Ethereum ETF Inflows Surge to 2025 Highs—Is a Price Explosion Next?

Money’s flooding into Ethereum ETFs like Wall Street just discovered yield—shocking, right? The 2025 peak suggests institutional FOMO is in full swing. But will ETH’s price deliver the moonshot retail’s praying for—or just another ’buy the rumor, sell the news’ circus?

Greedy bankers stacking ETH while Main Street still thinks it’s a meme? Classic. The real question: When the suits finish front-running, who’s left holding the bag?

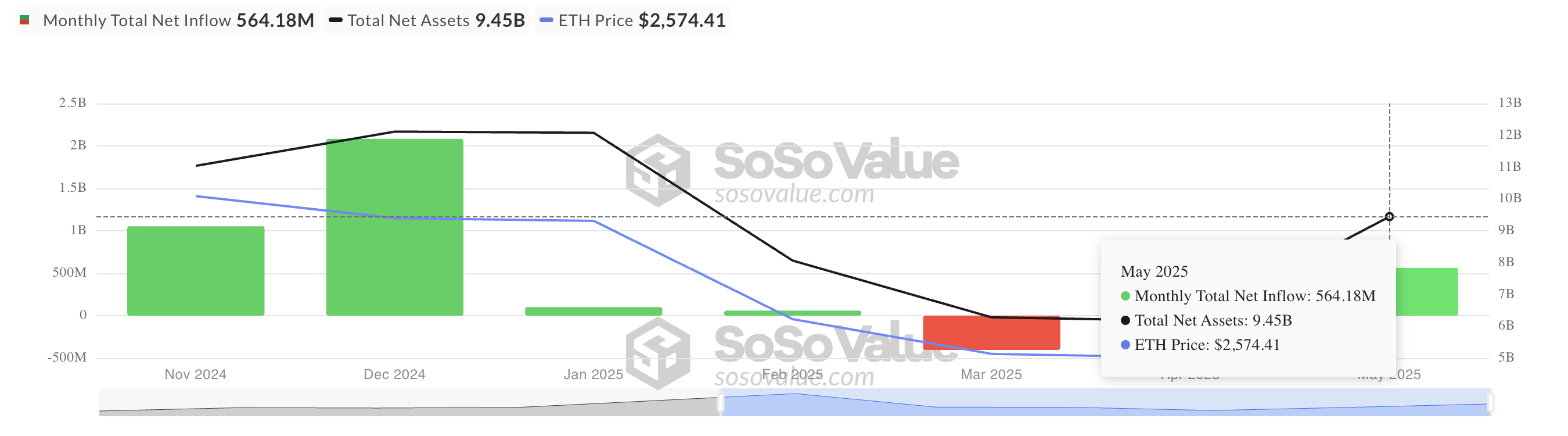

ETH ETFs Log Highest Monthly Inflows of 2025

According to data from SosoValue, ETH spot ETFs recorded a combined inflow of $564.18 million in May, surpassing all previous monthly totals this year.

The influx of capital was largely driven by ETH’s strong performance, with the leading altcoin breaking above the critical $2,000 level and attempting to consolidate gains above $2,500 during the month. This renewed bullish sentiment encouraged institutional investors to increase their exposure through spot ETFs and position ahead of a sustained rally in the coin’s price.

Ethereum Prepares for Next Leg Up

Readings from the daily chart show that ETH witnessed a 49% surge between May 8 and May 13, before settling into a consolidation phase that has now formed a bullish pennant pattern.

A bullish pennant pattern is formed when a strong upward price movement (flagpole) is followed by a period of consolidation that resembles a small symmetrical triangle (the pennant). This pattern suggests that buyers are temporarily pausing before continuing the uptrend.

If ETH breaks out of the pennant to the upside, it could trigger a renewed rally that mirrors the initial 49% surge. Such a breakout WOULD confirm continued bullish momentum and attract additional capital inflows.

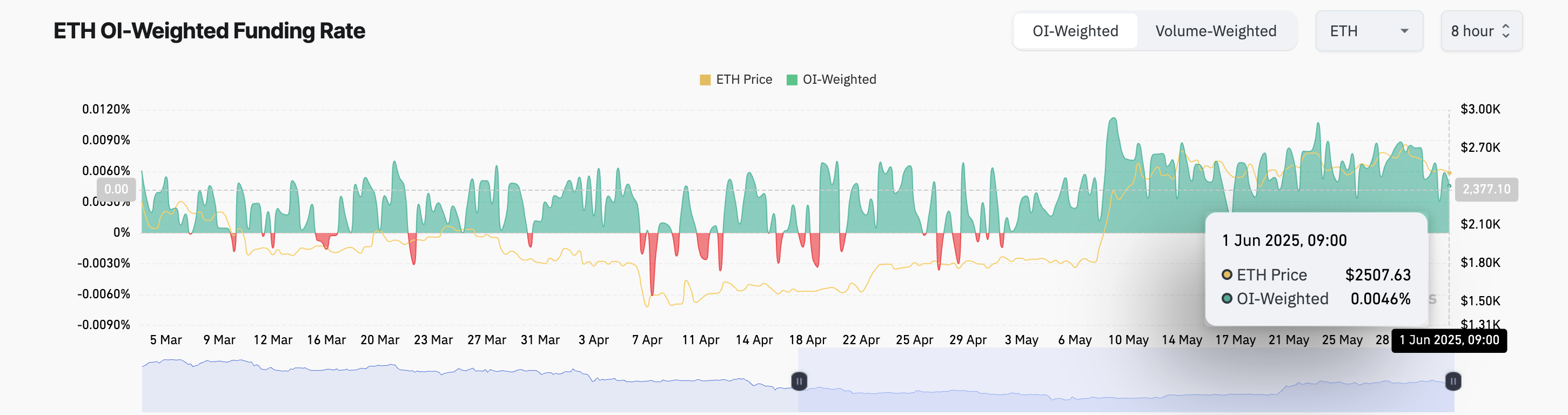

Moreover, the coin’s funding rate continues to print values above zero, indicating a preference for long positions even amid the ongoing consolidation phase. As of this writing, ETH’s funding rate stands at 0.0046%.

A positive funding rate like this means that long-position holders are paying short-position holders, indicating bullish sentiment and that more traders are betting on price increases.

Ethereum’s Next Move: Can Bulls Push ETH 49% Higher From Here?

ETH currently trades at $2,489, sitting above the lower line of its pennant, which forms support at $2,479. If a bullish breakout occurs, ETH’s price could rally by the flagpole’s length (49%) to trade at $3,907.

However, if selloffs resume, the coin’s price could break below the pennant and trade at $2,419.