🚀 VanEck’s XRP ETF Imminent? Mysterious Exchange Outflows Spark Speculation

Whale-sized XRP movements trigger market frenzy as VanEck rumors swirl.

The smoking gun? Over $250M vanished from exchanges in 48 hours—just as SEC whispers go quiet.

Traders are betting big this isn't another false alarm. "When custody wallets bleed, ETFs breed," quips a hedge fund manager (between martini sips). Meanwhile, Bitcoin maxis are muttering about "altseason cope"—but their clenched jaws tell the real story.

Wall Street's playing 4D chess again: first they ignore crypto, then they repackage it with 2% management fees. Checkmate?

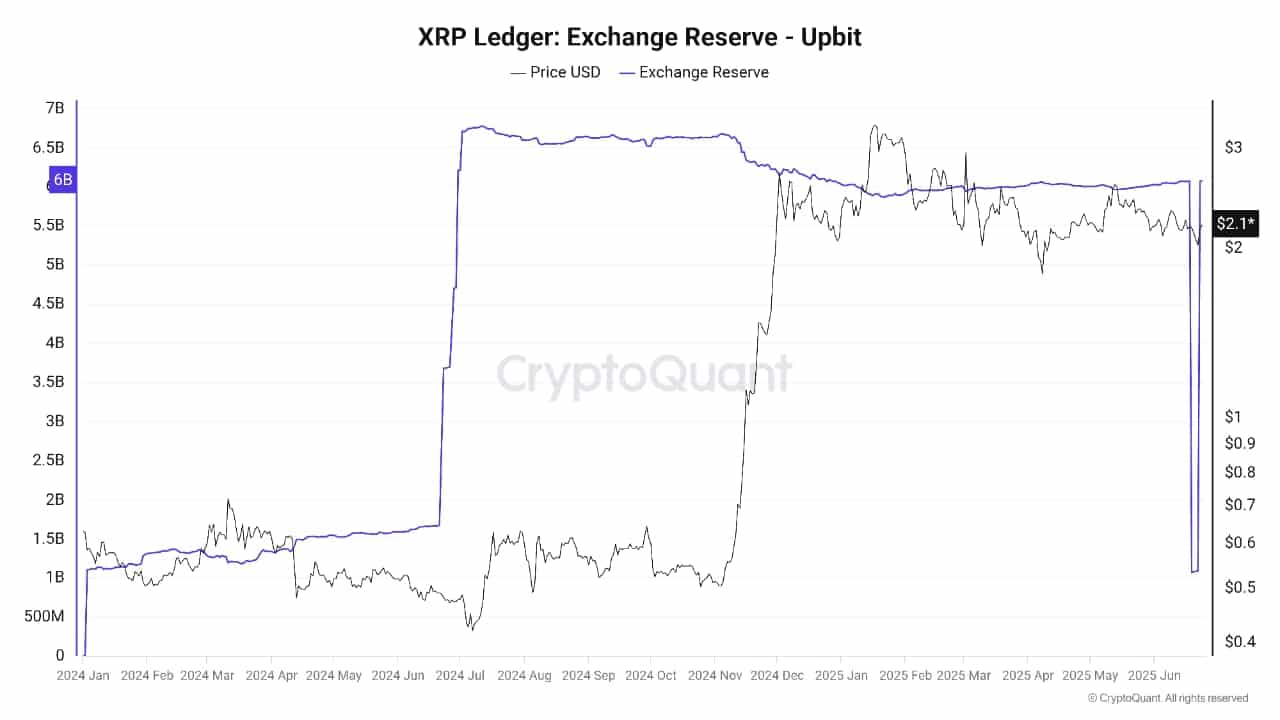

Source: CryptoQuant

These declines suggested the withdrawal of XRP by institutions such as ETFs, dividend funds and payment companies. They probably intend to store funds with custodial services or utilize them in settlement operations.

Conspicuously, the reserves of the Upbit which plunged have already started to fill in some measures, indicating that it might be undergoing some realigning.

Although these actions may indicate institutional buildup, they were indicative of liquidity in the exchange in the short run, but this may heighten the volatility.

Why XRP ETF approval could be near

Apart from the withdrawal, the launch of MVDApp by Vaneck increased the possibility of an XRP ETF, indicating more intensive institutional activity.

The step was regarded as a harbinger of ETF-related plumbing, potentially laying the groundwork to induct Ripple in the regulated asset club.

Additionally, both XRP and Micro XRP Futures have become active, since they were launched on the 19th of May.

CME Group observed the altcoin had over the course become one of the best monitored crypto assets during this time.

The increasing interest by institutional and retail traders pointed to the rising need of regulated derivatives with a structured exposure.

However, there was still divided sentiment as per Market Prophit data. The gauge showed the crowd was optimistic with 1.94 as the score reflecting a bullish outlook.

The smart money sentiment on the other hand was still in the negative side with the number standing at -1.30. This indicated a conservative mood among the informed investors.

Source: Market Prophit

This disconnect pointed to the unclarity of how Ripple may fare over the short-term, though the ETF story continues to build with increased institutional cues and increased demand in Futures.

Subscribe to our must read daily newsletter