$256 Million Exodus—But XRP Bulls Hold Firm: Who’s Bluffing in This High-Stakes Standoff?

XRP just bled $256 million in sell-offs—yet the funding rate stubbornly stays green. Are bulls playing 4D chess, or is this another ''hold my beer'' crypto moment?

Behind the panic: Whale dumps meet retail FOMO. While paper hands flee, derivatives traders keep betting big on an upside breakout. Either someone knows something, or we’re watching the market equivalent of a TikTok dare.

The cynical take? Wall Street’s algo-traders probably triggered the sell-off to scoop up cheap tokens before the next narrative pump. Because nothing says ''decentralized finance'' like hedge funds front-running retail yet again.

Bottom line: This isn’t your 2017 bull run. Today’s XRP holders either diamond-hand through volatility—or get steamrolled by institutional gamesmanship. Place your bets.

XRP Investors Move To Sell

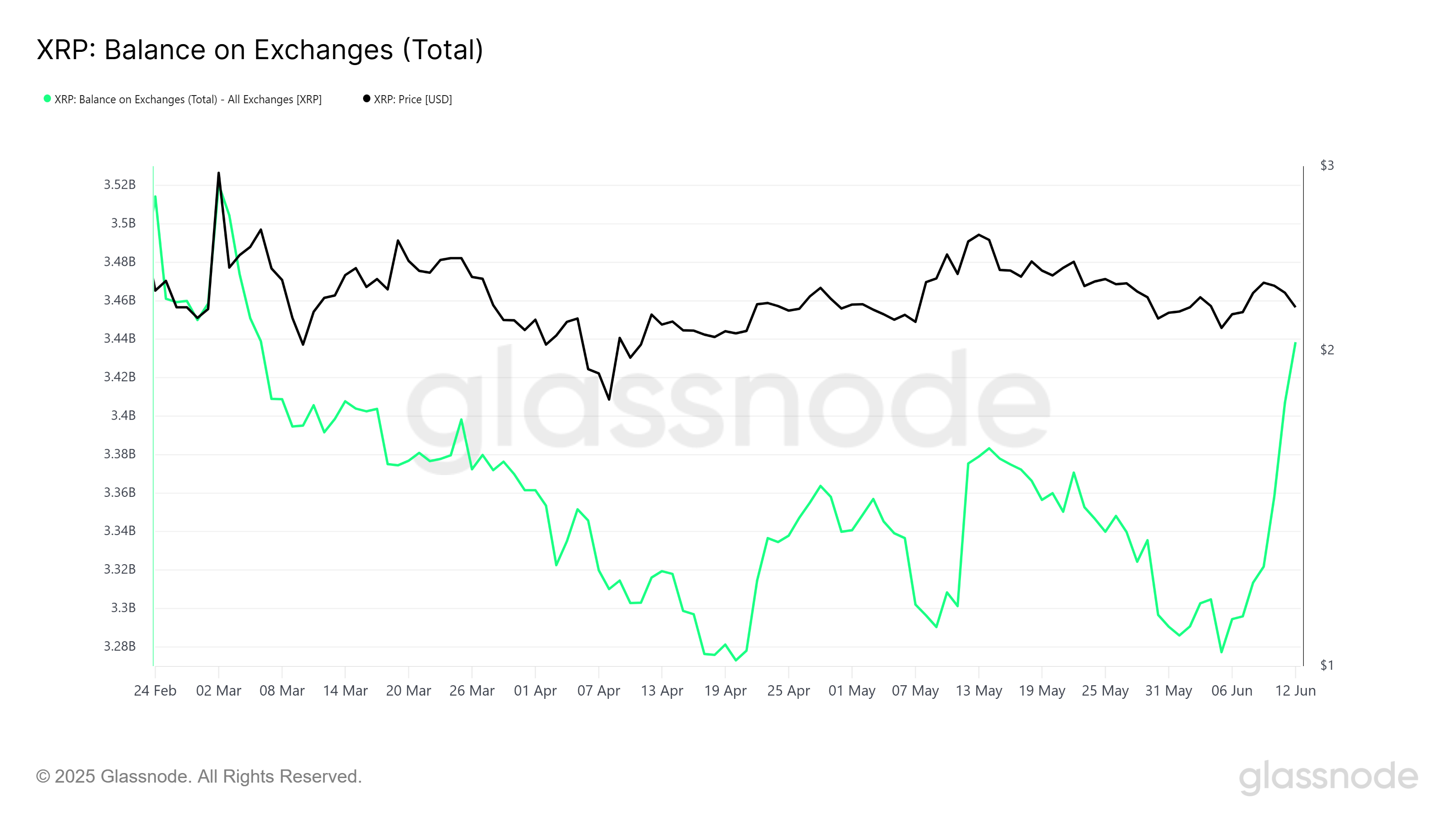

Over the last 24 hours, investors sold a significant 116.72 million XRP, worth more than $256 million. This panic sell-off stemmed from fears that the price WOULD continue to fall, prompting traders to exit before facing further losses. The broad market correction contributed to this rush to sell as holders attempted to safeguard their profits.

This large-scale selling shows rising uncertainty among XRP holders, especially as the altcoin faces downward pressure. Although the market conditions are not favorable, traders appear to be acting out of fear rather than clear analysis. This uncertainty could result in more volatility in the coming days unless a recovery emerges.

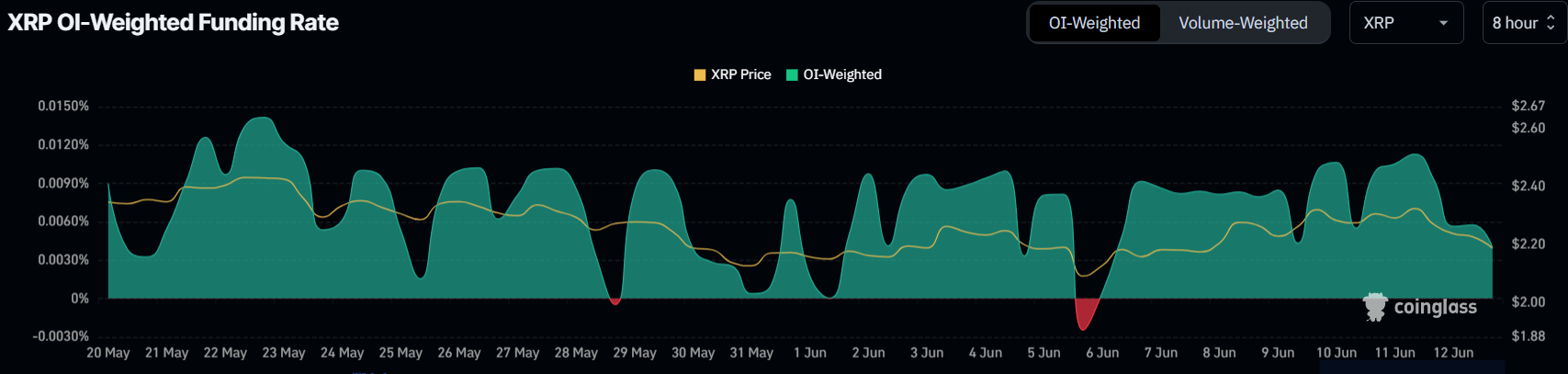

Despite the bearish market and the selling from investors, XRP’s funding rate remains positive. This is a clear indication that there is still a group of traders confident in the cryptocurrency’s potential, even during a market dip. These traders are likely betting on the eventual price increase, showing their conviction in the long-term growth of XRP.

The ongoing positive funding rate suggests that many believe the downturn will be temporary. Their continued support, even amidst a market correction, highlights the potential for XRP to regain momentum. The fact that there is still buying interest signals that traders are focused on capitalizing on future price increases, potentially leading to a recovery.

XRP Price Decline Could Be Reversed

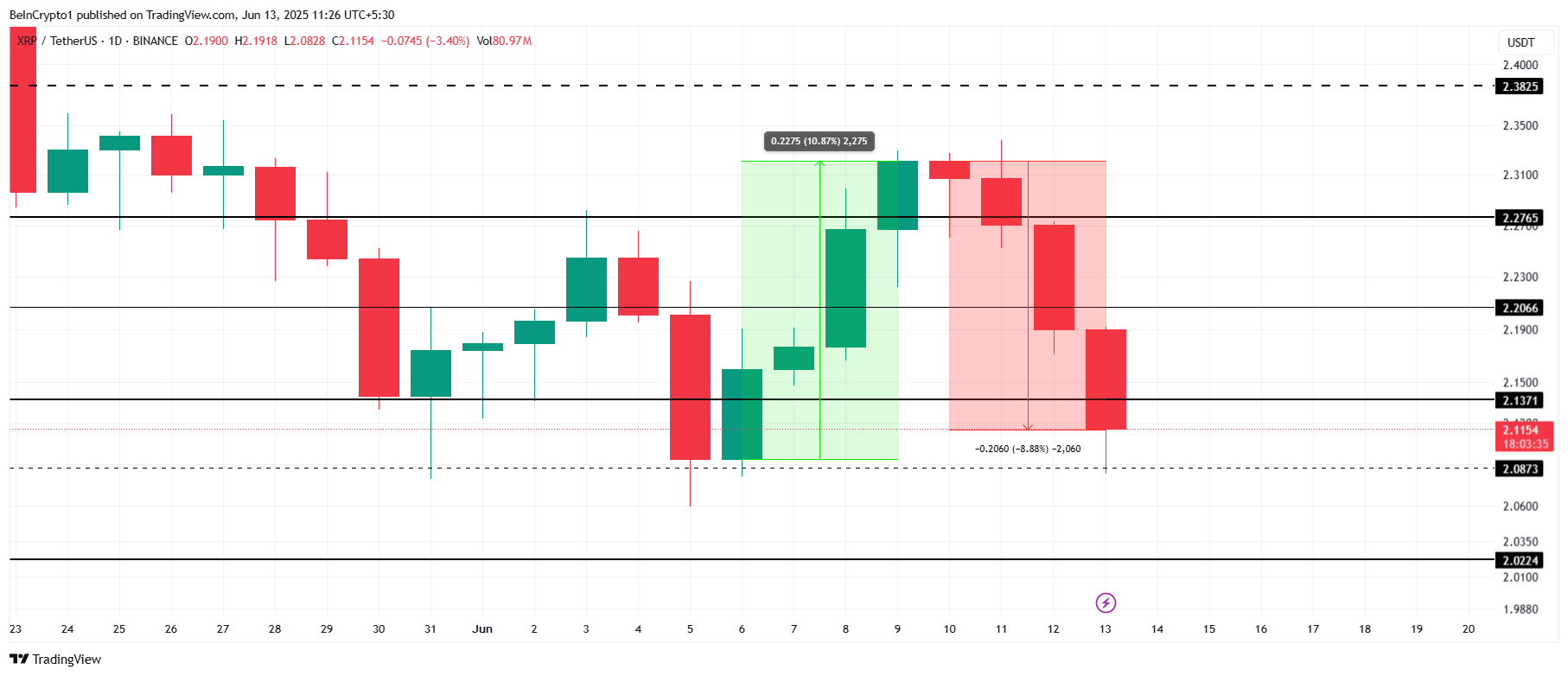

At the time of writing, XRP’s price is down 8% over the last four days, trading at $2.11. The altcoin is holding above the critical support of $2.08, though recent selling pressure could continue to weigh on the price.

A loss of the local support level of $2.08 could trigger a deeper decline for XRP. In this case, the altcoin might even test $2.00, marking a two-month low. Such a MOVE would suggest continued weakness in the market, further worrying traders and investors about the future direction of XRP.

However, if XRP manages to hold above the $2.08 support, it could bounce back, just as it has in the past. A recovery past $2.13 would signal the possibility of a trend reversal, allowing XRP to rise towards $2.20 and potentially invalidate the bearish outlook.