$3.3B Crypto Bomb Drops Today: Bitcoin, Ethereum Options Expire Post-ATH Frenzy

Wall Street’s favorite casino chips—sorry, ’derivatives’—are settling today as over $3.3 billion in Bitcoin and Ethereum options contracts hit expiry. Timing is everything: this comes hot on the heels of Bitcoin punching through its all-time high, leaving traders either popping champagne or sweating through their Lamborghini-embroidered shirts.

Who’s left holding the bag? The smart money’s already moved—retail FOMO crews, brace yourselves.

Bitcoin and Ethereum Options Expiry: What Traders Should Know

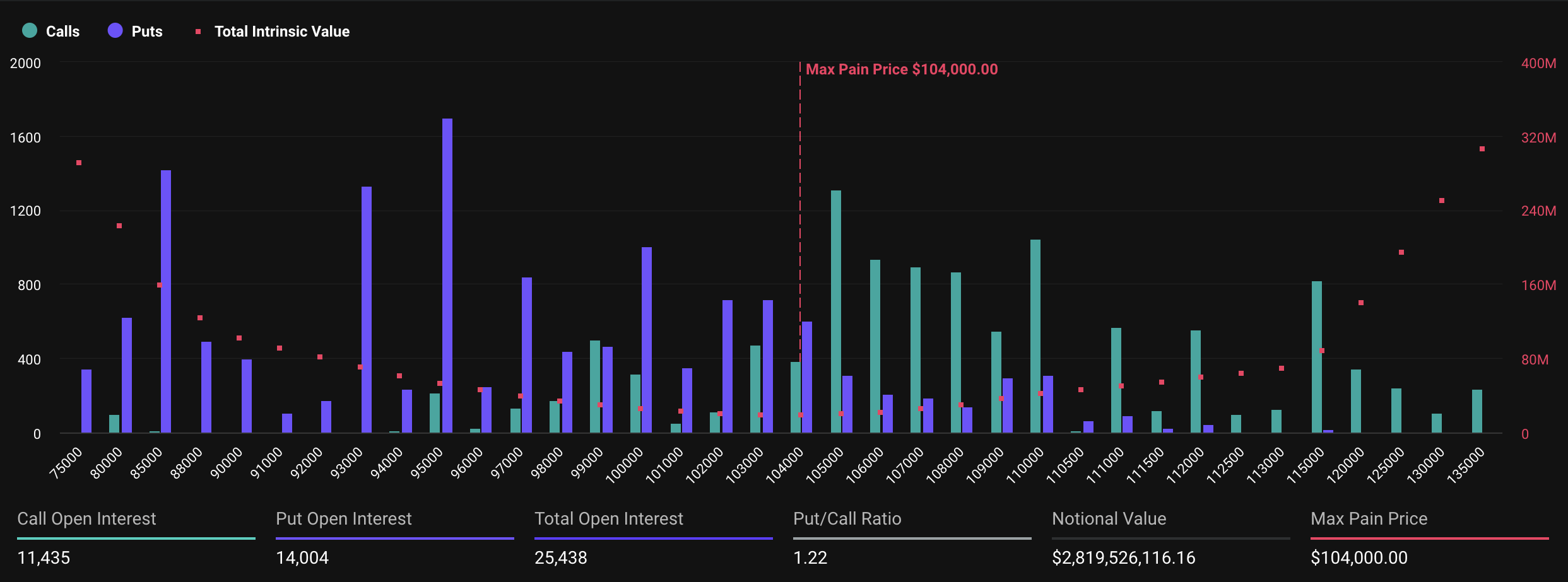

Deribit data revealed that today’s expiring options carry a notional value of $2.8 billion. The total open interest is currently at 25,438 contracts, down slightly from last week’s 26,543 contracts.

Of the total, 11,435 are call contracts, and 14,004 are put contracts. This results in a put-to-call ratio of 1.22. This suggests the market is skewed toward bearish sentiment, with traders expecting downward price movement or hedging against it.

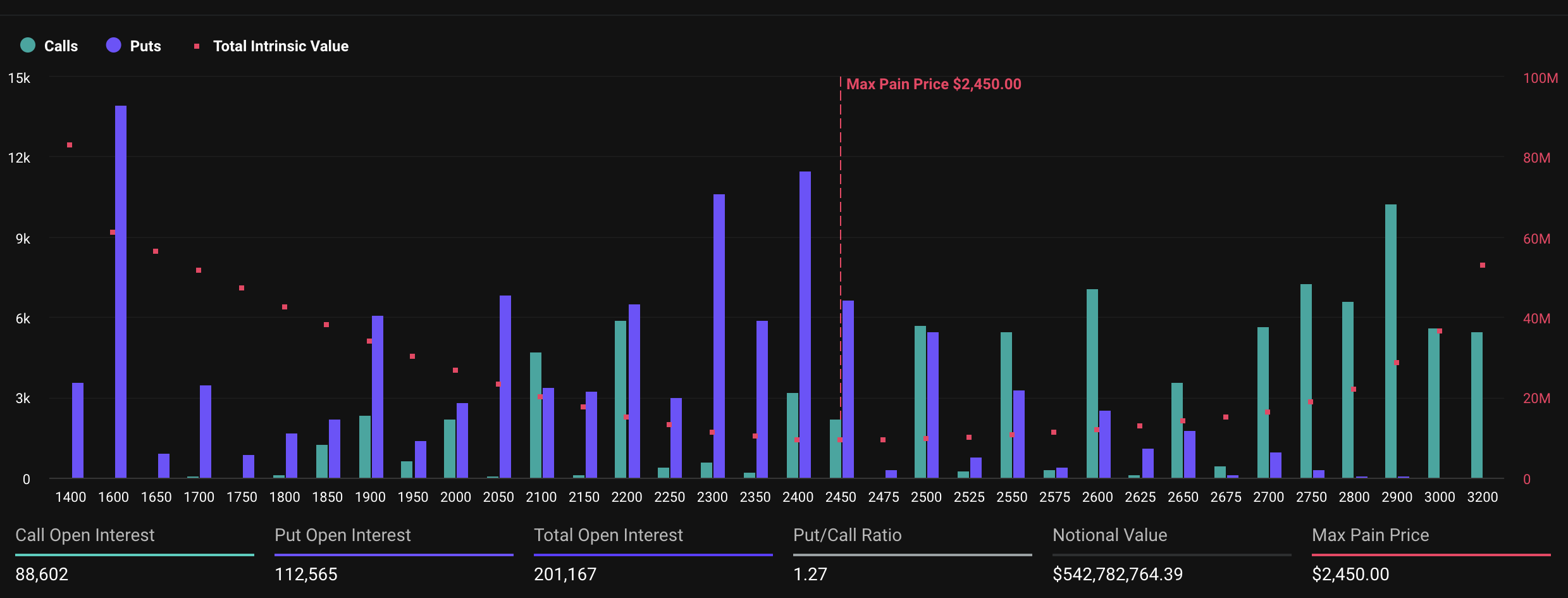

Meanwhile, the market sentiment for ethereum is similarly bearish, with a put-to-call ratio of 1.27. The notional value of the 201,167 expiring contracts is over $542 million.

This includes 112,565 put contracts and 88,602 call contracts. This is a decrease from last week’s 219,986 total contracts.

Notably, the maximum pain price for both Bitcoin and Ethereum is below their current price. According to the Max Pain theory, the market could gravitate toward these lower price points as expiration approaches, potentially making the highest number of options contracts worthless.

For Bitcoin, the max pain price is $104,000. At the time of writing, BTC was trading at $110,787. It reached an all-time high of $111,917 yesterday but has since slipped around 1.0% from its peak.

Analysts at Greek.live highlighted that a 15-20% correction in the short term could occur. They explained that many traders are securing downside protection through puts, anticipating a brief pullback to the $100,000–$103,000 range.

Despite this, the predominant market sentiment remains bullish, with many expecting Bitcoin to resume its upward trajectory.

The analysts also pointed out that negative funding rates reflect ongoing skepticism. Many participants are still shorting the market. This could potentially trigger a short squeeze and drive prices even higher.

“Key levels being watched include $110,000 as immediate support, $120,000 as a near-term target, and $150,000-200,000 as longer-term targets, with negative funding rates suggesting many are still shorting despite the rally,” the post read.

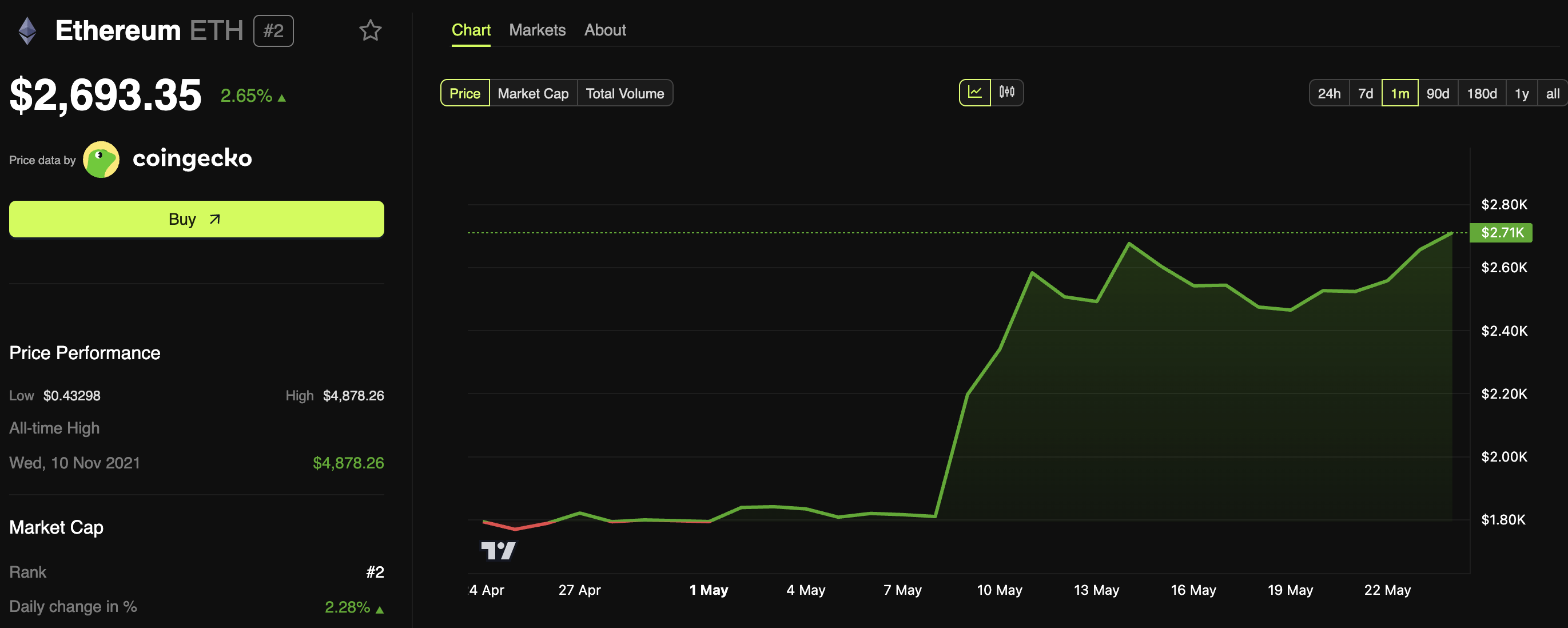

For Ethereum, the max pain price stands at $2,450. Despite trading at $2,693, a 2.6% increase over the past day, the market may still see price movements toward the max pain level as expiration approaches.

“Ethereum’s underperformance relative to Bitcoin is notable, with ETH failing to follow BTC’s new all-time high despite expectations for ETH to reach $3,000 by June,” Greek.live added.

Thus, while short-term price swings may follow the options expirations, it’s worth noting that markets usually find their footing again pretty quickly as traders adjust to the new price levels.