Satoshi-Era Whale Awakens: 80,000 BTC Dumped on CEXs as Bitcoin Shatters ATH

An ancient Bitcoin whale just stirred—and the market felt the ripple. As BTC prices hit record highs, a single entity moved 80,000 coins (worth billions) to centralized exchanges. Was this a sell signal or just proof that early adopters still control the game?

Timing is everything. The transfer coincided with Bitcoin’s latest all-time high, sparking debates: Strategic exit? Or just another crypto millionaire cashing out before the next 'correction'?

CEXs win again. While decentralization purists scream 'not your keys, not your coins,' the whales keep feeding the very system they’re supposed to disrupt. Some things never change—like Wall Street’s cut.

Satoshi-Era Whale Cashing Out as Bitcoin Peaks?

Earlier this July, BeInCrypto reported that a cluster of bitcoin wallets holding over 80,000 BTC—belonging to a mysterious whale from the Satoshi era—had moved after 14 years of inactivity.

Now, on July 15, 2025, Lookonchain reported that the whale executed two large transactions. One moved 9,000 BTC ($1.06 billion), and the other moved 7,843 BTC ($927 million) to Galaxy Digital, an over-the-counter (OTC) trading firm.

Galaxy Digital then transferred 2,000 of those BTC to the centralized exchanges Bybit and Binance. These transfers raised concerns about potential sell-offs. Soon after, Bitcoin’s price corrected more than 5%, dropping to $116,900.

“This is his first cash-out in 14.3 years,” Spot On Chain commented.

This whale’s movement caused a spike in Bitcoin’s “Coin Days Destroyed” metric in July. Historically, this is one of the most reliable on-chain signals used to identify corrections or reversals after long periods of price increases.

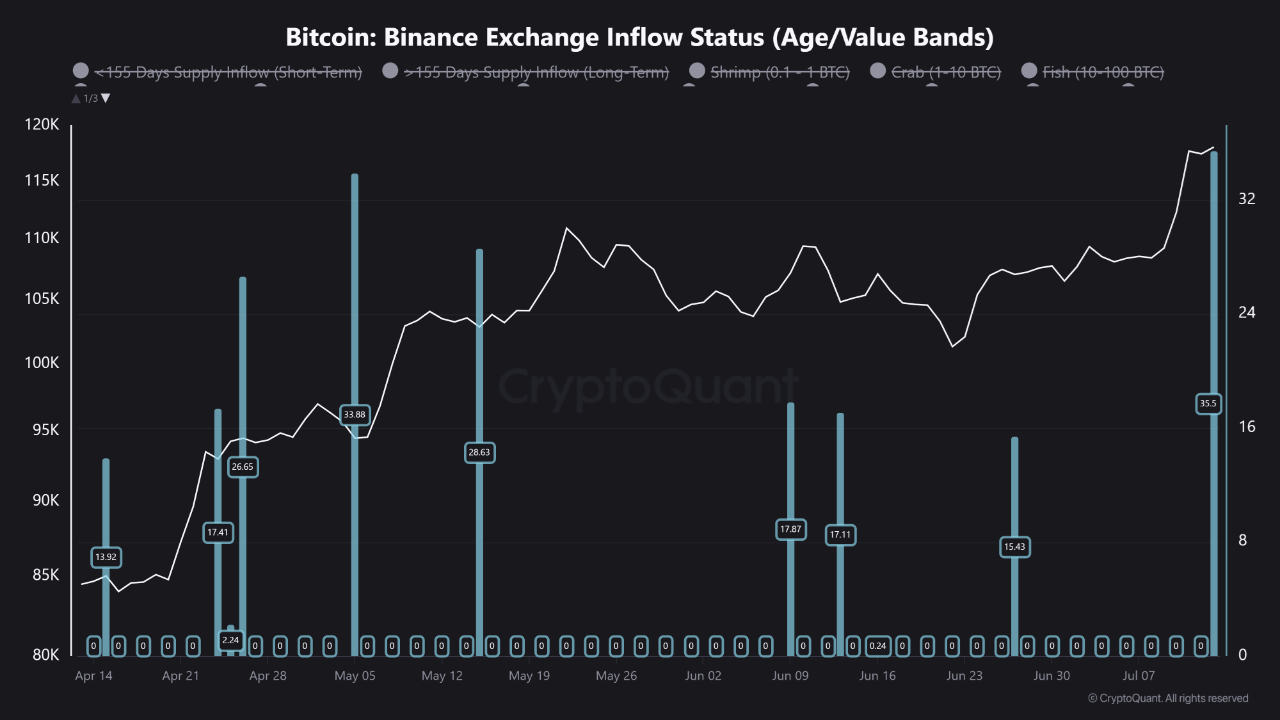

Binance Whale Activity Spikes as Bitcoin Reaches ATH

Meanwhile, analyst Crazzyblockk observed a surge in whale activity on Binance using CryptoQuant data. He noted that transactions worth over $1 million now account for more than 35% of all Bitcoin inflows to the exchange.

His findings align with recent actions by old wallets. According to him, the age data of recent exchange deposits shows that many of these inflows come from older coins. He proposed two potential scenarios behind this move:

“This surge in deposits suggests that large-scale investors are preparing for two likely scenarios:

- Profit-Taking – securing gains after a historic run.

- Speculation – utilizing the exchange’s deep liquidity to hedge or open new positions amidst peak volatility.

Either way, the presence of this much ‘sell-side’ pressure on the market’s primary trading venue increases the risk of sharp price swings.” – Crazzyblockk explained.

Bitcoin now appears to be caught in a fierce tug-of-war. On one side are legacy wallets potentially taking profit after more than a decade. On the other side, institutional and publicly listed companies are aggressively accumulating.