Meme Coins Gobble 41% of AI Crypto Market—While DeFAI Quietly Eats Their Lunch

Dog-themed joke tokens still dominate AI’s crypto niche—proof that even blockchain isn’t immune to the ’money printer go brrr’ mentality. But look past the hype, and you’ll spot DeFAI protocols gaining real traction.

Why it matters: When meme coins crash (again), the infrastructure play might be the only thing left standing. Just don’t tell that to the degens chasing 1000x returns on ShibaGPT tokens.

The bottom line: In crypto, even ’artificial’ intelligence can’t outrun human greed—but at least some builders are stacking code instead of memes.

Binance Research Studies DeFAI

Binance’s research-focused arm routinely compiles insightful studies on the industry as it stands. Today, it continued the trend, as Binance Research released a report on DeFAI, referring to it as the future of on-chain finance altogether:

“The integration of artificial intelligence into crypto is moving rapidly from novelty to infrastructure. What began with experiments… has begun to evolve into a deeper, more systemic transformation of how decentralized finance (DeFi) is built, used, and scaled,” the report began.

DeFAI, the integration of AI and decentralized finance, has been growing in prominence for several months now. Nonetheless, it’s currently quite far from the forefront of the AI industry.

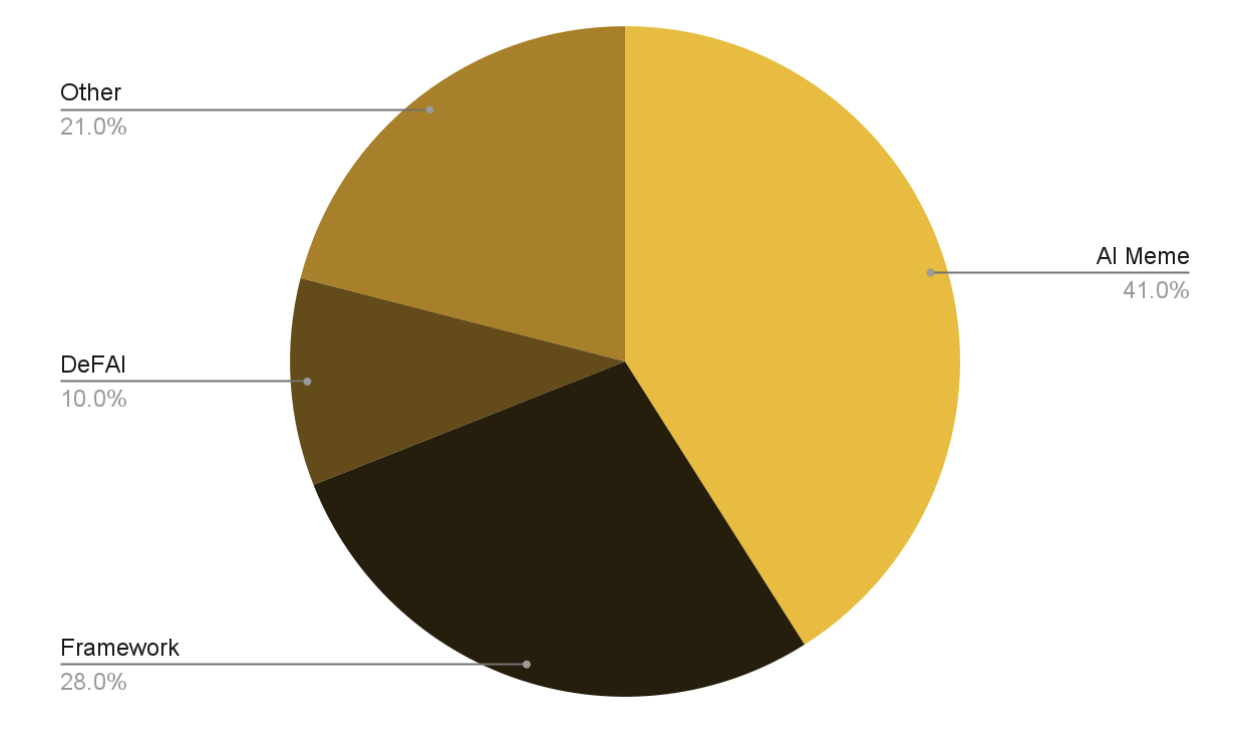

Binance Research broke down the market cap of various AI subsectors, determining that DeFAI only represents 10%. So far, AI meme coins are much more prominent.

However, Binance claimed that AI agents will power DeFAI’s success in the long run. It described four key architectural layers in DeFAI, all of which are related to AI agents.

These include the agents themselves, frameworks that determine their design, protocols to construct them, and marketplaces to distribute them. The report also explored several examples of each.

Several recent developments corroborate these bold claims. For example, AI agents recently expanded in number despite a bear market and pulled ahead of the industry when they made a rebound.

Earlier today, Tether announced QVAC, a major project which would likely fit Binance’s definition of a DeFAI agent framework or protocol, depending on unreleased specifics.

Looking forward, Binance Research pointed out a few potential concerns for the DeFAI sector. Two important considerations are ownership and transparency, both close to the crypto community’s sensibilities.

It also questioned the extent to which AI agents should directly participate in decentralized governance. As agents propagate through everything, the potential for abuse will only grow.

To sum up, Binance Research strongly believes in DeFAI’s potential. These agents are autonomous, modular, and intelligently decentralized, which could bring huge benefits alongside possible risks.

Still, as long as human actors implement strong safeguards and standards, these tools might create crypto’s future.