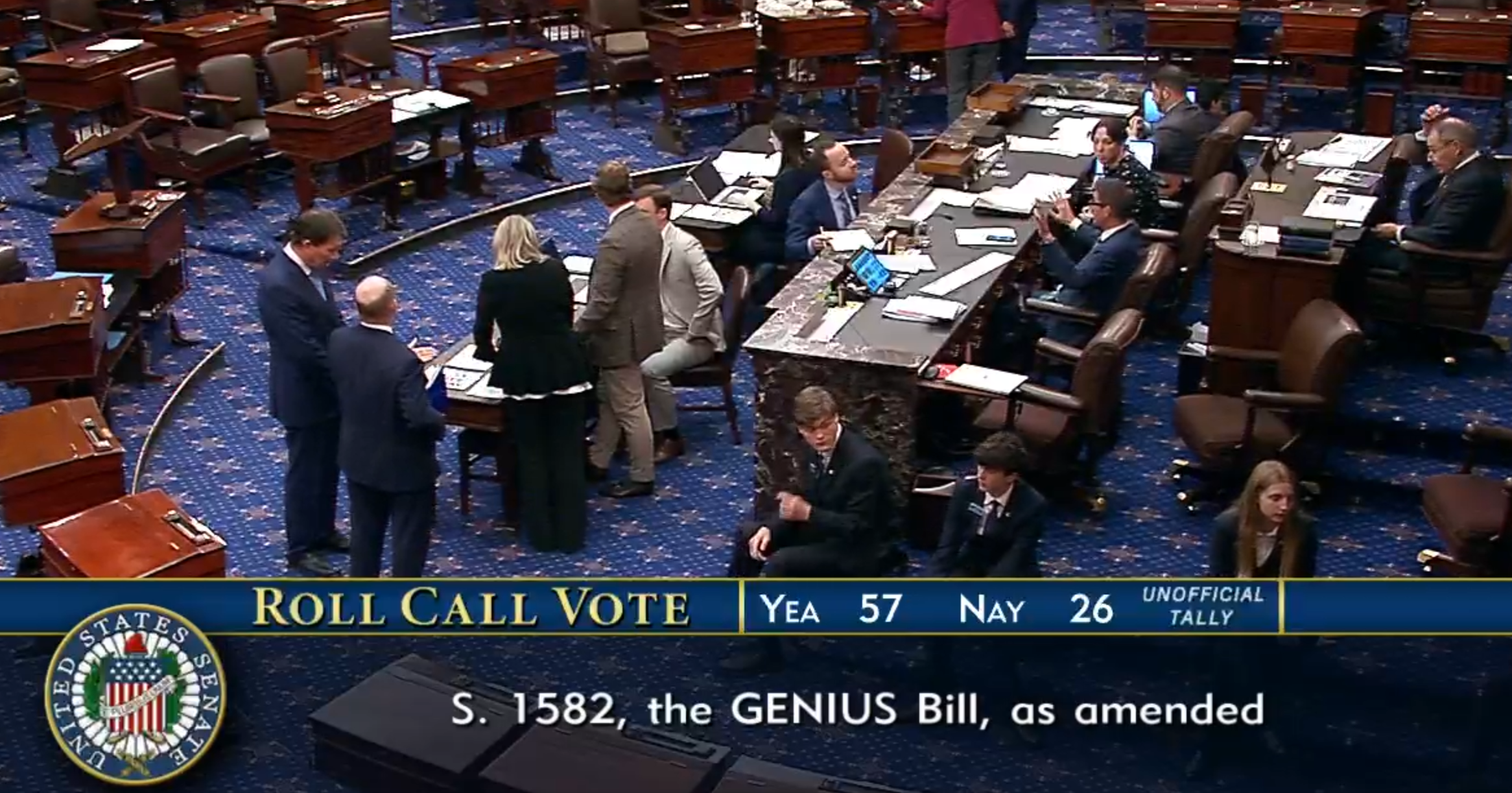

BREAKING: US Senate Greenlights GENIUS Act – Stablecoins Get Legal Stamp of Approval

Washington just handed crypto its biggest regulatory win yet. The GENIUS Act—buried in bureaucratic jargon but packed with real-world implications—cleared the Senate floor today. Here’s what changes.

Stablecoins escape purgatory

No more regulatory limbo. The bill grants dollar-pegged tokens a formal classification, putting an end to the SEC’s game of "are-they-securities-or-not" that’s stalled innovation since 2020. Exchanges can finally breathe—compliance teams might even take a lunch break.

Banks vs. blockchain: The showdown clause

Buried in Section 4: Federally insured institutions get 18 months to launch their own stablecoins. Watch legacy finance scramble to compete with Tether and Circle—like teaching grandpa to use DeFi, but with taxpayer-backed capital.

Market impact: Liquidity tsunami incoming

Analysts predict $50B in fresh institutional inflows within six months. "This isn’t just legitimacy—it’s an on-ramp," says Galaxy Digital’s head of trading. Cynics note the bill conveniently drops as election campaigns start hunting for crypto donor dollars.

The fine print: Innovation with handcuffs

All issuers must maintain 1:1 reserves (bye-bye algorithmic stablecoins), and yes—every transaction over $10K gets reported to FinCEN. Decentralization purists are already screaming, but let’s be real: Wall Street never plays without guardrails.

Bottom line: The dinosaurs in suits finally moved. Now watch the market do what it does best—price in the news before DC finishes their celebratory martinis.

GENIUS Act To Take Effect

Stablecoin regulation is a hot topic in the crypto industry right now, and the GENIUS Act represents a major breakthrough for innovation.

After months of debate and failed votes, a series of new amendments and bipartisan support have pushed it over the finish line. Now, all it’ll need is President Trump’s signature to take effect.

Several major institutions have already anticipated this MOVE and are preparing accordingly. Both JPMorgan and the Bank of America have announced plans to launch their own stablecoin soon.

The GENIUS Act will impose new restrictions on stablecoin issuers, mandating that they purchase huge sums of US Treasury bonds.

This requirement pushed Tether to buy more Treasuries than most states, potentially giving stablecoins new influence in world finance. President Trump has big plans for this industry, assigning them a role in dollar dominance.

A few Democratic Senators strenuously opposed the GENIUS Act, viewing it as an avenue for Trump’s crypto corruption. Additionally, critics have pointed out that it may complicate bankruptcy proceedings.

According to Section 9 of the bill, stablecoin holders get priority over other creditors in the event of issuer insolvency. This could create serious problems if banks or major corporations begin issuing stablecoins.

In the main, however, the Party supported the bill. A few Dems, such Senator Kirsten Gillibrand, spoke in favor of the crypto industry while denouncing the President’s investment, which other lawmakers may adopt.

In any event, a new chapter of US crypto regulation has begun. The industry marshaled an immense effort to pass the GENIUS Act, and its struggle paid off. Hopefully, this bipartisan coalition can deliver future victories, too.