Coinbase Listing Ignites Caldera (ERA) Rally—But Airdrop Sellers Keep a Lid on Gains

Caldera's ERA token rockets 40% post-Coinbase listing—only to face brutal resistance from profit-hungry airdrop hunters.

The 'Coinbase Effect' strikes again. Another altcoin surges on exchange hype, another reminder that retail traders arrive fashionably late to the party.

Market movers vs. bag holders. While early investors dump free tokens, true believers bet on Caldera's modular blockchain tech—because this time it's totally different.

Gravity always wins. The age-old crypto cycle continues: exchange listing pumps get sold, leaving Twitter threads full of 'I told you so' and diamond-handed cope.

Coinbase Announces Caldera (ERA) Listing

In a recent X (formerly Twitter) post, Coinbase first notified users that it will be supporting ERA trading on its platform. A few hours later, ERA went live to trade against the USD trading pair.

“Caldera (ERA) is now live on Coinbase.com & in the Coinbase iOS & Android apps with the Experimental label. Coinbase customers can log in to buy, sell, convert, send, receive, or store these assets,” the post read.

The exchange uses the ‘Experimental Label’ to flag tokens that are new or have low trading volume. These tokens may be susceptible to more price volatility. Notably, Binance also listed ERA with a ‘seed tag.’

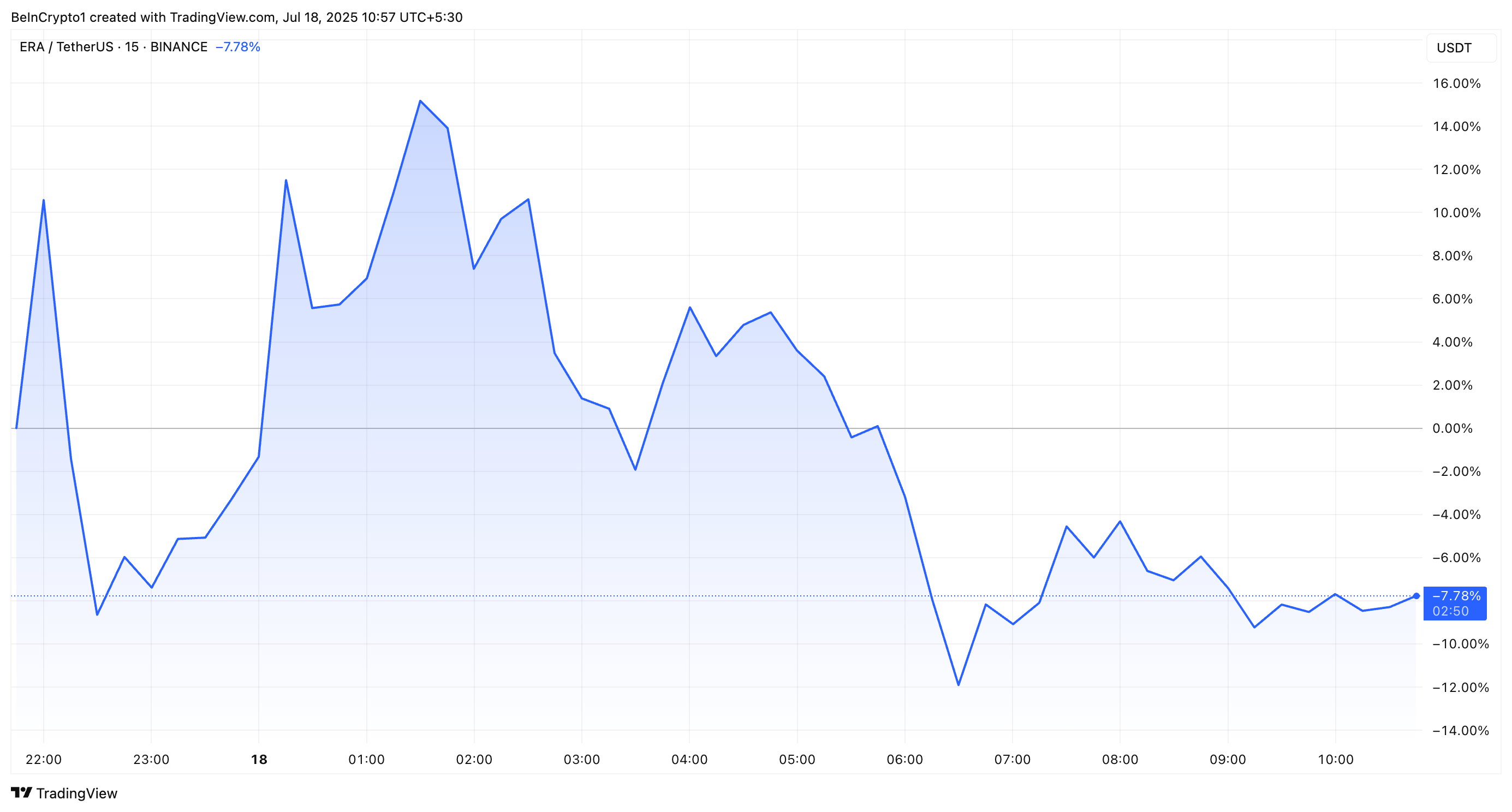

Nonetheless, the announcement triggered a modest price uptick of approximately 9.6%, aligning with patterns observed after Upbit’s listing, which spurred a 60% surge. However, these gains proved short-lived.

The price drop can largely be attributed to the ERA airdrop, which the Caldera Foundation opened for claims yesterday.

“Wallets that have successfully pre-claimed their allocations have until July 31 at midnight UTC to claim their tokens,” the foundation wrote.

When a project distributes free tokens, recipients may sell them once they receive them, potentially increasing the token’s supply in the market. If there isn’t enough demand to absorb the new supply, this can lead to a price decline. At press time, ERA was trading at $1.52, reflecting a 7.78% decline.

Despite the drop, ERA has still captured significant investor interest. The altcoin has emerged as one of the top trending cryptocurrencies on CoinGecko today.

ERA Airdrop Claims Drive Up Ethereum Gas

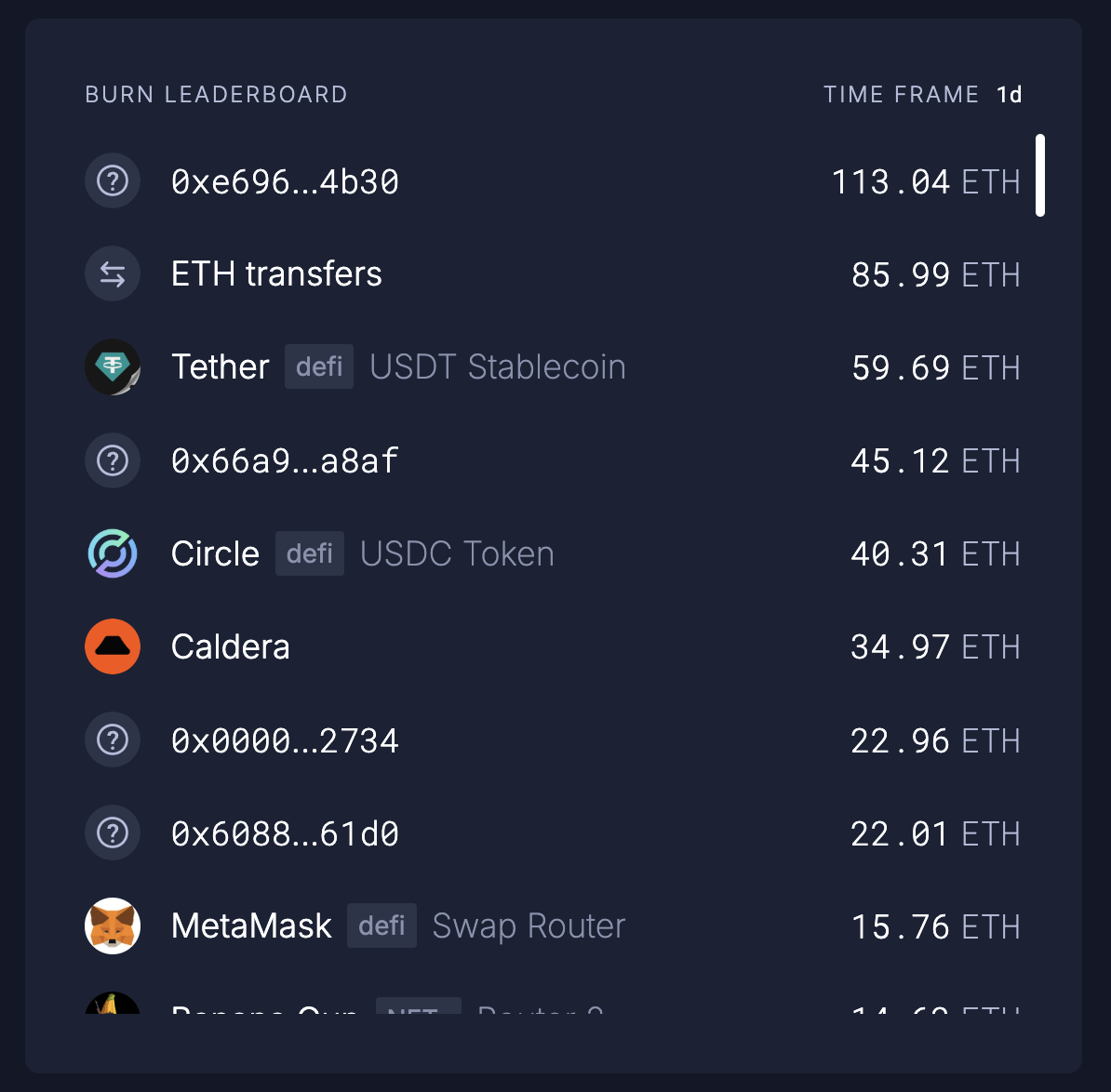

Meanwhile, the ERA airdrop also impacted the broader ethereum network. The surge in airdrop claim activity led to an increase in Ethereum Gwei.

It is a unit of measurement for gas prices on the Ethereum network, representing one billionth of an ETH.

“Binance’s new coin ERA airdrop claim has pushed Ethereum Gwei up to 36.7,” an analyst posted.

According to the latest data from Ultra Sound Money, the claim contract burned 113.04 ETH in the past 24 hours, worth over $412,000.

The surge in gas fees due to the ERA airdrop indicates that it has gained significant traction among users. As the claims continue, gas fees and selling pressure may continue to rise.

However, once the airdrop claims conclude, this selling pressure could subside, potentially stabilizing the price and allowing ERA to find a more sustainable market level.