Blockchain Forensics Expose Iran’s $90M Nobitex Hack: The Untold On-Chain Evidence

Crypto heists don’t lie—blockchains do. Iran’s biggest exchange just learned that the hard way.

When $90 million vanishes, the trail always leads back to the ledger. Nobitex’s breach wasn’t just another hack—it was a masterclass in on-chain obfuscation. Here’s how the money moved.

The smoking gun? Mixers, fake KYC, and decentralized amnesia

Tornado Cash transactions spiked hours after the breach. ‘Private’ wallets suddenly had VIP access to liquidity pools. And guess what? None of the stolen funds ever touched a regulated exchange—almost like someone knew compliance would be their downfall.

The irony? This ‘decentralized’ theft relied on centralized greed

Every laundered satoshi traced back to over-the-counter desks in jurisdictions where ‘anti-money laundering’ is just a suggestion. But hey—when your national currency loses 50% annually, maybe $90M in crypto seems like a reasonable career pivot.

Blockchain transparency wins again. The thieves got the coins—but the chain got the last laugh.

Was Iran’s Nobitex Exchange Laundering User Funds Before the Hack?

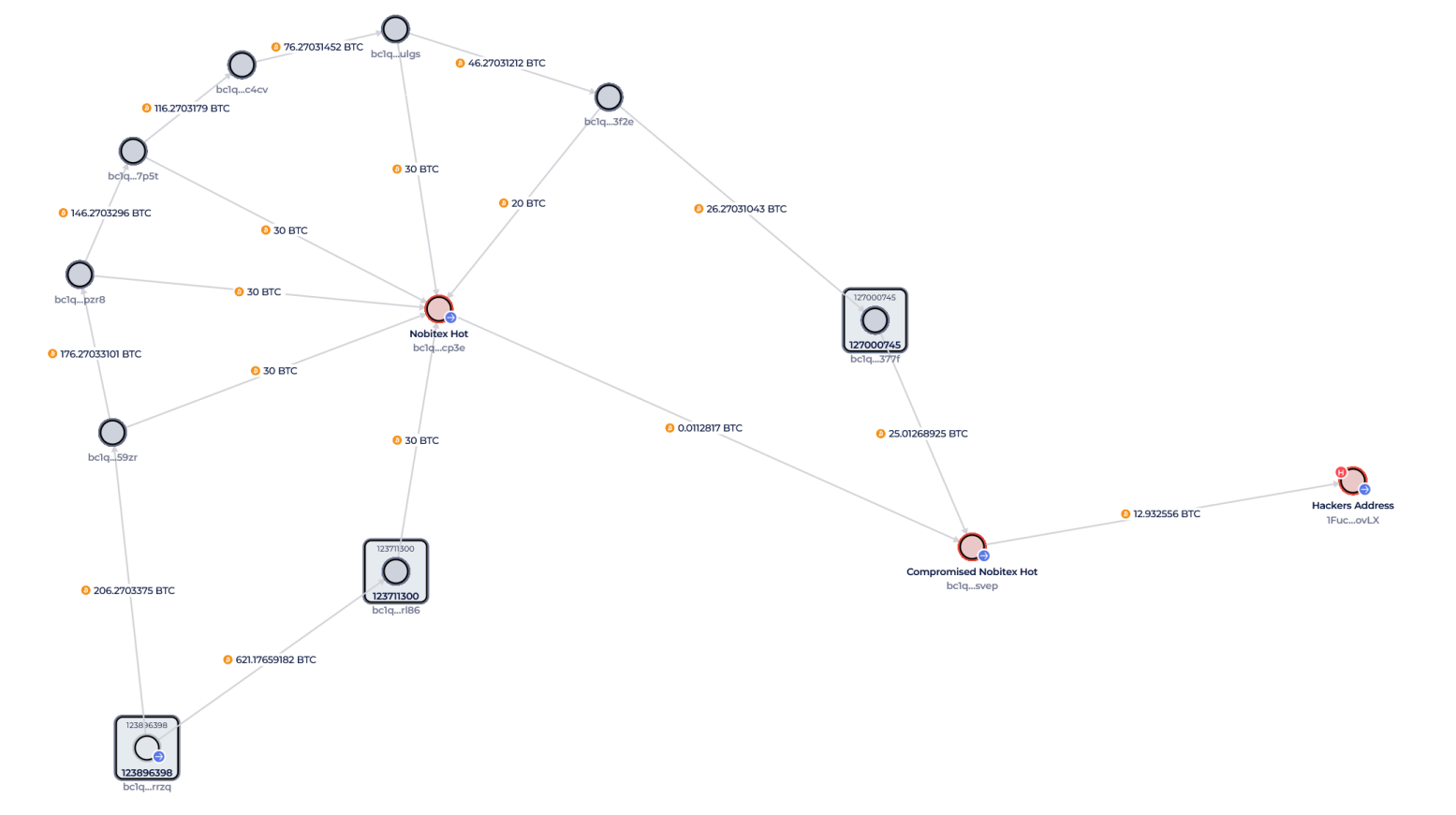

On-chain data shows that Nobitex employed a method called peelchaining. This is when large amounts of Bitcoin are split into smaller chunks and routed through short-lived wallets.

The technique makes fund tracing difficult and is often used to obscure the origins of money. In Nobitex’s case, analysts found a pattern of BTC being cycled in consistent 30-coin chunks.

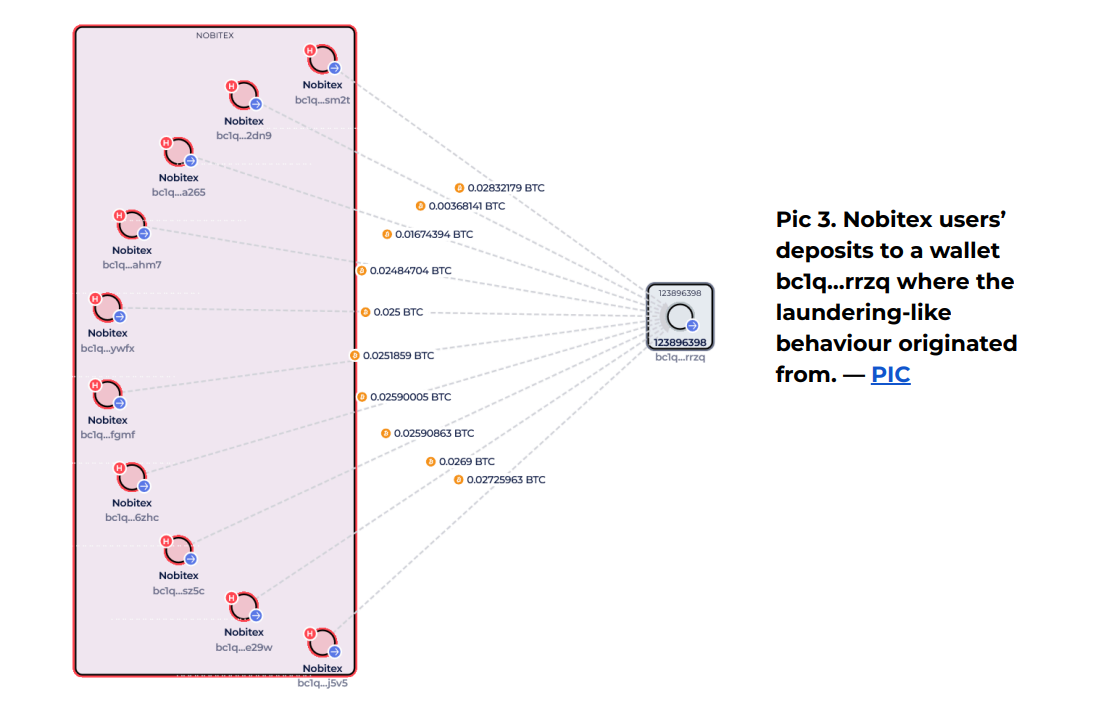

Global Ledger also found that Nobitex used temporary deposit and withdrawal addresses—a behavior known as chip-off transactions. These one-use addresses funnel BTC into new wallets, disguising liquidity trails.

The “Rescue Wallet” Wasn’t New

After the hack, Nobitex claimed it moved remaining funds as a safety measure. On-chain activity did show a 1,801 BTC sweep (worth ~$187.5 million) into a newly created wallet.

But this wallet wasn’t new. Blockchain data traces its. The wallet had long been collecting chipped-off funds.

This “rescue wallet” received multiple 20–30 BTC transfers that followed the same laundering-like patterns, even before the hack occurred.

Post-Hack Activity Shows Continued Control

Hours after the breach, Nobitex moved funds from its exposed hot wallet to another internal address. This full-balance sweep indicated Nobitex retained operational control.

On June 19, investigators observed 1,783 BTC transferred again to a new destination wallet. This matched Nobitex’s public claim of securing its assets—but now with added context.

The flows suggest that rather than reacting to the hack, Nobitex was simply following its pre-existing money laundering playbook.

The pro-Israel hacking group Gonjeshke Darande published files exposing Nobitex’s internal wallet structure.

The hack may have shocked users, but blockchain data shows that.

Old wallets linked to the exchange were regularly sending Bitcoin to new wallets. From there, the funds were broken into smaller amounts and moved again and again—often in chunks of 20 or 30 BTC.

This method makes it harder to track where the money ends up. It’s similar to how some people hide their tracks when moving funds through crypto.

What’s important is that this wasn’t something Nobitex started after the hack. They had been doing it long before, and they kept doing it after—.

One wallet in particular——shows up again and again. It received lots of user deposits and appears to be the starting point for many of these hard-to-trace fund movements.

In short, the hack didn’t cause Nobitex to change how it handled funds. It simply brought.