Elon Musk’s Tweet Sends PNUT Into Frenzy—But On-Chain Reality Check Exposes the Hype

Elon Musk strikes again—this time sending PNUT token holders into a speculative frenzy with a single cryptic post. But before you ape in, the blockchain doesn’t lie.

The Musk Effect: More Noise Than Signal?

Another day, another crypto pumped by the world’s richest meme lord. PNUT’s price chart looks like a heart attack after Musk’s tweet, but on-chain metrics paint a sobering picture: zero institutional inflows, mostly retail FOMO, and a few whales ready to dump.

Liquidity ≠ Legitimacy

Sure, trading volume spiked 500% in 24 hours—but that’s what happens when bagholders see an exit opportunity. The ‘fundamentals’? A whitepaper thinner than a Tesla Cybertruck’s margins.

The Punchline

Musk moves markets, but smart money watches the blockchain. And right now? It’s whispering ‘pump and dump’ in binary. (But hey, at least it’s not Dogecoin this time—progress, right?)

Netflows Flipped After Tweet, But Retail Sold the Top

The first signs of movement came before Musk’s tweet, not after it.

They arrested (and killed) Peanut, but have not even tried to file charges against anyone on the Epstein client list.

Government is deeply broken. pic.twitter.com/YndRadQUBE

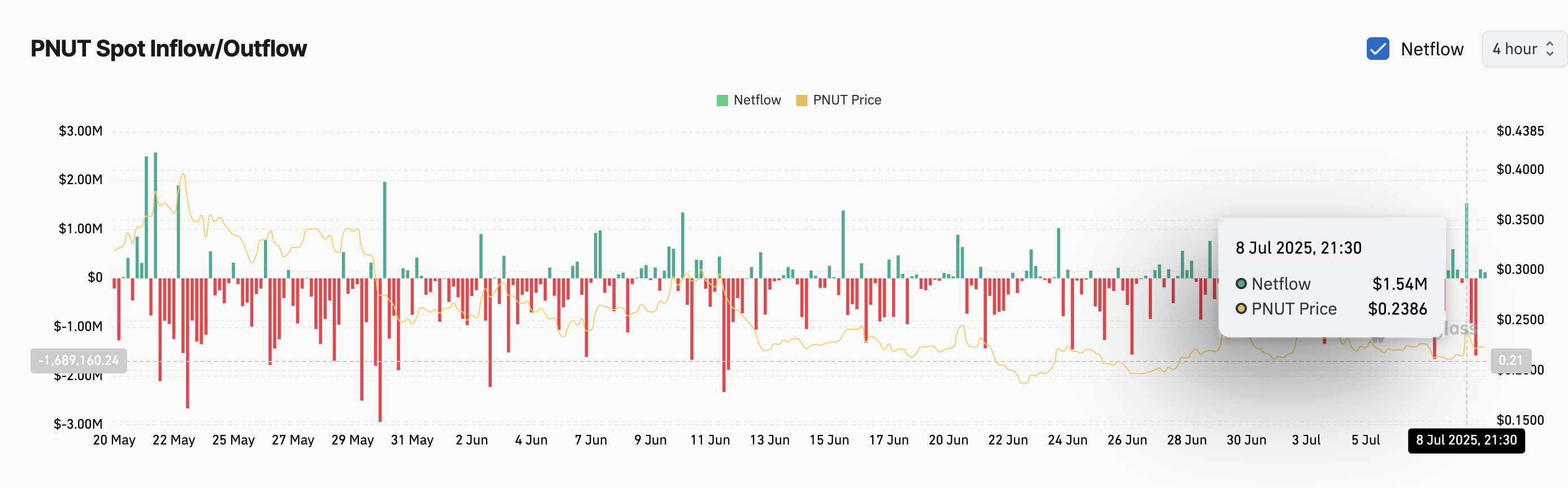

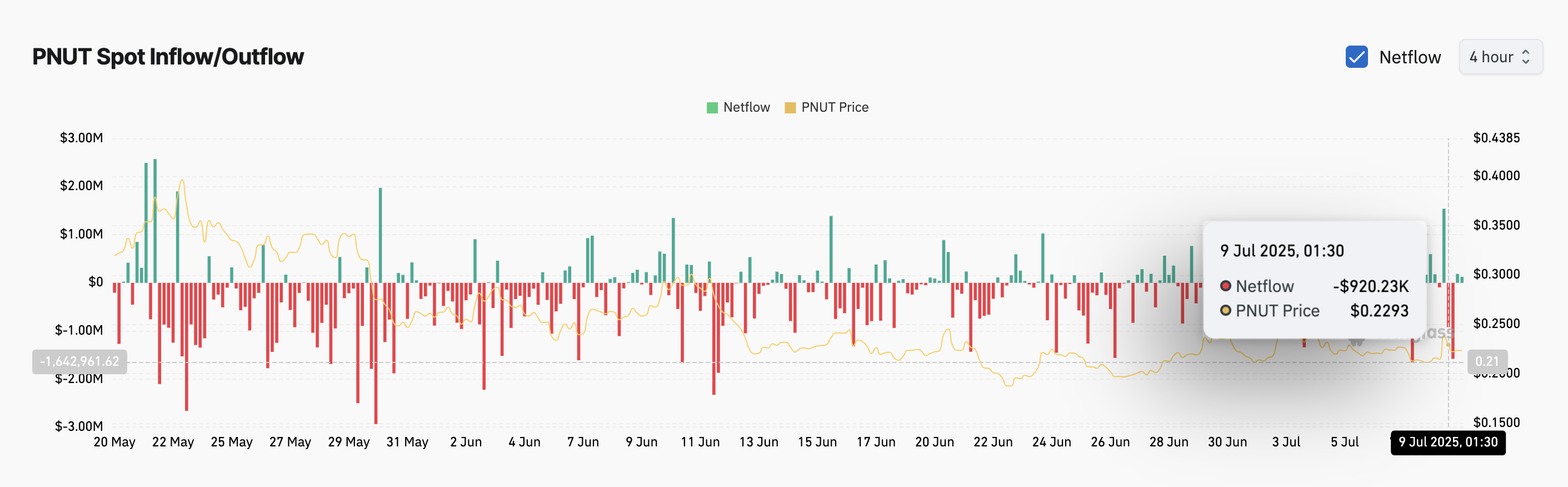

On July 8, the exchange netflows flipped positive, with $1.54 million worth of PNUT moving onto exchanges, likely traders positioning for a sell.

That was hours before the price peaked.

Four hours later, as PNUT hit $0.2398 (up from $0.2136), outflows spiked again, with nearly $920,000 in tokens withdrawn. The pattern is clear: early players moved in before the tweet, while retail likely bought the top and exited late.

Funding Rate Move Towards Zero for First Time in Weeks

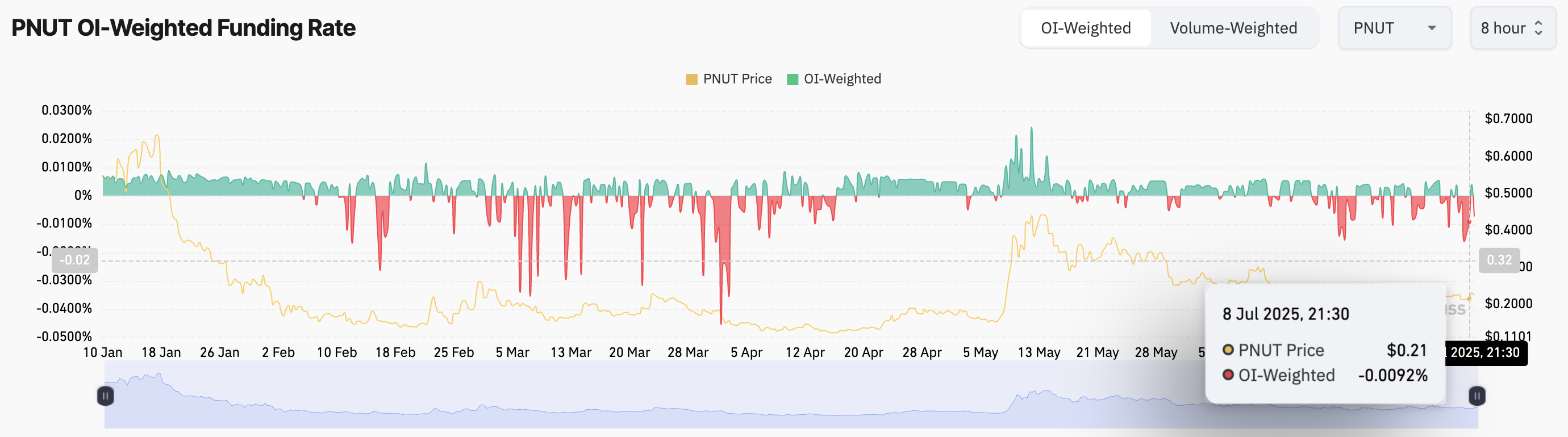

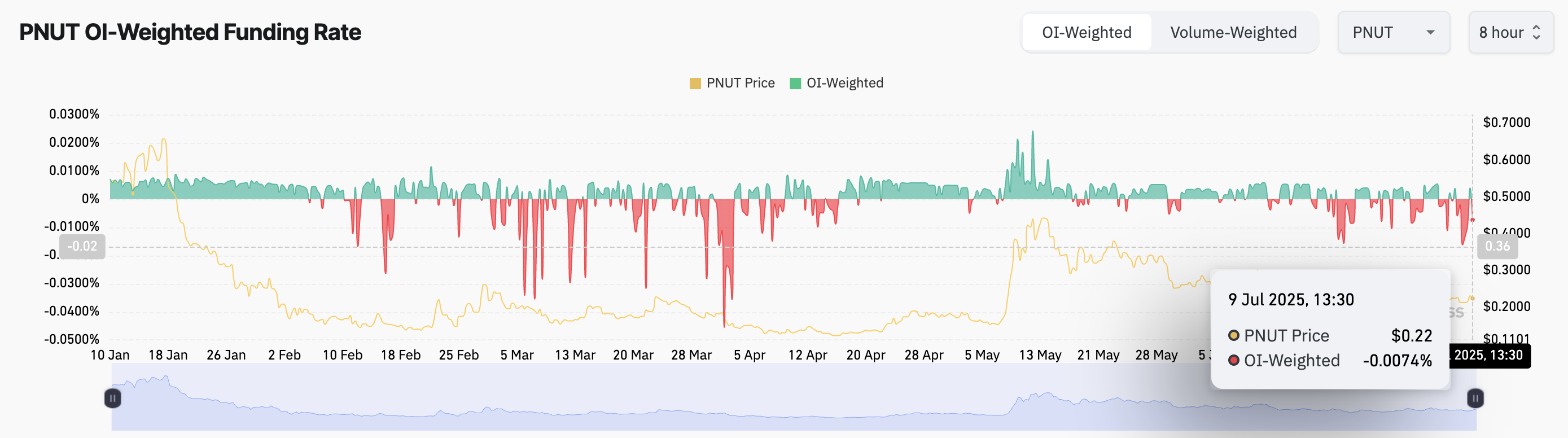

For many days, the funding rate for PNUT stayed negative, showing that more traders were betting on the price to fall. But right after Musk’s tweet on July 8, that changed. The rate moved closer to zero, reaching -0.0074% on July 9.

That means some traders started opening long positions, expecting the price to rise. However, since the rate was still negative, it indicates they aren’t yet confident. They’re testing the trend, not jumping in fully. This shift hints at growing interest, but not a strong bullish signal.

PNUT price and funding rate pre-tweet: Coinglass

Funding rates are fees paid between long and short traders. When funding is negative, short traders are dominant. A positive rate means long traders are in control.

PNUT Price Faces Fib Resistance, With Invalidation in Sight

The Fibonacci retracement drawn from the previous swing low to high (July 3) shows PNUT price retested the 0.382 Fib level at $0.2386, after momentarily breaching it. That zone, along with $0.245 and $0.256, remains the critical resistance levels. PNUT Price is now back NEAR $0.22 and struggling to reclaim the bullish trend.

If PNUT price manages to reclaim $0.245 cleanly, a move toward $0.256 is back on the table.

But a drop below $0.216 (key trendline and 0.786 Fib) WOULD break the bullish structure, pushing PNUT lower than the long-holding ascending trendline. This would flip short-term bias bearish.