$17B Bitcoin & Ethereum Options Expiry: June’s High-Stakes Crypto Showdown

Crypto markets brace for impact as $17 billion in BTC and ETH options face expiry this week. Will bulls or bears dominate the final showdown?

The ticking time bomb: Traders scramble to hedge positions ahead of Friday's options expiration—the largest crypto derivatives event since March's volatility surge.

Market makers sweating bullets: Liquidity providers face maximum pain scenarios as open interest clusters around key strike prices. 'Gamma squeeze' whispers grow louder among institutional desks.

Meanwhile, Wall Street's quants pretend they totally saw this coming—just like they predicted last month's flash crash (spoiler: they didn't).

High-Stakes Crypto Options Expirations: What Traders Should Watch Today

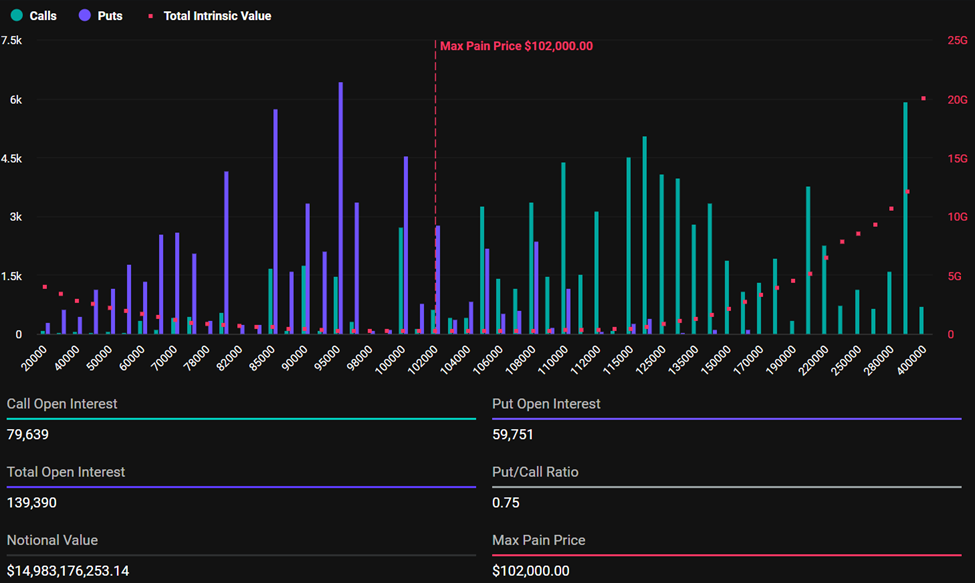

Today’s expiring options mark a significant increase from last week. According to Deribit data, Bitcoin options expiration involves 139,390 contracts, compared to 33,972 contracts last week.

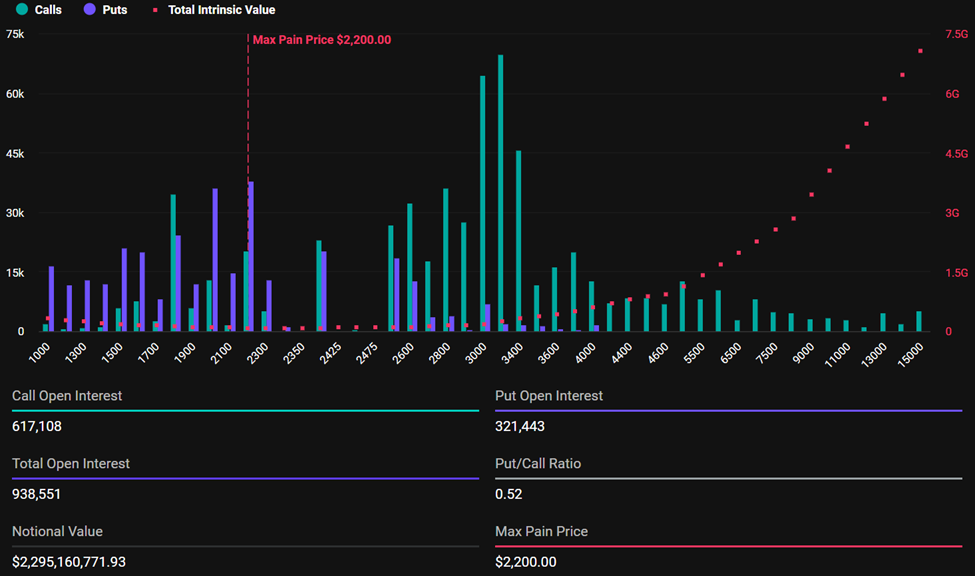

Similarly, Ethereum’s expiring options total 938,551 contracts, up from 224,509 contracts the previous week.

Notably, the huge difference between today’s expiring options and last week comes as the June 27 contracts are for the month.

For the expiring Bitcoin options, the maximum pain price is $102,000, and the put-to-call ratio is 0.75. This suggests traders are buying more call (purchase) options than put (sale) options.

It points to a generally bullish sentiment even as the pioneer crypto reaches for new highs.

The bullish outlook extends to Ethereum, which has a maximum pain price of $2,200 and a put-to-call ratio of 0.52, suggesting Optimism in the market.

The maximum pain point is a crucial metric in crypto options trading that often guides market behavior.

It represents the price level at which most options expire worthless. Additionally, the put-to-call ratios below 1 for Bitcoin and Ethereum suggest optimism in the market, with more traders betting on price increases.

![]() H1 Expiry Incoming

H1 Expiry Incoming![]()

Over $17B in BTC & ETH options are set to expire tomorrow on Deribit, the largest of the year so far.$BTC: $15B notional | Put/Call: 0.74 | Max Pain: $102K$ETH: $2.3B notional | Put/Call: 0.52 |Max Pain: $2,200

Will Q3 start with a breakout or reset?… pic.twitter.com/ye92lhXP4Z

Analysts at Greeks.live note a mixed market sentiment, with traders experiencing flat or break-even results despite market momentum.

The latest data shows that Bitcoin’s trading value has dropped by 0.25% to $107,562. Similarly, Ethereum has fallen by 1.02%, trading at $2,449.

The drop is unsurprising. Based on the Max Pain Theory, asset prices tend to gravitate toward their respective max pain or strike prices as the options NEAR expiration.

As of this writing, Bitcoin and Ethereum are trading well above their maximum pain levels. Traders and investors should brace for volatility, as options expirations often cause short-term price fluctuations, which create market uncertainty.

“…with key resistance at 110k noted as a significant level that may be difficult to breach. There’s a shift in focus toward ETH options trading as Bitcoin volatility remains low, with traders expecting potential downside movement in July,” wrote analysts at Greeks.live.

However, markets usually stabilize soon after traders adapt to the new price environment. With today’s high-volume expiration, traders and investors can expect a similar outcome, potentially influencing future crypto market trends.