Cardano’s ADA/JPY Trading Volume Surges—Is Japan Fueling a Comeback?

Cardano’s ADA is making waves in Japan as trading volume against the yen skyrockets. Could this be the lifeline the project needs?

Market watchers are buzzing—while some see Japan’s strict FSA oversight as a trust-builder, others smirk at yet another ’revival’ narrative in crypto’s endless cycle of hype and hope.

One thing’s clear: if traders keep piling in, even the skeptics might have to pay attention. Just don’t expect Wall Street to notice—they’re still too busy pretending NFTs were a good idea.

Cardano taps into Japan’s appetite for long-term plays

One word captures Japan’s pivot toward a decentralized future: Metaplanet. The Tokyo-based investment firm has ramped up its Bitcoin [BTC] holdings to 7,800 BTC — worth roughly $850 million in spot terms.

That puts it ahead of El Salvador’s sovereign stack of 6,181 BTC, making Metaplanet the new heavyweight in institutional accumulation. What’s more? The firm’s 2025 target is a clean 10,000 BTC.

If Metaplanet stays on pace, the line between institutional and nation-state Bitcoin [BTC] holdings could start to blur — an edge that alternative assets like Cardano are quietly leveraging.

The ADA/JPY pair has shown a tight correlation between spikes in local demand and broader valuation peaks.

The November breakout in ADA/JPY was the first real signal of retail-driven price discovery in the Japanese market.

Source: TradingView (ADA/JPY)

But it’s the volume profile that’s really flashing green.

Compared to the November rally, the most recent monthly rebound has seen ADA/JPY volume climb north of $400 million, marking a structural uptick in participation.

In turn, this suggests Japan may be quietly assigning cardano long-term asset status. And if that trend scales, a “Metaplanet moment” for ADA isn’t just plausible — it’s loading.

ADA awaits the institutional catalyst

What truly sets Cardano’s rally apart from its high-cap peers is the absence of heavy institutional flow.

Bitcoin [BTC] and ethereum [ETH] ride the tailwinds of spot ETFs, Ripple [XRP] dominates futures market liquidity, and Solana [SOL] boasts strategic backing from top-tier DeFi dev funds.

In short, each blue-chip asset is buoyed by strong smart money capital, while Cardano’s still hunting for its institutional breakthrough to fuel the next leg up. That’s why Cardano’s demographic edge in Japan matters.

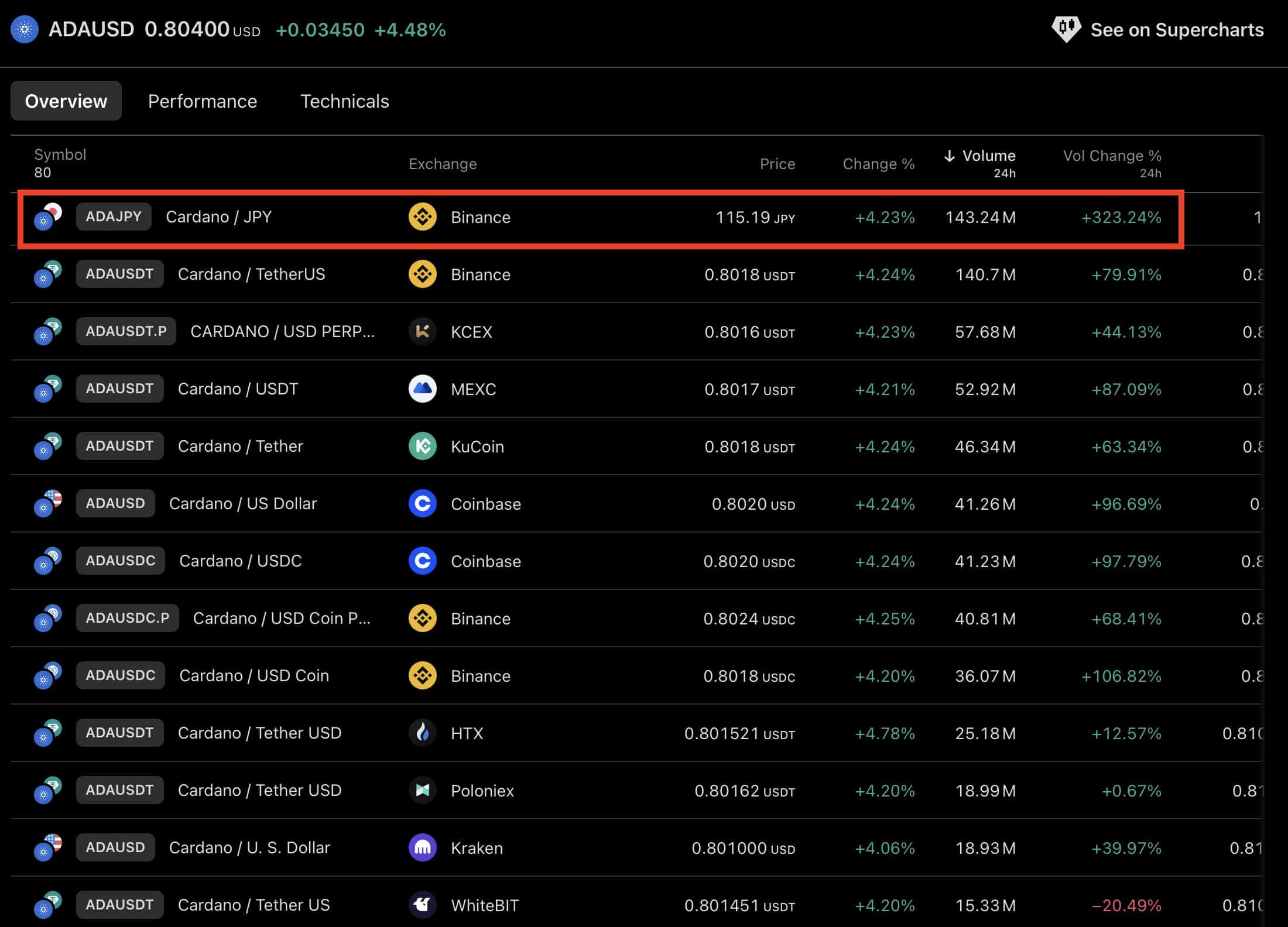

As the chart below shows, the ADA/JPY pair is leading volume flows, posting a staggering 323.24% daily jump with $143.24 million in trading volume — far outpacing ADA/USD and ADA/USDT.

Source: X

This divergence highlights weak U.S. demand, helping explain ADA’s persistent sub-$1 consolidation. Time for Cardano to shift its institutional radar toward Japan?

If this regional momentum sustains, it could be the institutional spark ADA’s been missing. This could fuel a breakout powered by the East.

Subscribe to our must read daily newsletter