DWF Labs-Backed Stablecoin Stumbles: Peg Crisis Sparks Market Jitters

Another day, another stablecoin wobble—this time with DWF Labs' pet project in the hot seat. When algorithmic assurances crack, even briefly, crypto's favorite illusion of stability gets a reality check.

The peg that wasn't: For a white-knuckled stretch, traders watched the token veer off its dollar tether. Not a crash, but enough to flood Crypto Twitter with 'I told you so' takes from decentralization maxis.

Market mechanics exposed: The slip reveals what institutional backers hate admitting—liquidity pools can turn from shock absorbers to amplifiers when confidence flickers. DWF's damage control? The usual 'isolated incident' playbook.

Here's the kicker: every depegging event makes TradFi's 'volatile crypto' narrative easier to sell. Meanwhile, degens will keep chasing that 20% APY on questionable stablecoin farms—because nothing screams 'safe' like unsustainable yields, right?

Community Concerns Around USDF

Thanks to its partnership with DWF Labs, Falcon Finance’s USDF stablecoin had a strong start, reaching a $570 million market cap less than four months after launch.

However, its recent depeg has drawn considerable community scrutiny. For most of an hour, the USDF completely lost parity with the dollar, falling as low as 94.3 cents per token.

USDf depegging from $1 overnight amid rumours surrounding the quality of its collateral base

On-chain liquidity appears to be dwindling quickly too pic.twitter.com/HgJFBI1dEE

A closer look at the project’s financials has raised even more questions. Falcon Futures and DWF Labs both made statements about the stablecoin, claiming that it has 116% over-collateralization.

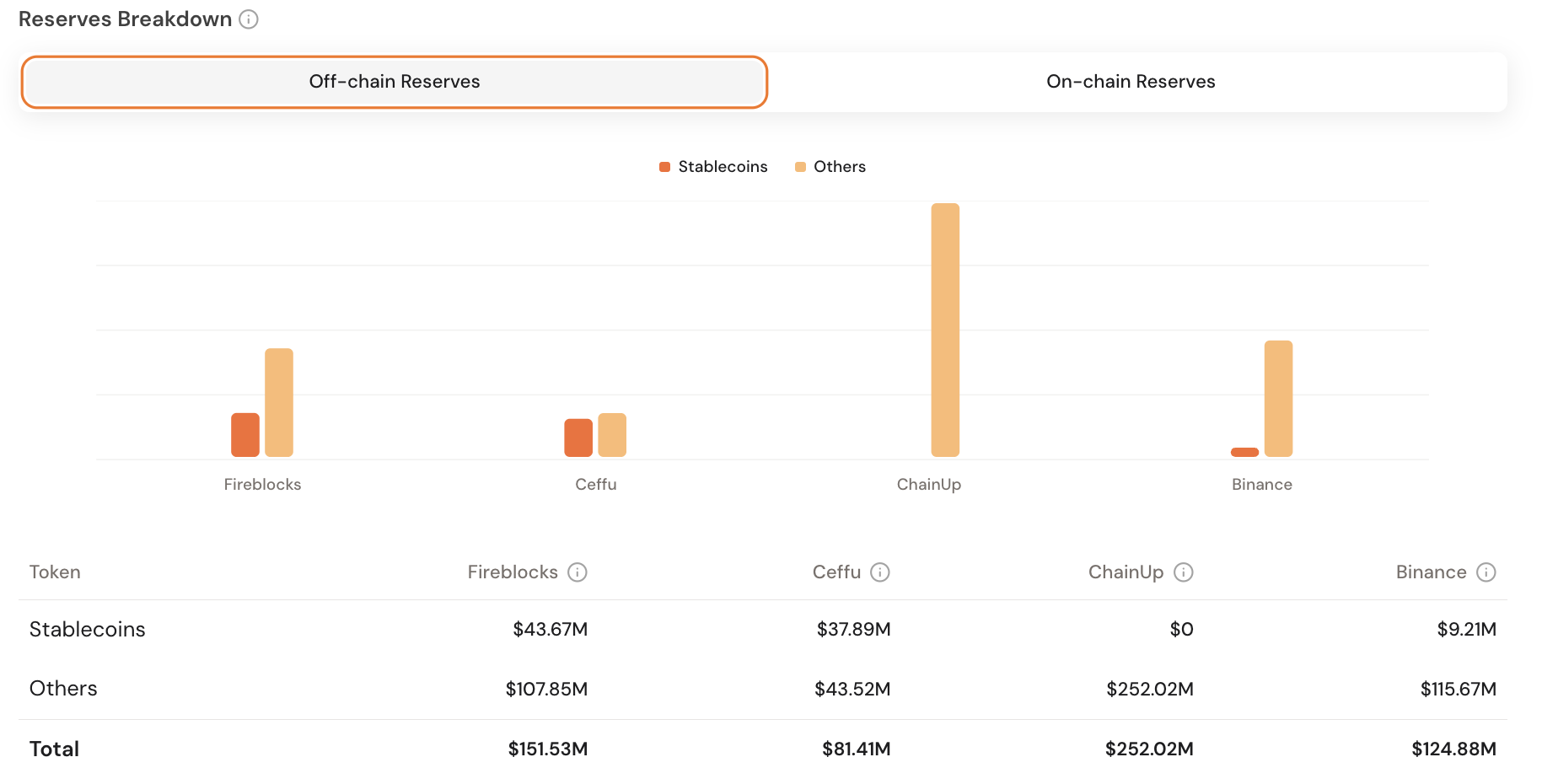

However, Falcon’s own data shows that more than $609 million of this is stored off-chain, compared to a measly $25 million in on-chain reserves.

Moreover, these reserves suffer from a dire lack of transparency. Falcon’s own audits don’t discuss the names, liquidity, volatility, or possible price impact of liquidation for any of the reserve’s tokens.

DWF Labs claims that it will publish a proper breakdown of the stablecoin’s reserves next week, but it’s a total black box right now.

Future Causes for Concern

LlamaRisk, a DeFi risk assessor, detailed in a forum post how dangerous this lack of transparency can be. It’s unclear why exactly USDF lost its peg, but the lack of clarity is itself a problem.

Even if other stablecoins make up a huge chunk of Falcon’s reserves, there’s no guarantee that these assets are credible. Any of them could’ve caused the depeg.

“The Falcon team has unilateral authority over the operational management of the reserve assets. Insolvency may occur due to operational mismanagement or failure of underlying strategies which include exposure to CEX exchanges and DeFi strategies. As with analogous products, Falcon relies on off-exchange custodians to mitigate losses,” it claimed.

This depeg attracted harsh community criticism. It may make future stablecoin launches more difficult, and it reflects poorly on DWF Labs. Furthermore, DWF has become a recurring partner in President Trump’s crypto empire in the last few months.

The UAE-based company has faced scandal after scandal in recent years, including accusations of wash trading and one of its previous partners drugging a job applicant.

Now, DWF Labs is partnering with TRUMP to provide liquidity for World Liberty Financial’s USD1 stablecoin, while the President aims to make such assets part of global dollar dominance.

With such ambitious goals, an incident like this seems very concerning. What if another DWF project experiences a glitch like this while stablecoins are more integrated with TradFi? What WOULD such an incident do to market confidence?

These are just some of the current concerns. However, in a retrospective, the GENIUS Act will bring strong clarity over the reserve assets of US-based stablecoins. So, FUD-driven depegs might become less likely under such regulatory protection.