Bitcoin Price Alert: How US Involvement in Iran-Israel War Could Trigger a Crypto Shockwave

Geopolitical tensions are boiling over—and Bitcoin is in the crosshairs. As the US weighs intervention in the Iran-Israel conflict, crypto markets brace for impact. Here’s the playbook for what comes next.

The Safe-Haven Narrative Put to the Test

Will BTC live up to its ‘digital gold’ hype or buckle under risk-off pressure? Past crises offer clues—but this time, the stakes are higher.

Liquidity Crunch or Flight to Freedom?

Traditional markets wobble as war drums beat. Watch for capital fleeing into crypto—or getting trapped by exchange freezes (because nothing says ‘decentralization’ like KYC bottlenecks).

The Fed’s Invisible Hand

Rate cuts? Money printing? Every central bank move now sends crypto parabolic. Just don’t ask Wall Street analysts—they’re still trying to price in last quarter’s FOMO.

One thing’s certain: when missiles fly, charts lie. Buckle up for volatility that’ll make your stablecoin look anything but.

Bitcoin Faces Immediate Downside if US Enters the Conflict

Bitcoin, currently trading NEAR $104,500, could drop 10–20% in a matter of days, based on patterns from previous geopolitical shocks.

In the early stages of large-scale conflicts, investors typically flee to traditional SAFE havens—such as US Treasuries, the dollar, and gold.

Crypto, despite some claims of being a hedge, has consistently behaved like a high-risk asset during such episodes.

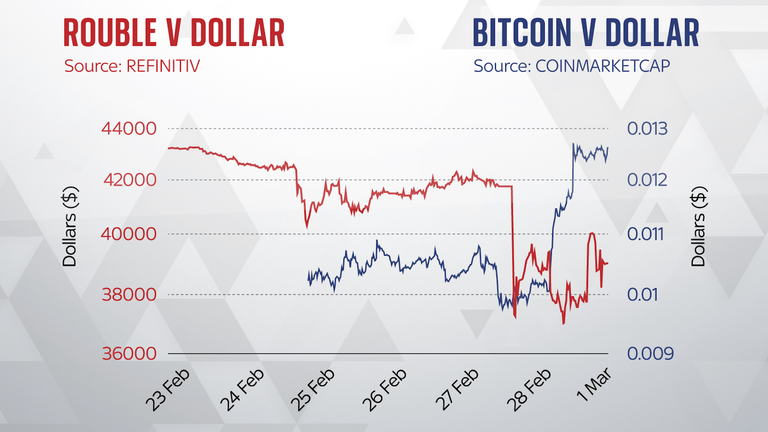

For example, during the Russia–Ukraine war in 2022, Bitcoin dropped over 12% within a week of the initial invasion. It later recovered partially but tracked equity markets closely throughout the escalation.

On-chain activity often reflects this risk aversion. Leverage tends to fall, exchange inflows rise, and trading volumes drop during periods of geopolitical stress.

These metrics signal investor flight and de-risking.

Macro Catalysts Will Compound Crypto Market Volatility

If US military action in Iran leads to a wider regional conflict, it may also spike oil prices and inflation expectations. That WOULD pressure the Federal Reserve to delay rate cuts or even consider tightening again.

Higher energy prices could drive consumer inflation back above the Fed’s 2% target, especially with WTI crude already showing sensitivity to headlines from the Middle East.

War-driven supply shocks would likely disrupt shipping and increase input costs globally.

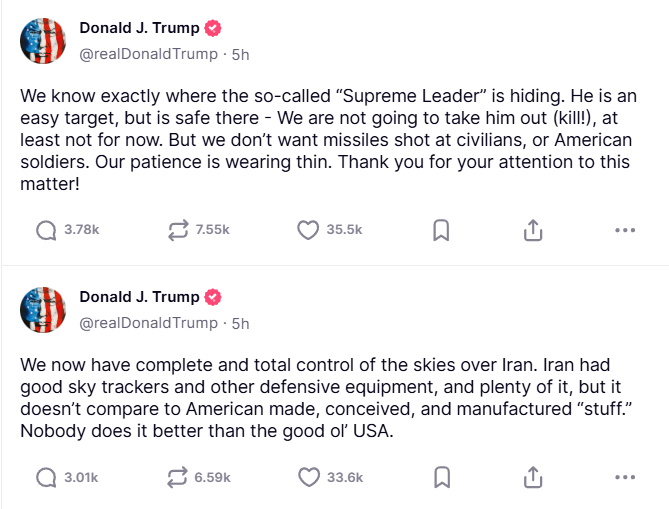

This is interesting:

Israel and Iran are attacking each other, TRUMP is saying he knows where Iran’s Supreme Leader is hiding, and the US is deploying fighter jets to the Middle East.

Yet, oil prices are -10% below last week’s high.

What does the market know here? pic.twitter.com/R05NAKSb97

In that scenario, the Fed would face a difficult trade-off between economic stability and inflation control. A prolonged hawkish stance would drive up real yields and suppress crypto valuations.

US Treasury yields, already near 4.4% on the 10-year note, may rise further if war spending expands fiscal deficits. The US national debt has surpassed $36 trillion, raising long-term debt service risks.

Meanwhile, the US Dollar Index (DXY), now hovering around 98.3, could strengthen further as global investors seek dollar-denominated safety.

A rising dollar has historically been bearish for Bitcoin and altcoins, particularly in emerging markets where capital outflows follow dollar surges.

How did we arrive at a point in this country where 25% of all tax revenue goes to just paying the interest in $37 trillion in govt debt?

Annually:

US govt total reveneue = about $5 trillion

US govt interest on debt = about $1.2 trillion

US govt spending = about $7 trillion pic.twitter.com/d0te2sZ7is

Crypto markets also tend to suffer when traditional equity volatility spikes.

The VIX, a benchmark fear gauge, usually climbs during war or crisis periods—further tightening risk budgets and triggering margin calls across crypto exchanges.

Longer-Term Path Depends on War Duration and Fed Response

If the US intervention is brief and leads to a quick ceasefire, markets may rebound. Bitcoin has historically recovered within 4–6 weeks after the initial shock, as seen in past conflict-related downturns.

However, if the war drags on or expands regionally, crypto could face an extended period of volatility, declining liquidity, and suppressed prices.

Investor appetite for speculative assets would likely remain low until geopolitical clarity returns.

That said, persistent inflation from war-related disruptions could revive the narrative of Bitcoin as a long-term hedge against fiat debasement.

But this bullish case competes directly with tighter monetary policy, which limits upside in risk-on assets.

Institutional inflows may pause or decline under such conditions. CME futures positioning, stablecoin supply, and L2 on-chain flows will be important indicators of sentiment shift in the weeks ahead.

Key levels to monitor include Bitcoin’s $100,000 psychological support and Ethereum’s $2,000 zone.

If broken, technical selling could accelerate downward pressure across all major tokens.

What to Watch Now

Investors should closely track:

- Oil price movements and forward contracts.

- Fed statements on inflation and rate policy.

- Treasury auction results and bond yield spreads.

- Exchange outflows and leverage usage in crypto.

- VIX and global risk indicators.

If the US joins the conflict, Bitcoin’s short-term future will likely be dictated by macro conditions—not crypto fundamentals.

Traders should prepare for volatility, stay hedged, and monitor geopolitical developments in real time.