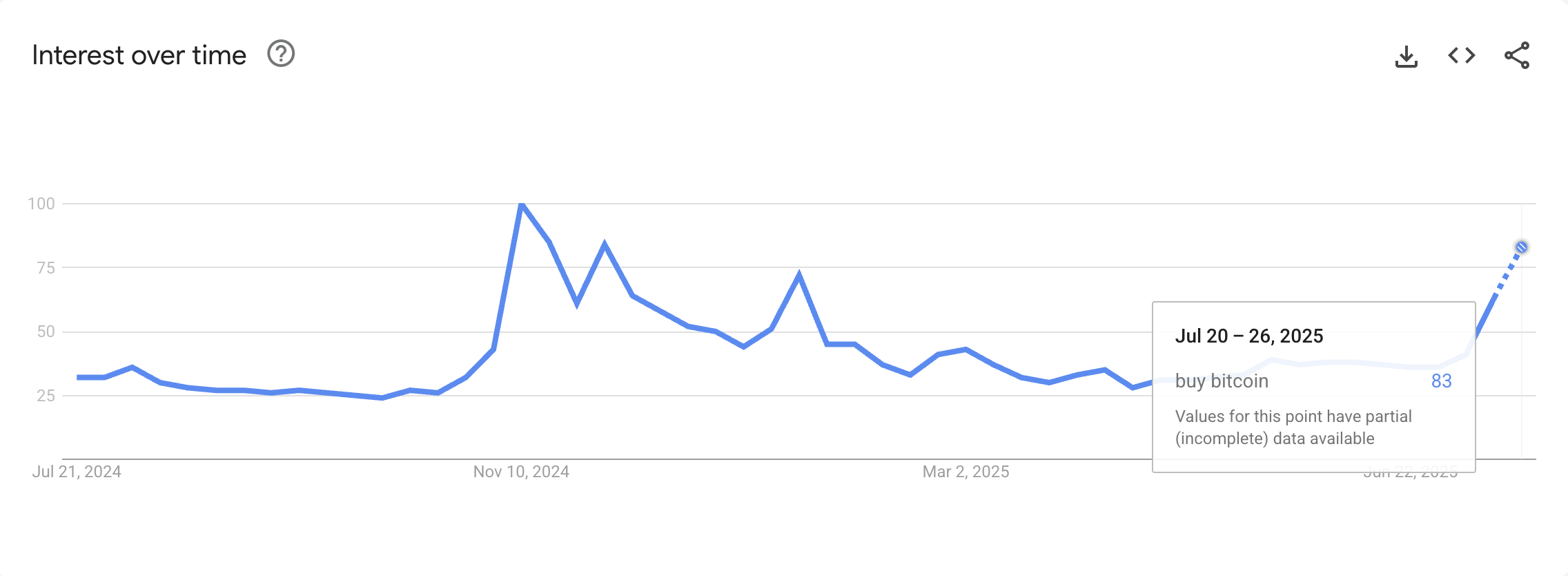

This surge coincides with a sharp increase in Google Trends searches for “Buy Bitcoin,” suggesting a revival of retail interest alongside institutional momentum.

Overall, corporate Bitcoin adoption reflects a broader financial paradigm shift. Bitcoin is no longer treated as a fringe or experimental asset. From tech to real estate, businesses are increasingly incorporating Bitcoin into their treasury models, not only for diversification but also as a hedge and a symbol of forward-thinking strategy.