XRP Price Rally Still Has Legs—But Brace for a 17% Dip First

XRP bulls aren't done yet—but the road ahead might get bumpy.

After a blistering rally, the digital asset faces a potential 17% pullback before resuming its upward trajectory. Traders are weighing whether to buy the dip or wait for clearer signals.

Market cycles being what they are—predictably irrational—this could be just another shakeout before the next leg up. Or, as cynics would say, 'just another Tuesday in crypto.'

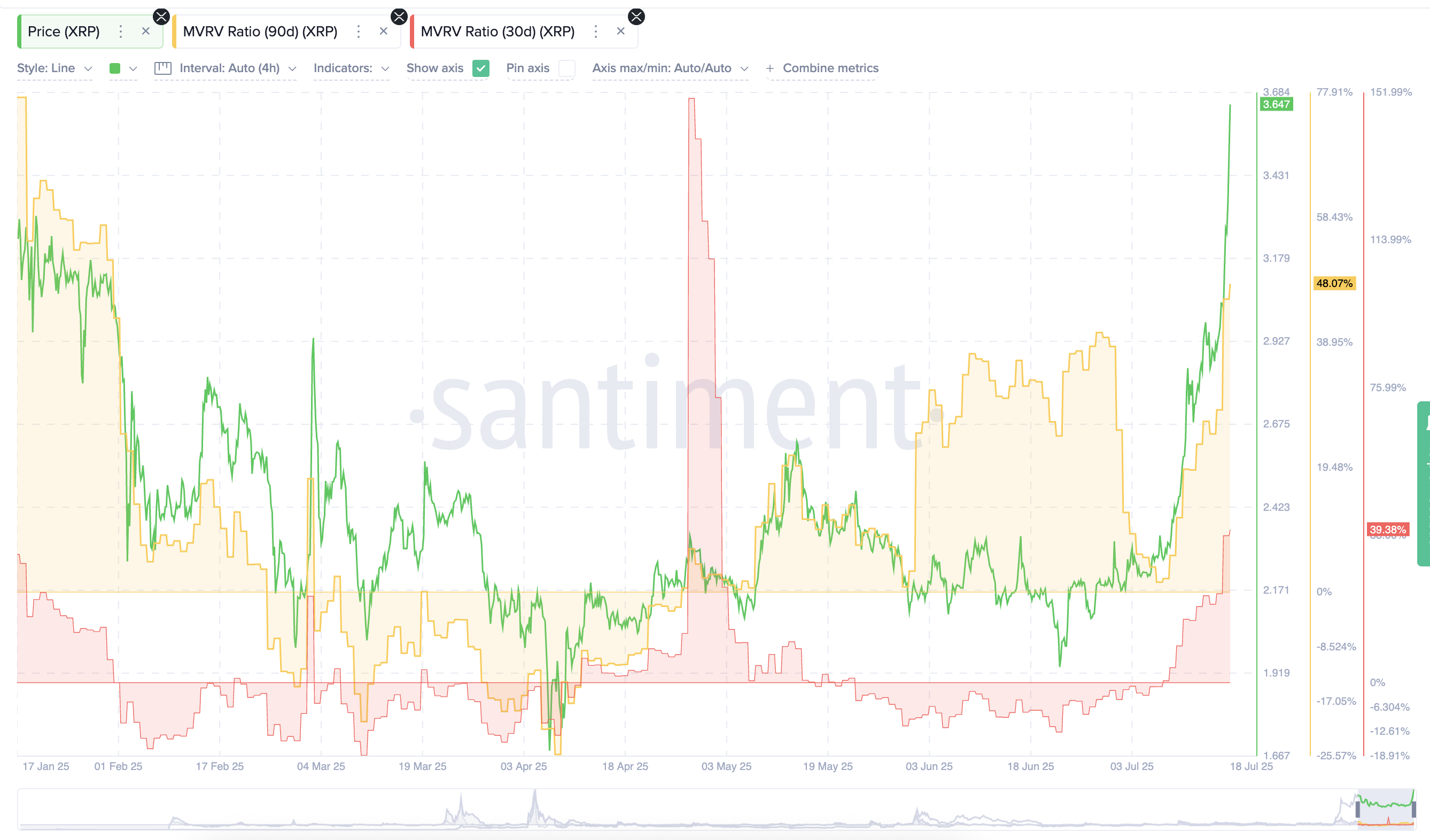

MVRV Ratios Flash Early Profit-Taking Signals

The first flag comes from the 90-day MVRV (Market Value to Realized Value) ratio, which has now surged to 48.07%. This number tracks how much profit wallets holding XRP for 90 days are sitting on.

Historically, high MVRV readings suggest holders may soon start selling to lock in profits.

: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily crypto Newsletter here.

To give context: back on January 31, the same 90-day MVRV level of ~48% preceded a sharp 17% drop, when XRP price fell from $3.11 to $2.58. That pullback came fast, and the same setup is forming again now.

Even the 30-day MVRV is warning potential sell-offs, currently sitting at 39%, its second-highest reading in six months, still way behind April’s peak. That means newer holders are also in healthy profit, which usually triggers some amount of selling pressure.

The Market Value to Realized Value (MVRV) ratio indicates the profit existing holders have realized. When it gets too high, it suggests a lot of unrealized gains in the system, which often leads to a sell-off as holders cash out.

Exchange Inflows Are Surprisingly Low

But while MVRV ratios hint that holders could sell, the actual behavior is currently different.

On-chain data shows that only 13.34 million XRP, worth around $48 million at current prices, have moved into exchanges. That’s extremely low for an all-time high scenario.

Compare this to earlier rallies, like the local tops in May and even January, where exchange inflows spiked dramatically as traders moved tokens to sell. This time, despite the XRP all-time high being here, the data tells a different story: holders aren’t rushing to exit.

Exchange inflows track how much XRP is being sent to centralized exchanges. Spikes usually mean people are preparing to sell. Low inflows, even at high prices, suggest traders are confident and holding.

So while MVRV says profits are up, the inflow metric says nobody’s hitting the sell button yet. That divergence supports the idea that this rally isn’t over, just momentarily stretched.

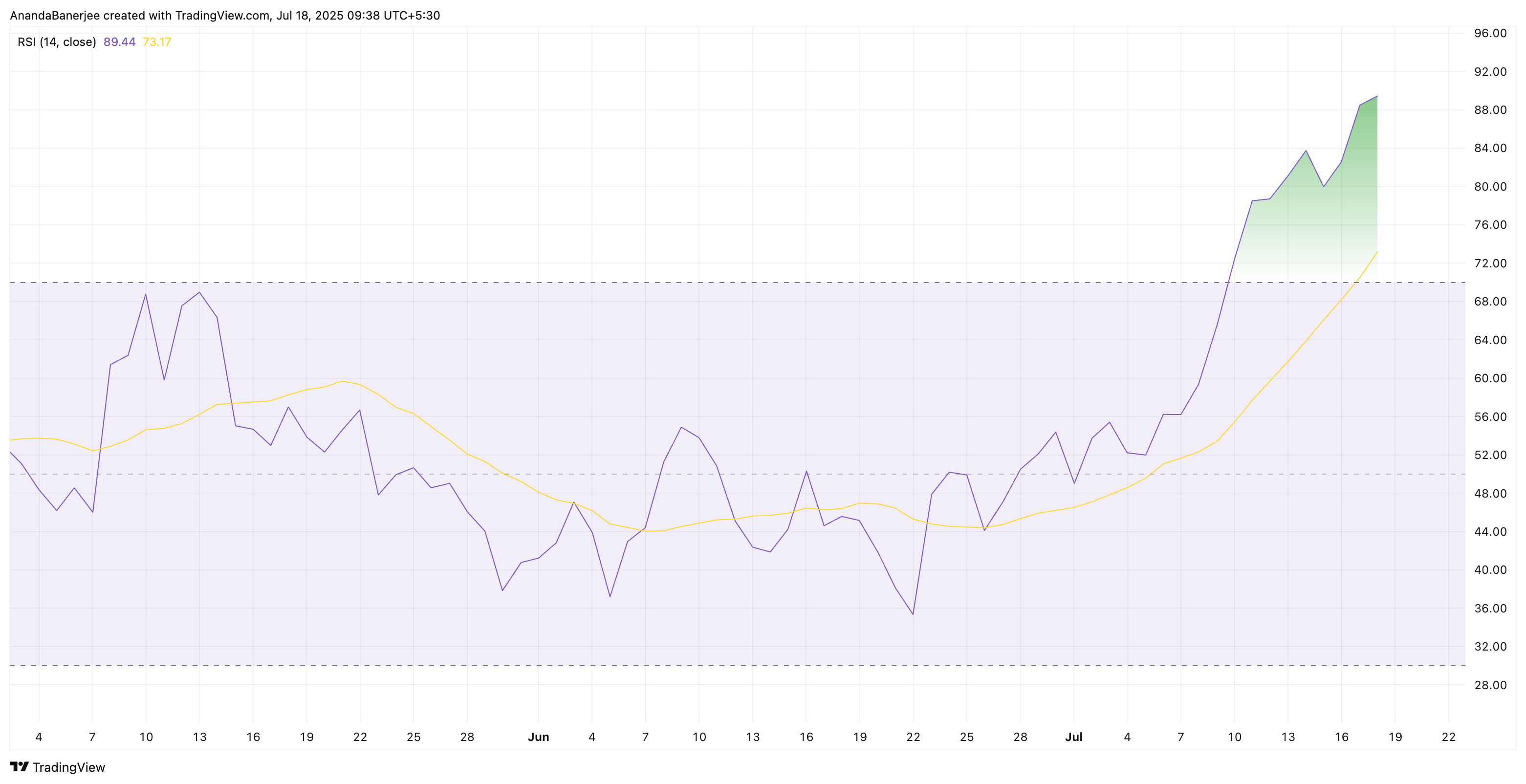

RSI Flashes Overbought Warning; A Temporary XRP Price Cooldown Likely

XRP’s strong rally has now pushed its daily RSI (relative strength index) to 89.44, signaling extreme overbought conditions. This aligns with the overheated MVRV levels, suggesting short-term excitement may be peaking. Historically, RSI above 85 often precedes cooling-off periods or short pullbacks, even in strong bull trends.

RSI measures how fast and how strongly a price has moved. When it crosses above 70, it means the asset may be rising too quickly and could see some short-term weakness.

XRP Price Action Suggests $2.95 Remains Crucial Support

XRP price is currently trading at $3.59, right at the 1.618 Fibonacci extension level. While the uptrend remains intact, current on-chain (the MVRV 90-day metric to be exact) and RSI signals suggest a cooldown toward $2.97 is possible, marking a healthy 17% pullback before continuation, approximately to $2.95.

The $2.95 zone, which aligns with the previous Fibonacci level, is therefore key. As long as the XRP price stays above this level, the bullish setup remains valid. A short-term dip toward it WOULD not invalidate the rally but instead might offer a potential reentry point.

However, a clean break below $2.95 could trigger deeper downside, if paired with profit-taking stints and increasing exchange inflows. Until then, the path toward $4.64, the 2.618 Fib extension, remains the primary target.

Also, the short-term bearish hypothesis, relying on the pullback, would be invalidated if the XRP price cleanly breaches the $3.59 resistance level, searching for a new all-time high.