Cardano (ADA) Braces for Storm: $34 Million Liquidation Threat Sparks Market Jitters

Cardano's ADA finds itself in the crosshairs as a $34 million liquidation risk casts a shadow over its price action. Traders are buckling up for potential turbulence—because when crypto markets sneeze, altcoins catch pneumonia.

Liquidation Looms Large

With $34 million worth of ADA positions at risk, the third-generation blockchain faces its first major stress test since last quarter's rally. Exchange order books show thin support below current levels—never a comforting sight when leverage gets unwound.

The Silver Lining Playbook

For all the hand-wringing, seasoned traders see opportunity. 'These shakeouts create the healthiest foundations for rallies,' notes one hedge fund manager between sips of overpriced cold brew. 'The market's memory lasts about as long as a TikTok trend.'

As always in crypto, the only certainty is volatility. Whether this proves to be a buying opportunity or the start of something uglier depends entirely on whether the 'strong hands' show up—or remember their wallet passwords.

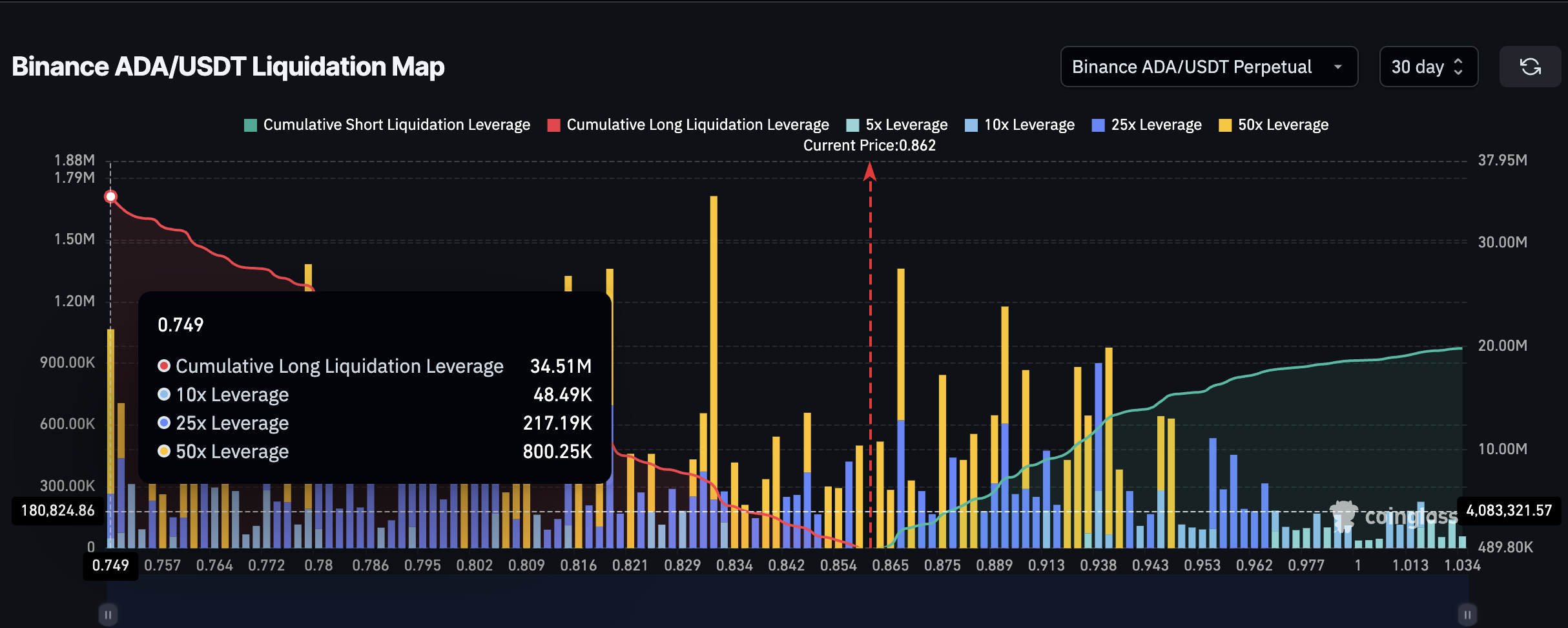

Liquidation Clusters Below $0.749 Signal Breakdown Risk

A sharp risk to the Cardano price lies in the rising concentration of long liquidations stacked just below the $0.749 mark. This $34 million cumulative zone represents traders who opened bullish leveraged bets expecting prices to continue rising. If ADA slides further and breaches that level, these positions will automatically be closed out; a process called liquidation, which can snowball into a steeper drop.

: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily crypto Newsletter here.

Liquidations happen when traders borrow funds (leverage) and the price moves against them. Exchanges forcibly close these positions to prevent further losses, creating rapid selling pressure. For Cardano, the fact that so many longs sit below $0.749 suggests that this level has become a fault line. If broken, ADA could quickly tumble to $0.728 or even $0.687.

A liquidation cluster this large beneath support is a red flag. It not only reflects trader overconfidence but also sets the stage for an automated sell-off if the market turns.

MVRV Suggests Holders Are Primed to Sell

Cardano’s 30-day MVRV (Market Value to Realized Value) ratio flipped positive on July 8 and has continued climbing, meaning most recent buyers are now sitting on paper profits. MVRV compares an asset’s current price to the average price paid by holders. When the ratio is above zero, especially in short timeframes, it often indicates that traders may begin taking profits.

Currently, the 30-day MVRV ratio sits at 22.43%, one of the highest since early May.

This aligns with the elevated liquidation risks. If traders are already incentivized to exit due to being in profit, any drop near the $0.749 level could trigger both manual selling and forced liquidations, creating a compounding bearish effect.

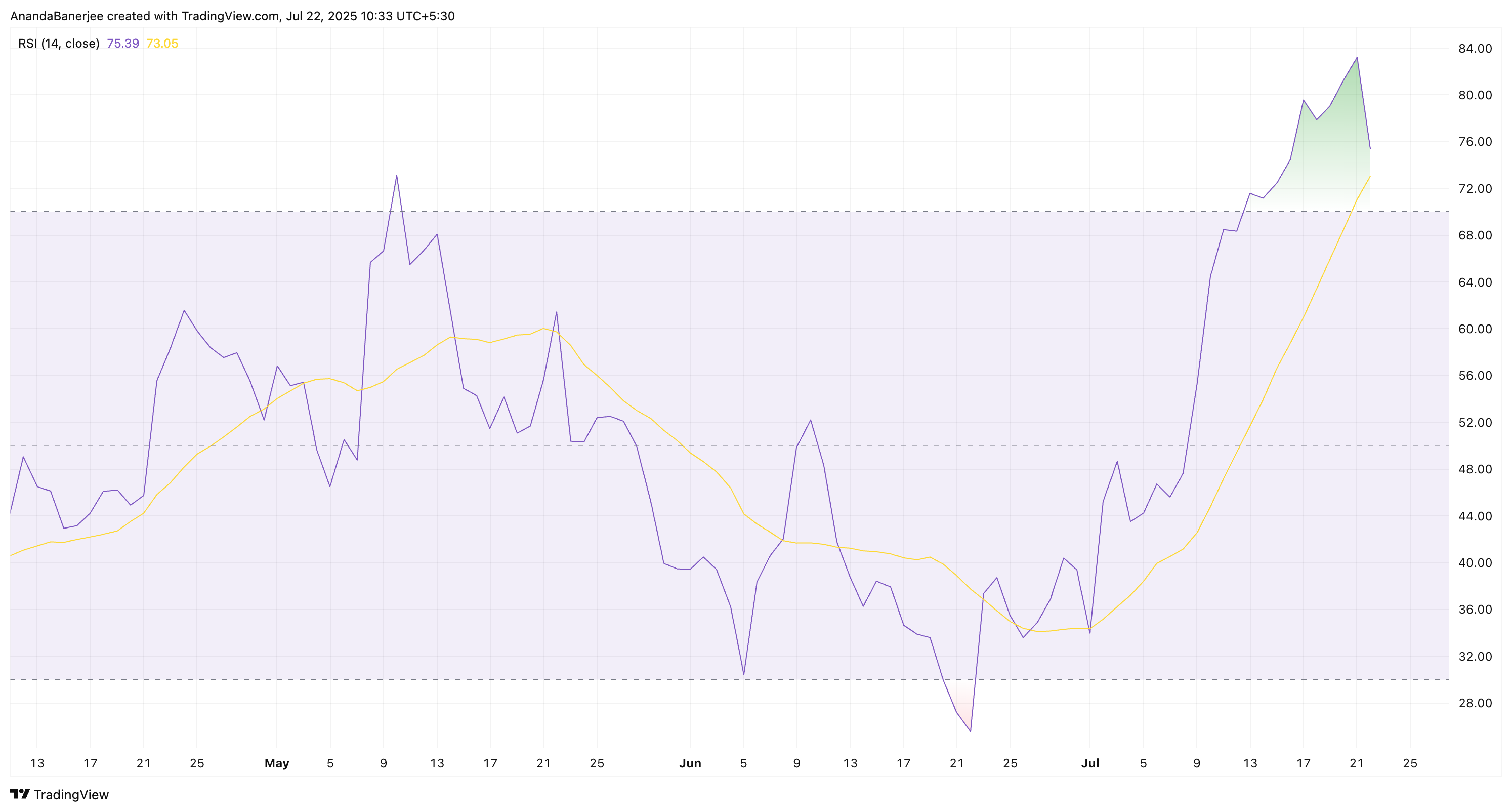

RSI Shows Overheating

Momentum indicators also reinforce the bearish setup. Cardano’s 14-day RSI recently touched 82.6, DEEP into overbought territory, before curling lower. The Relative Strength Index (RSI) tracks how quickly and strongly the price has moved in recent sessions. Readings above 70 suggest excessive bullishness, often preceding reversals.

Cardano Price Outlook: Can $0.749 Hold?

Cardano price is now trading just above $0.86, and the pressure is mounting. If the $0.86 support level (1 Fib extension zone) breaks, the price WOULD look to stay above key horizontal resistance-turned-support lines in $0.84 and $0.81. If you have looked at the liquidation chart from earlier, a push under the aforementioned support levels can start the chain of Long liquidations.

The next key support (previously resistance at 0.786 Fib) sits at $0.78, under which the actual cumulative liquidation threat looms. Even though $0.77 and $0.75 are decently strong support levels, they might not be able to stop the compounding sell pressure once liquidations keep piling.

The trend-based Fibonacci extension tool used here connects the low of $0.51 to the last swing high of $0.86 (support level now) and then to the retracement level of $0.51. This tool can help chart the next targets for a trending asset.

The $0.749 level (from the liquidation chart shared earlier) isn’t just another support; it’s a heavily defended support backed by Leveraged positions. If it cracks, liquidation pressure could push ADA down to $0.72 or even $0.68 (both Fib levels).

However, this bearish thesis is invalidated if the cardano price convincingly breaks above $0.93. That level holds clustered short positions, and a breakout above it could flip the momentum back in favor of the bulls, possibly retesting the $0.98 zone.