Bitcoin’s Long-Term Holders Are the Silent Force Pushing BTC Toward $110K

While Wall Street hedgies flip-flop on crypto between coffee breaks, Bitcoin’s long-term holders keep stacking—and their diamond hands could be the rocket fuel for the next leg up. Here’s how.

The HODLer Effect: Supply Shock Gets Real

Over 60% of BTC hasn’t moved in a year. That’s a staggering 11.5 million coins gathering dust in cold wallets while exchanges scrape for liquidity. Every institutional FOMO buy now competes with an army of unshakable retail veterans who’ve survived three bear markets and still won’t sell for anything less than generational wealth.

Price Math Gets Scary (for Shorts)

Post-halving, daily new supply just got cut to 450 BTC—barely enough to cover MicroStrategy’s weekly buys. With spot ETFs vacuuming up 5,000+ BTC daily since January, the arithmetic points to one thing: a violent squeeze past $100K isn’t a matter of if, but when.

The Cynic’s Corner

Of course, Goldman Sachs will publish a 180-page ‘BTC valuation framework’ exactly 48 hours after the $110K breakout—just in time to take credit while their private wealth clients FOMO in at the top. Classic.

Long-Term Holders Keep Bitcoin Grounded

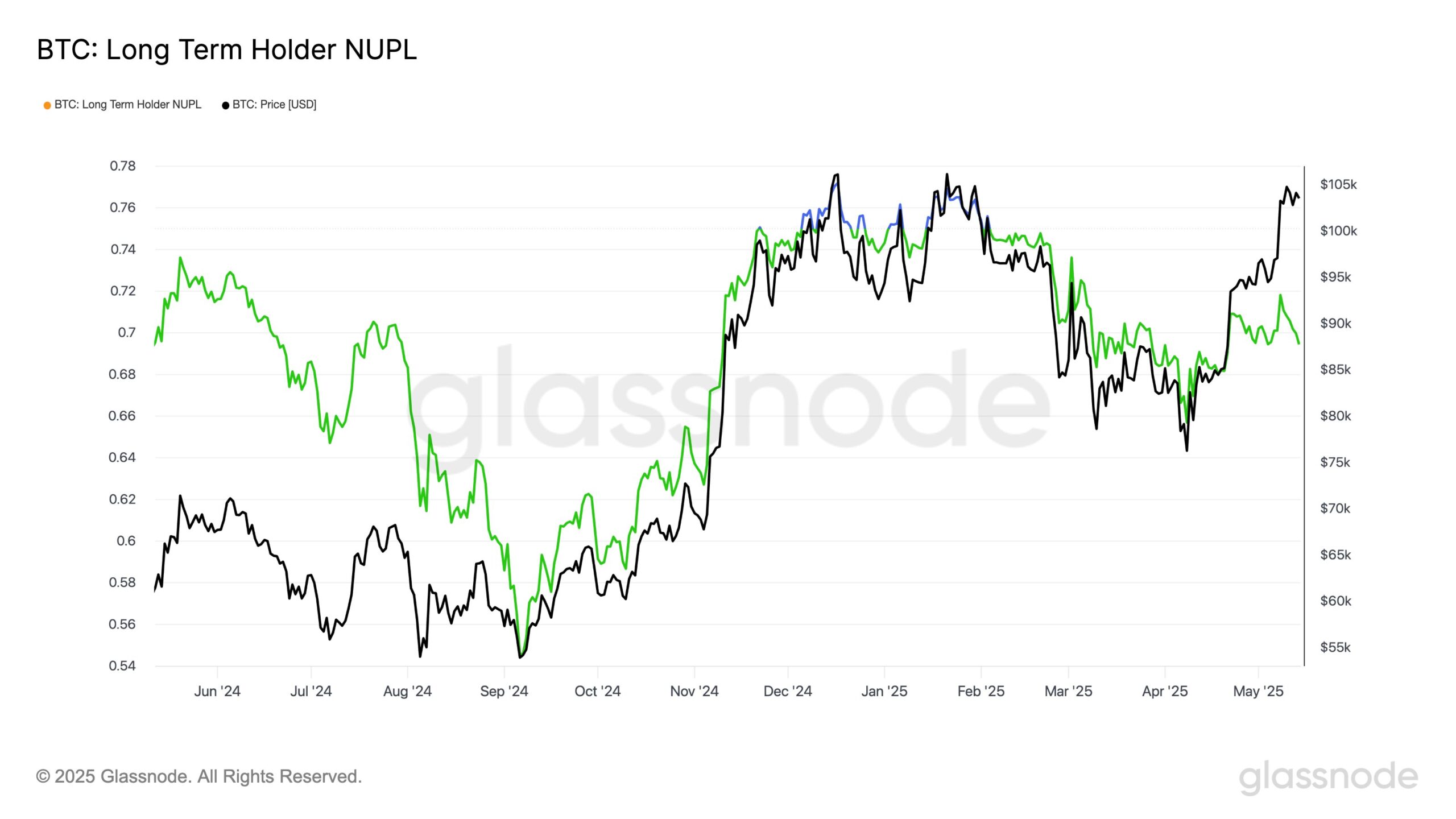

The long-term holder (LTH) net unrealized profit/loss (NUPL) indicates that investors who bought Bitcoin in December 2024 are maturing into LTHs, which requires a 155-day holding period. This is positive for Bitcoin because maturing buyers often hold coins longer, reducing impulsive selling pressure.

When more investors become LTHs, coins tend to stay in strong hands, which builds resilience against price dips. This behavior could support Bitcoin’s price stability and potentially drive gains as the market matures and short-term volatility diminishes.

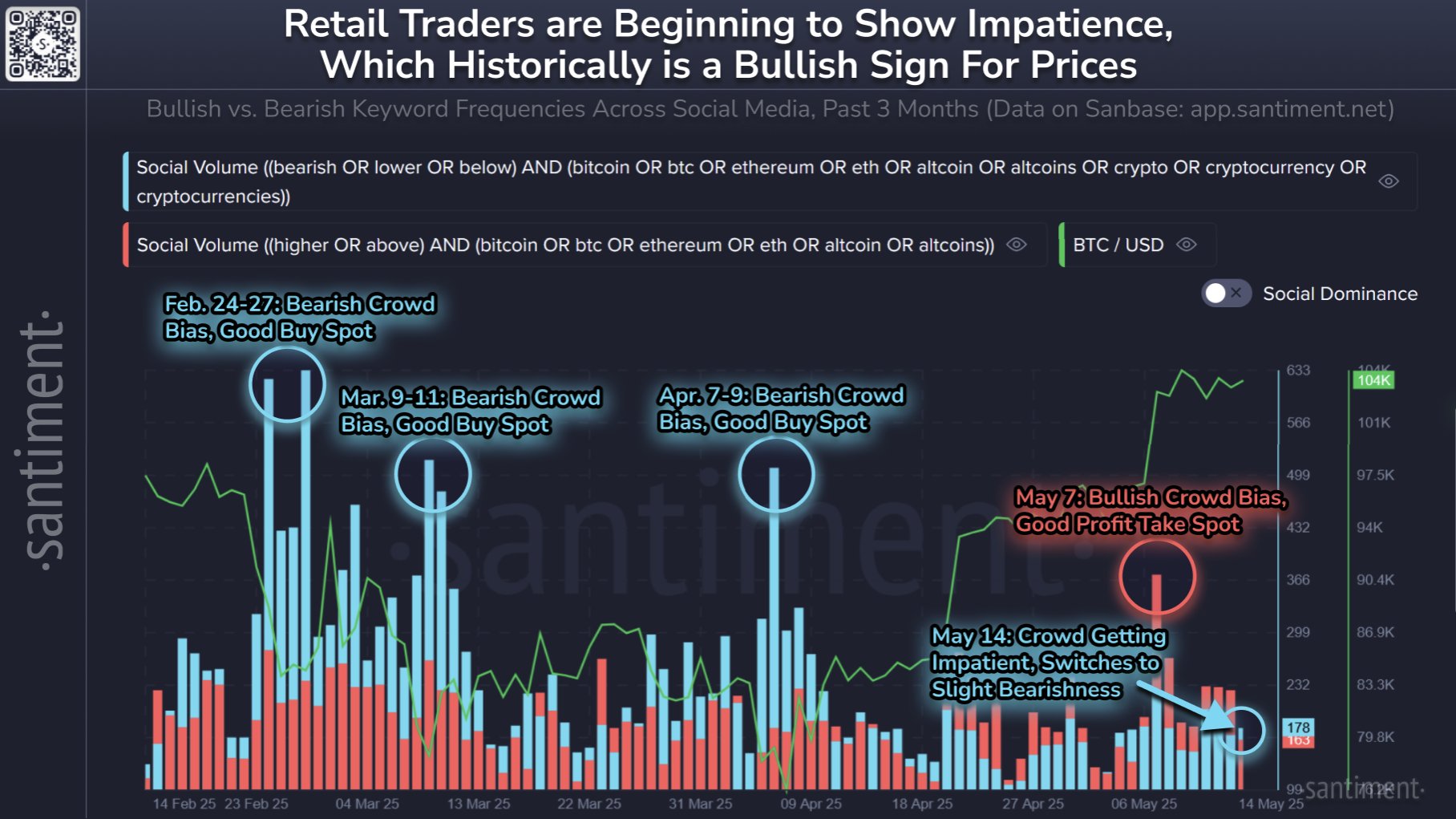

Bitcoin investors’ sentiment often moves contrary to market performance. Historical data shows bearish crowd sentiment typically signals a buying opportunity, while excessive bullishness precedes sell-offs. Over the past 48 hours, sentiment has shifted toward bearishness again.

This increased fear among retail investors could set the stage for a market rise, as traders look for value during dips. The growing apprehension contrasts with the positive price fundamentals, suggesting a potential breakout fueled by renewed buying interest amid caution.

BTC Price Needs To Breach Past A Key Barrier

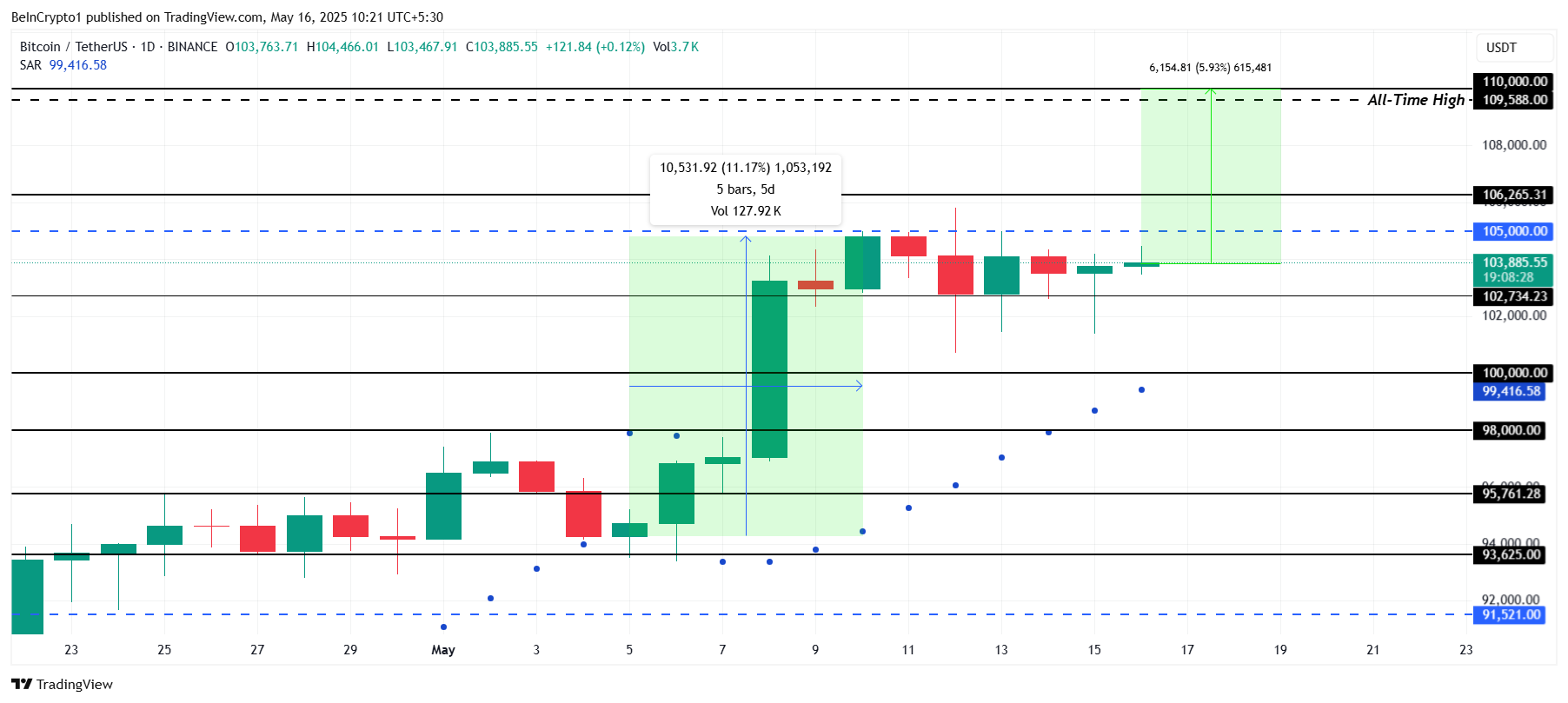

Bitcoin is currently trading at $103,885, moving sideways within a range between $105,000 and $102,734. To reach $110,000, bitcoin needs to rally nearly 6%, which is achievable given recent momentum.

Last week, Bitcoin surged 11% in just five days, showing strong potential for upward movement. The key resistance after $105,000 lies at $106,265. Successfully flipping this level into support WOULD likely confirm a push toward $110,000 and possibly a new all-time high.

However, if Bitcoin continues to consolidate sideways, impatient investors might sell to avoid losses. This selling pressure could drive the price below $102,734, potentially dropping toward $100,000 and invalidating the bullish outlook for now.