Ethereum Stages Comeback After Market Panic—But $2K Still Looks Like a Pipe Dream

Ethereum claws back from its latest bloodbath, though traders shouldn’t hold their breath for a moonshot to $2,000. The smart contract giant is showing signs of life after last week’s mass liquidation event—yet every rally gets smacked down by institutional bag-holders cashing out.

Key resistance levels loom like a brick wall. ETH’s recent 15% bounce? Classic dead cat bounce, fueled by retail FOMO and leveraged shorts getting squeezed. Meanwhile, the ’ultra-sound money’ crowd suddenly remembers why they hate volatility.

Face it: until macro conditions flip and the crypto bros stop day-trading with rent money, Ethereum’s stuck playing ping-pong between $1,600 and $1,800. But hey—at least the gas fees are low again (for now).

Ethereum Investors Are Prone To Selling

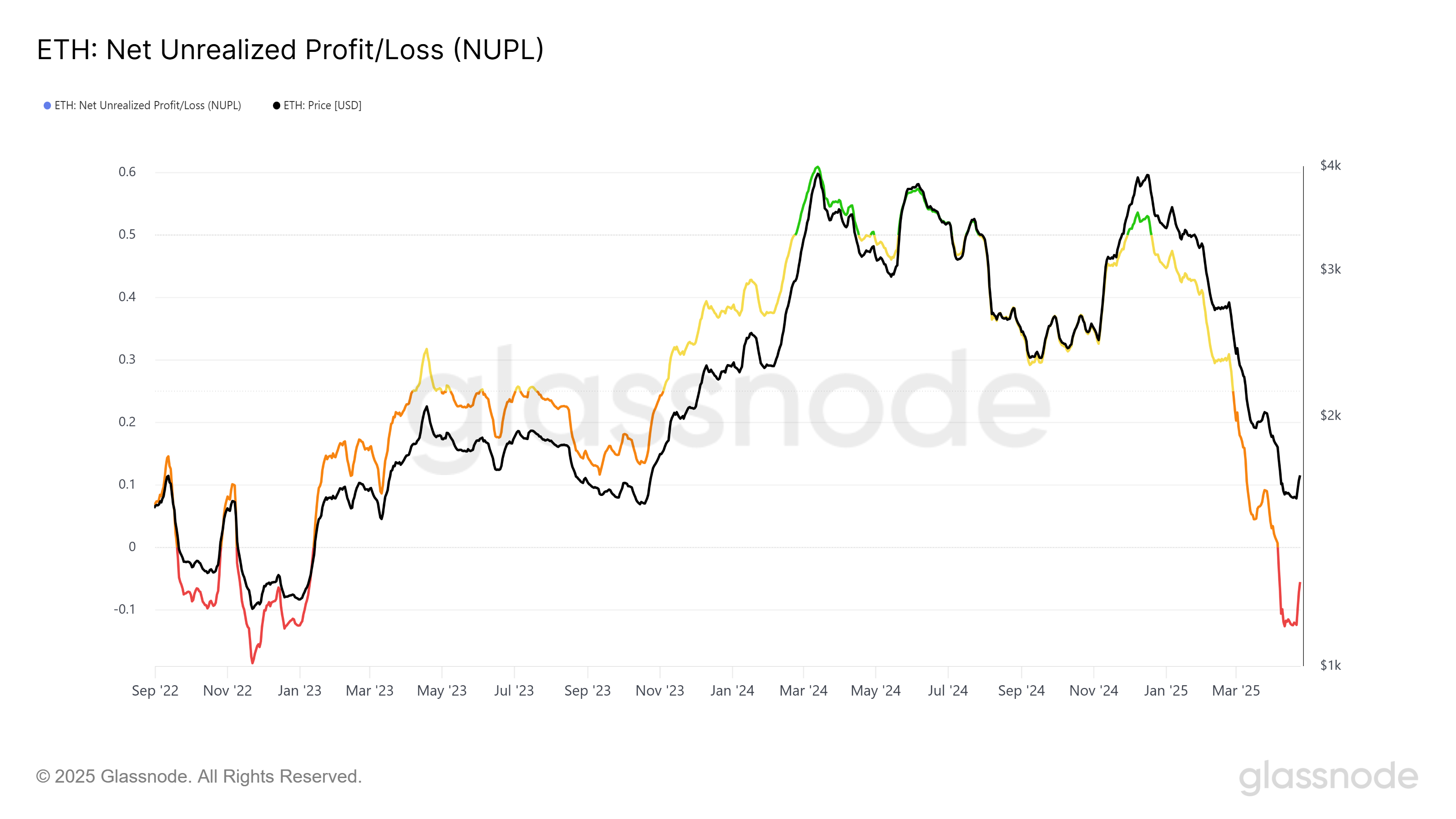

Ethereum’s network value and user activity are showing signs of a possible recovery, but its current market sentiment remains under pressure. The Net Unrealized Profit/Loss (NUPL) indicator, which gauges the overall profit or loss of coins in circulation, has entered a phase of capitulation.

Despite the uptick in Ethereum’s price, the underlying sentiment remains cautious. The increase in the NUPL could quickly reverse if short-term holders (STHs) decide to liquidate their positions.

Ethereum’s recovery hinges on investor confidence, with those holding onto their assets being the key to avoiding another sell-off. If more STHs choose to HODL instead of selling, Ethereum could see sustained upward momentum in the coming weeks.

On a broader scale, Ethereum’s macro momentum presents mixed signals. The Market Value to Realized Value (MVRV) Long/Short Difference indicator is currently deeply negative at -30%. This suggests that the market may face additional resistance in its recovery efforts.

The indicator highlights the disconnect between long-term and short-term holders, with the latter showing profits at a two-year high. The last time this occurred was in January 2023, when Ethereum experienced significant sell-offs, pushing the price lower.

The presence of STHs in a profitable position increases the likelihood of further selling pressure on Ethereum. As these investors are more likely to liquidate at the first sign of profits, the recovery could face challenges.

Ethereum’s price could struggle to maintain upward momentum, especially if short-term holders capitalize on their gains, pushing the altcoin back into a downtrend.

ETH Price Needs Support

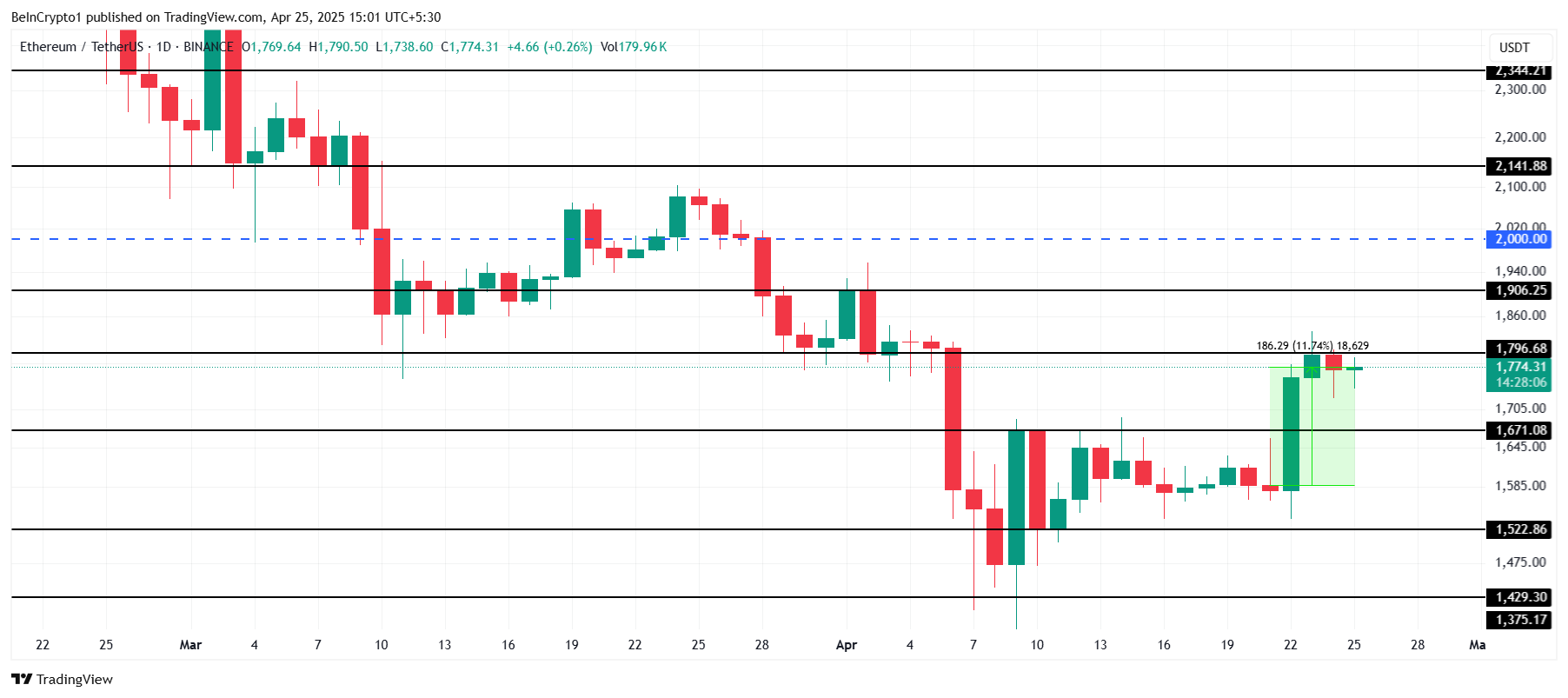

Ethereum’s price has risen by 11% in the past week, currently trading at $1,774. It is now testing the resistance at $1,796, and breaching this level is crucial for Ethereum to continue its recovery toward the $2,000 mark. A successful breakout above this resistance would signal a continuation of the recovery trend, pushing Ethereum closer to its previous high.

However, considering the market sentiment and the current indicators, Ethereum’s chances of reaching $2,000 in the short term seem unlikely. Ethereum is at risk of falling below the $1,671 support, which could trigger a deeper pullback to $1,522. This bearish outlook suggests that the recovery may be short-lived unless strong buying support materializes.

If the broader market conditions remain strong, Ethereum could manage to breach the $1,796 resistance and even push past $1,906. A move above these levels would set Ethereum on track to reach $2,000, invalidating the bearish outlook and signaling a more sustainable recovery for the altcoin.