BREAKING: Ondo’s USDY Fund Brings US Treasuries Onchain via Sei Network – DeFi Just Got Serious

Wall Street meets crypto—again. Ondo Finance just dropped a game-changer by tokenizing US Treasury yields on Sei Network, and TradFi won’t know what hit it.

### Yield Goes Digital

USDY isn’t just another stablecoin. It’s a yield-bearing token backed by short-term US Treasuries, now live on Sei’s high-speed blockchain. Forget 0.01% savings accounts—this is institutional-grade yield, onchain.

### Why Sei? Speed.

Sei’s parallelized EVM handles 20K TPS—perfect for TradFi refugees who still think ‘blockchain’ means ‘waiting.’ Ondo’s move proves real-world assets (RWAs) aren’t a niche play anymore.

### The Fine Print

Minimum investment? $100K. Target audience? Hedge funds pretending they ‘always believed in crypto.’ But make no mistake—this is the Trojan horse that could finally bridge DeFi and pension funds.

### Cynical Take

Bankers will mock it until they can’t ignore the APY. Then they’ll launch a ‘blockchain innovation task force’—with a 2-year roadmap and 10% fees.

Ondo Finance Taps Sei Network for Onchain US Treasuries Rollout

This event carries special significance, as it marks the first time a US government bond product has been tokenized on a truly scalable blockchain, Sei Network (SEI). It marks a strategic MOVE to bring regulated financial products into the DeFi ecosystem.

US Treasuries have long been regarded as the “safe haven” asset in traditional finance. With tokenization, fractionalizing, transferring, and owning bonds become far easier, more transparent, and more efficient than with traditional methods.

“USDY will be the first tokenized treasuries asset on the Sei network, one of the fastest-growing modular blockchain ecosystems, bringing institutional-grade onchain yield to its users for the first time,” Ondo said.

It’s also worth highlighting Ondo’s choice to build on Sei, a Layer-1 blockchain known for high throughput and optimization for financial applications. Compared to more widely used blockchains today, developers specifically designed SEI to reduce transaction latency.

The chain also aims to improve order execution speed, both of which are critical for running financial products that emulate traditional assets like USDY. Moreover, Sei’s TVL hit an all-time high of $626 million recently, reflecting explosive DeFi growth and rising investor interest.

Choosing Sei over more crowded ecosystems reflects Ondo’s strategic vision in pursuing technological advantages and attracting new users.

Another notable point is Ondo’s connection to the World Liberty Financial project. World Liberty has selected ONDO as a strategic reserve token, signaling long-term confidence in the project.

This quiet endorsement from politically connected entities adds significant legitimacy to Ondo. It also reflects the growing seriousness with which traditional capital is approaching the digital asset space.

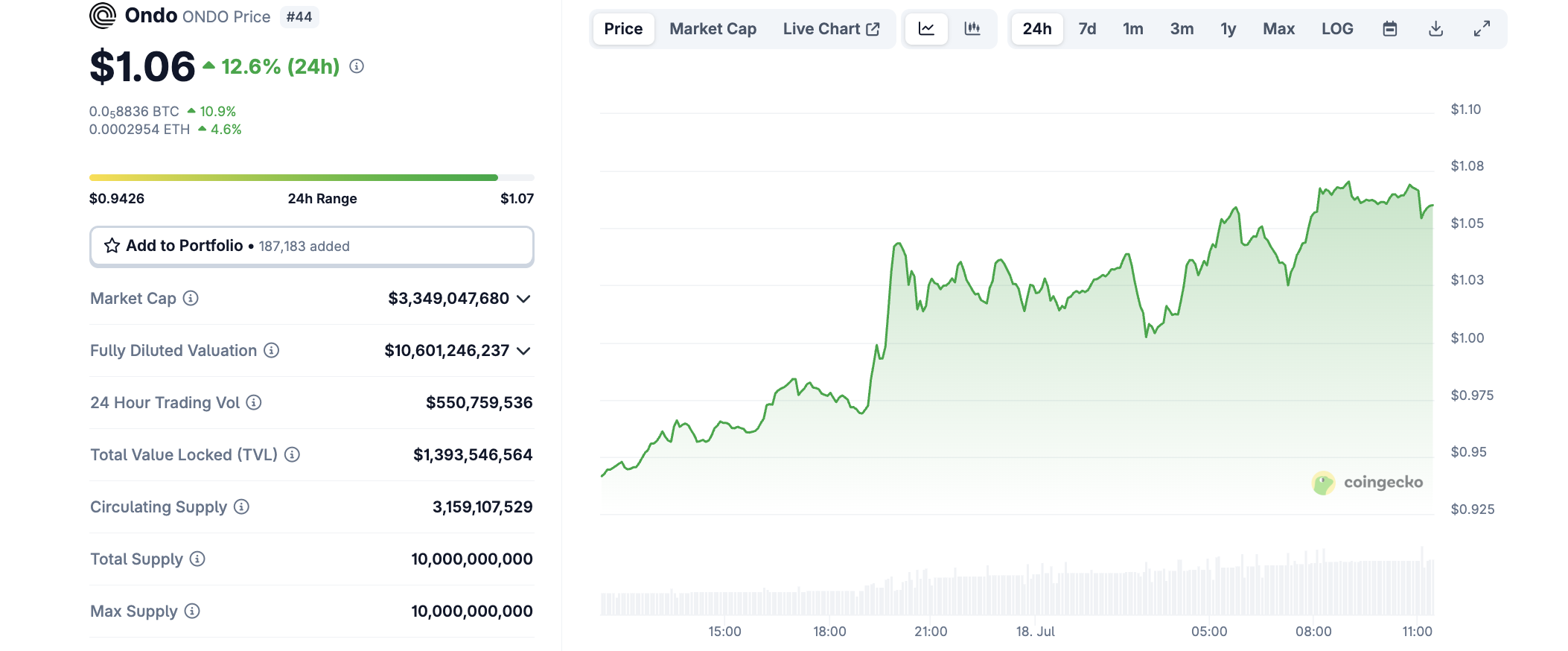

The 12.6% price jump in ONDO following the announcement isn’t merely a short-term market reaction. It signals the growing belief that Ondo is leading the tokenization wave for real-world assets.

With the cryptocurrency market on the rise again, investment in RWA protocols is booming, and there is growing interest from both financial institutions and governments. The combination of bonds, blockchain, and instant liquidity is an inevitable step.