Solana (SOL) Triggers Ultra-Rare 5-Year Bull Signal – Is a Mega Breakout Imminent?

Solana just fired a technical flare that hasn't been seen since the last crypto cycle's peak. The blockchain's native token SOL is printing a textbook bullish formation that historically precedes massive rallies.

When these signals last appeared in 2020, SOL surged 15,000% within 18 months. Now traders are scrambling to decode whether history's about to repeat—or if this is just another fakeout in crypto's endless parade of false dawns.

The setup comes as Solana's network activity defies the broader market slump. Daily active addresses hover near all-time highs while Ethereum struggles with $9 sandwich attacks—sorry, 'gas fees.'

Technical indicators suggest SOL could be coiling for a violent move. The weekly chart shows a potential inverse head-and-shoulders pattern completing near the $150 level. Break that, and the 2021 ATH at $260 becomes the next logical target.

Of course, in crypto-land, 'logical' is doing some heavy lifting here. Remember when the same signals flashed before FTX imploded? Good times. But with institutional inflows returning and Solana's developer ecosystem thriving, this might actually be different. Probably.

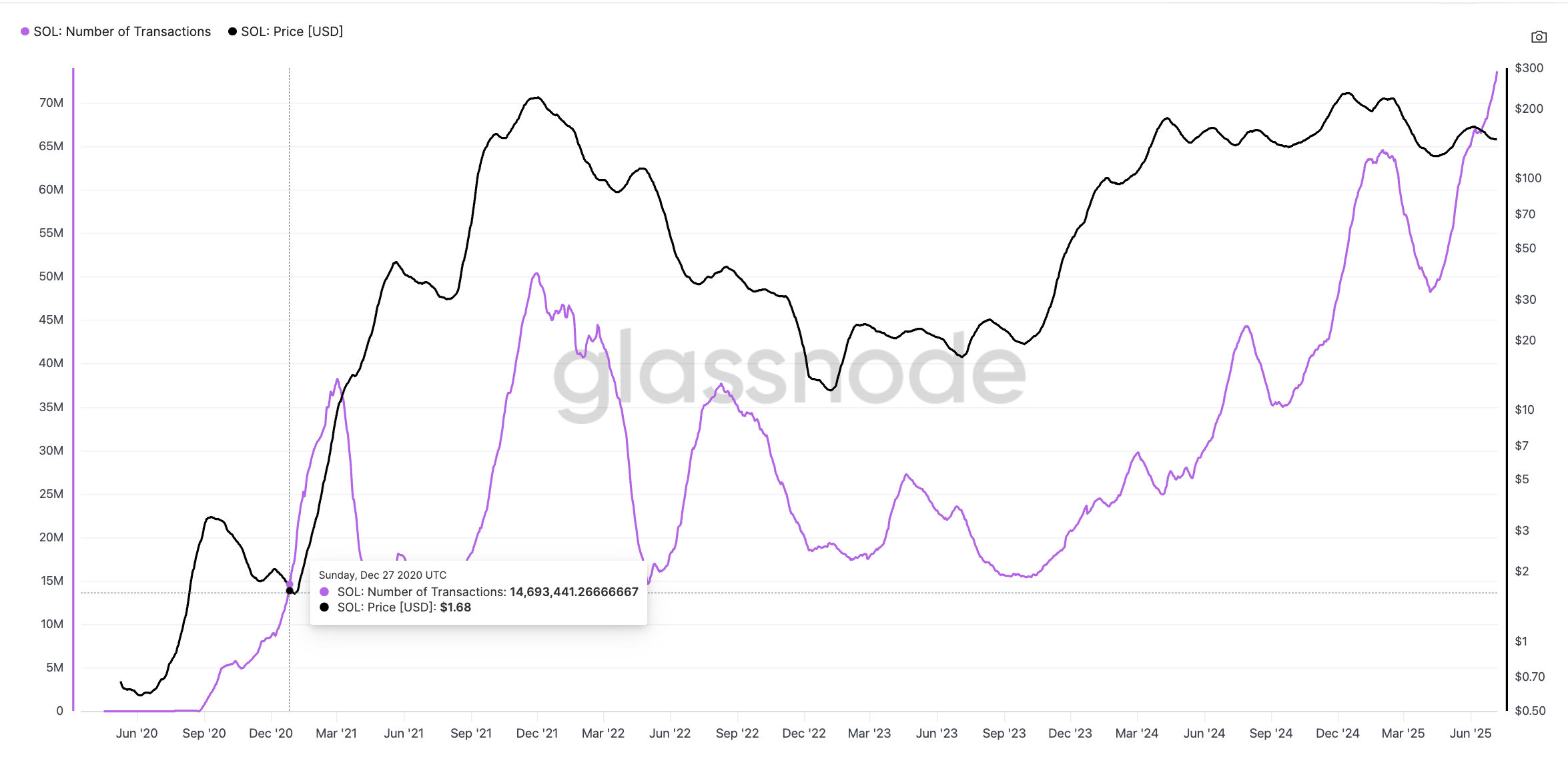

Transaction Count Hits 5-Year High, But SOL Price Isn’t Following Yet

Solana’s number of transactions has surged past 70 million. Yet, that is not the best part.

According to the chart, the last time the transaction count line crossed above the price line, a multi-year SOL price rally occurred. This time, in July 2025, the price remains sluggish, around $151, and a similar crossover has happened.

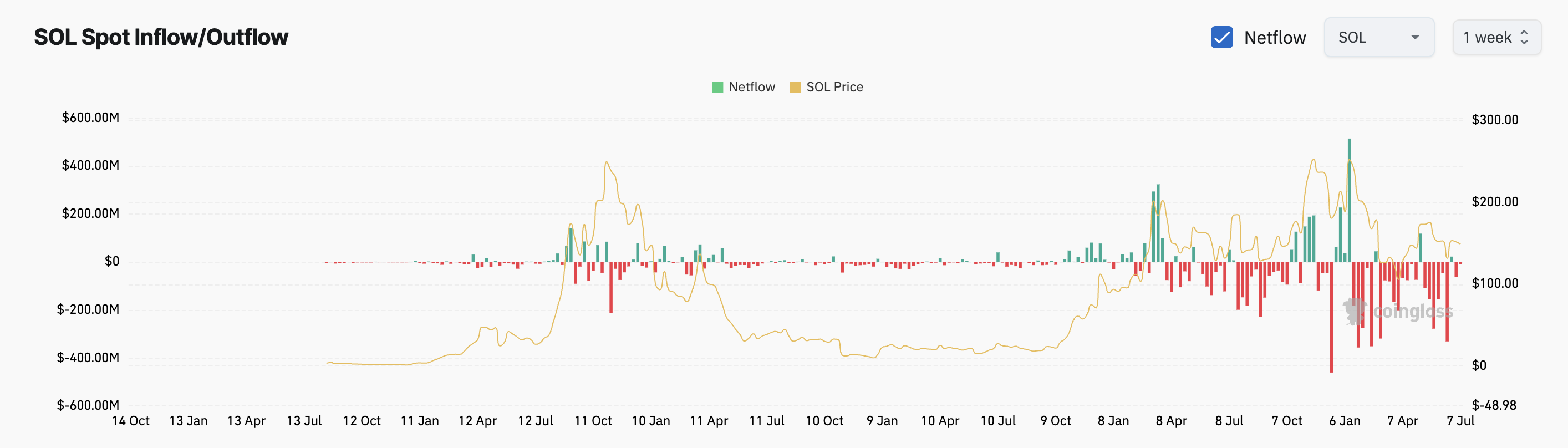

Netflows Tilt Bearish, Despite Exchange Exits

Data from Coinglass shows solana has seen steady outflows through early July. That usually points to accumulation. But the outflows have slowed down in recent days, and there’s no spike in inflows either.

In short, no one’s dumping SOL, but no one’s rushing to buy either.

This balance may explain why the SOL price hasn’t broken out yet. Traders seem to be waiting for a stronger signal before taking a side.

SOPR Flips Below 1; Sign of Panic?

Solana’s Spent Output Profit Ratio (SOPR), which tracks whether coins are being sold at a profit or loss, has hovered just below 1.0 since late June. That typically means holders are selling at a loss or break-even, often seen during market bottoms.

When SOPR drops below 1, it shows capitulation; traders are exiting positions at a loss. But when SOPR starts to rise again toward 1, it suggests most panic sellers are gone, and only long-term or break-even holders remain.

In this case, SOPR rising from 0.95 back toward 1.0 indicates that forced selling may be cooling off. Combined with the slowing exchange outflows, it suggests Solana is stabilizing, or rather, the bottom for this cycle might be forming.

SOL Price Structure: Falling Wedge Still in Play, But Momentum Lags

The Solana price has stayed locked inside a broad falling wedge since early January 2025. The structure is still intact, but SOL has tested the upper trendline multiple times without a breakout. That line now sits just under $155, and the price has been hovering close without clearing it.

A confirmed MOVE above $155 could shift the momentum. If that happens, upside targets sit at $169 and $180, both acting as major resistance zones from prior highs.

But if bulls fail to break the wedge, there’s a risk of sliding back into the old sideways band. This support zone between $140 and $125 has trapped the SOL price before. Losing that zone WOULD weaken the entire structure and possibly lead to deeper losses. The wedge is wide enough that even smaller dips won’t break the setup, but if SOL drops below $125, the pattern may no longer hold weight.

Supporting the pattern is the Moving Average Convergence Divergence (MACD), trying to turn bullish. The MACD line (blue) has flipped above the signal line (orange), a classic early momentum indicator. The flip happened NEAR a swing low, confirming bullish strength and a bottoming attempt, also indicated by SOPR.

But here’s the catch: the histogram bars, which represent the distance between the two lines, are fading. That signals a weakening upside momentum.

MACD is a momentum indicator that helps spot early trend reversals based on two moving lines and a histogram.

Solana is trading near $151. Unless it decisively breaks the $155, the falling wedge stays in control.