Worldcoin’s WLD Token Hits 3-Month Peak Following $135M Cash Injection

Another day, another crypto project swimming in venture capital—but this time, the market’s biting. Worldcoin’s WLD token just surged to its highest price since February after a $135 million investment landed in its lap.

Who’s buying the hype? The usual suspects: institutional investors chasing the next shiny thing in decentralized identity. Never mind that most retail traders still can’t explain how Worldcoin’s eyeball-scanning ’proof of personhood’ actually works.

The rally defies the broader market’s sideways slog—proving once again that in crypto, nothing pumps a token like fresh money and vague promises. Just don’t ask what happens when the funding runs dry.

WLD Momentum Turns Positive After $135 Million Injection—Is More Upside Ahead?

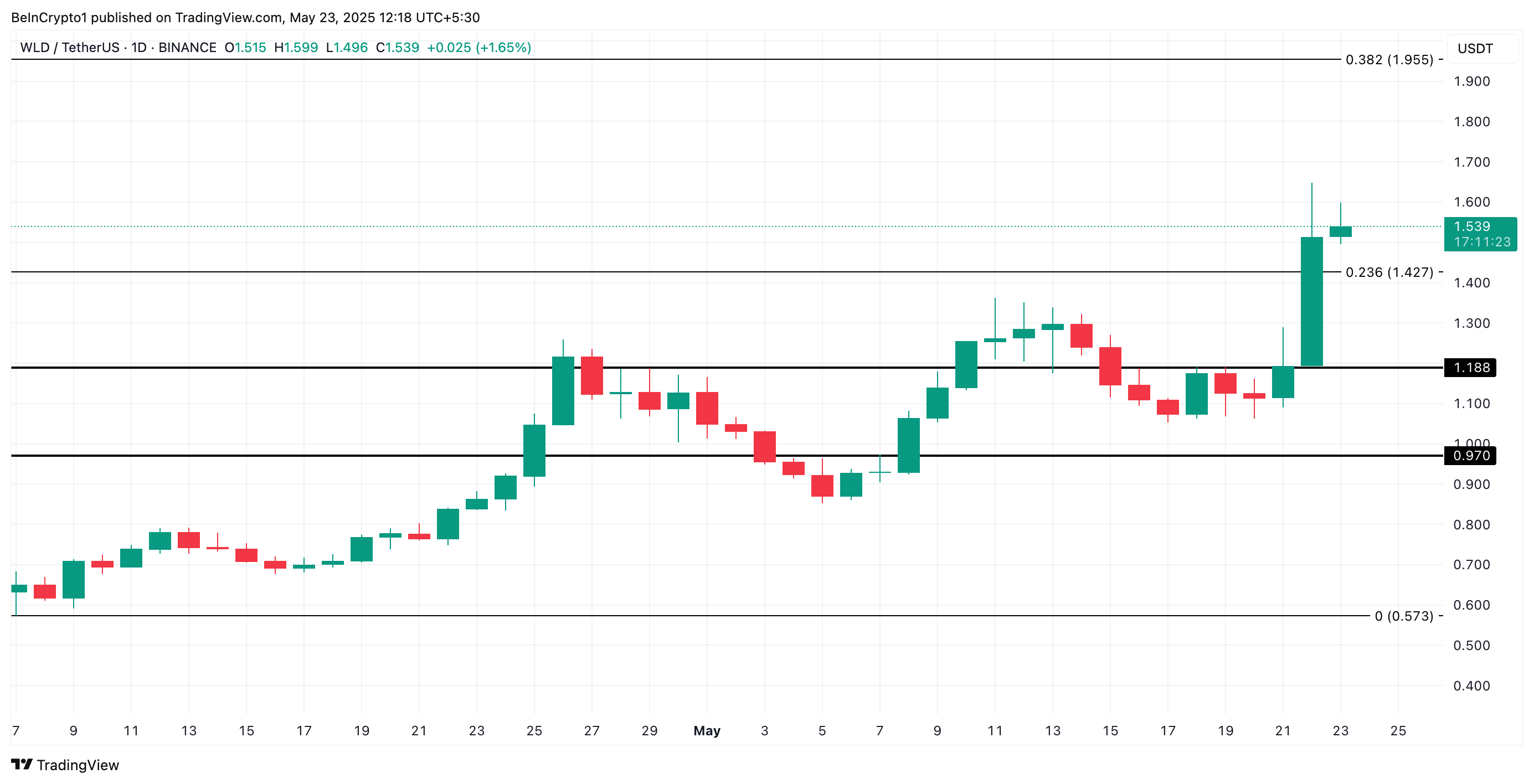

On May 21, Worldcoin announced a substantial $135 million capital injection, led by venture firms a16z and Bain Capital Crypto, through the direct purchase of its WLD tokens. This triggered significant buying momentum across the market, propelling WLD’s price to a three-month high of $1.64 by Thursday.

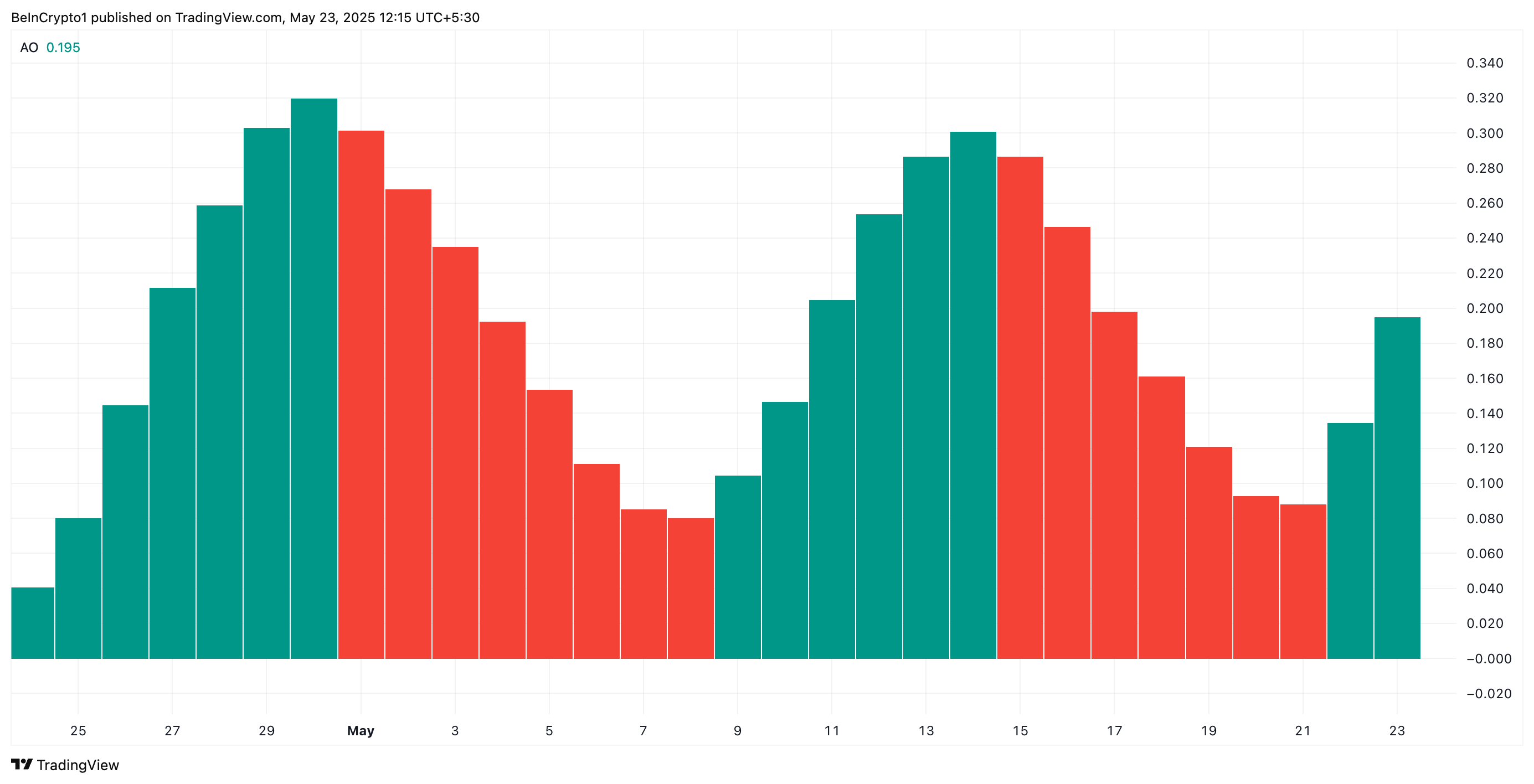

While WLD has since witnessed a minor retracement to trade at $1.53 at press time, bullish sentiment remains firmly intact. Readings from the token’s Awesome Oscillator observed on a daily chart confirm this.

At press time, the momentum indicator is flashing green, with the histogram bar registering a value of 0.195. This marks the second consecutive day of positive momentum after a seven-day streak of red bars.

The Awesome Oscillator compares an asset’s current market momentum to a longer-term momentum, helping to identify potential trend shifts. When it shows green histogram bars and positive values, it indicates that the current momentum is strong and that bullish sentiment is increasing.

This suggests that WLD’s price could continue to rise, presenting a potential buying opportunity for market participants.

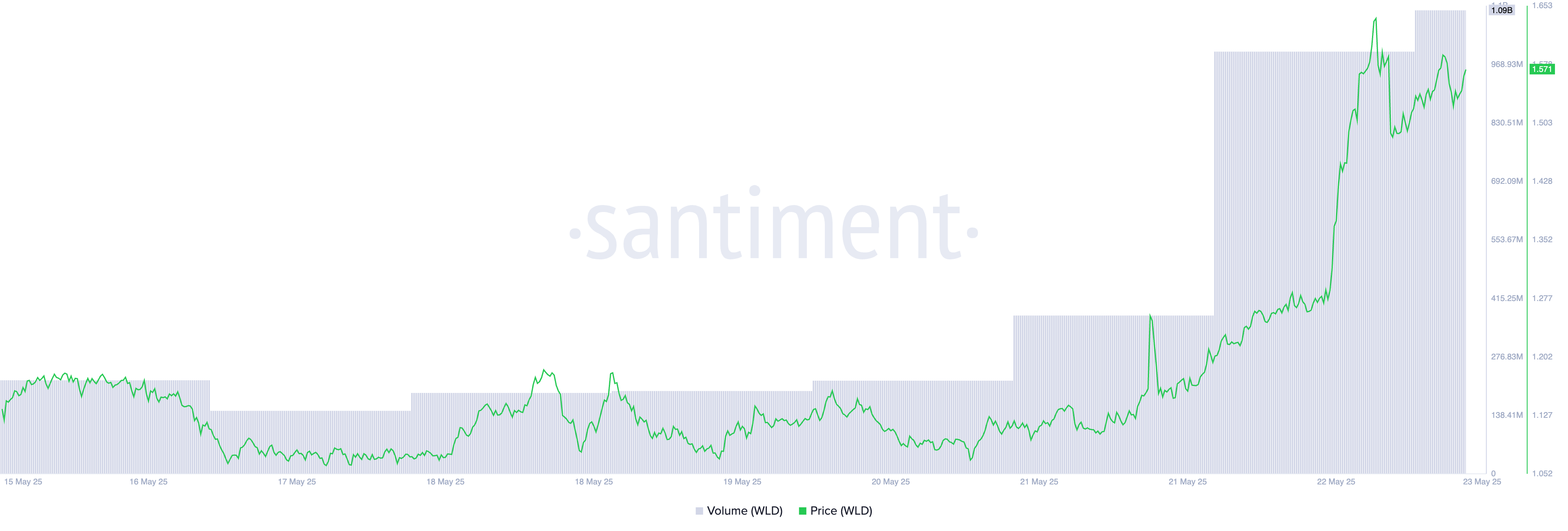

Further, WLD’s daily trading volume continues to rocket, indicating that its price surge is backed by actual token demand and not by speculative trading activity. As of this writing, the altcoin’s trading volume is up 159%, exceeding $1 billion.

When an asset’s price and trading volume climb simultaneously, it signals strong market interest and increased demand. This trend suggests that the WLD token price rally is supported by conviction rather than short-term speculation.

WLD’s Breakout Could Lead to January Highs — Unless Profit-Takers Step In

WLD’s double-digit surge has pushed its price above the resistance formed at $1.42, turning it into a support floor. If demand climbs and this price floor strengthens, the altcoin could extend its rally toward $1.95, a high it last reached on January 27.

However, a resurgence in profit-taking activity will invalidate this bullish outlook. If selloffs resume, WLD could lose recent gains and test the support at $1.42. If it fails to hold, it could give way to a further decline to $1.18.