XRP Stuck in 3-Month Channel—Why Bulls Might Get Disappointed

XRP’s price action is painting a frustrating picture for traders—locked in the same sideways channel since January 2025. Despite three breakout attempts, each rally got smacked down at the upper trendline like a overeager intern at a Wall Street bonus meeting.

The setup? Textbook descending channel with weakening volume. Every ’breakout’ so far has been a fakeout, leaving bagholders muttering about manipulation (as usual).

Key resistance sits at $0.62—a level that’s rejected price four times since February. Until XRP can close a weekly candle above that zone with conviction, this is just another ’when lambo’ waiting room.

Meanwhile, Bitcoin’s flirting with new highs while XRP traders are stuck watching paint dry. Some things never change—except maybe your portfolio balance if you keep chasing these dead-cat bounces.

XRP is Highly Overvalued

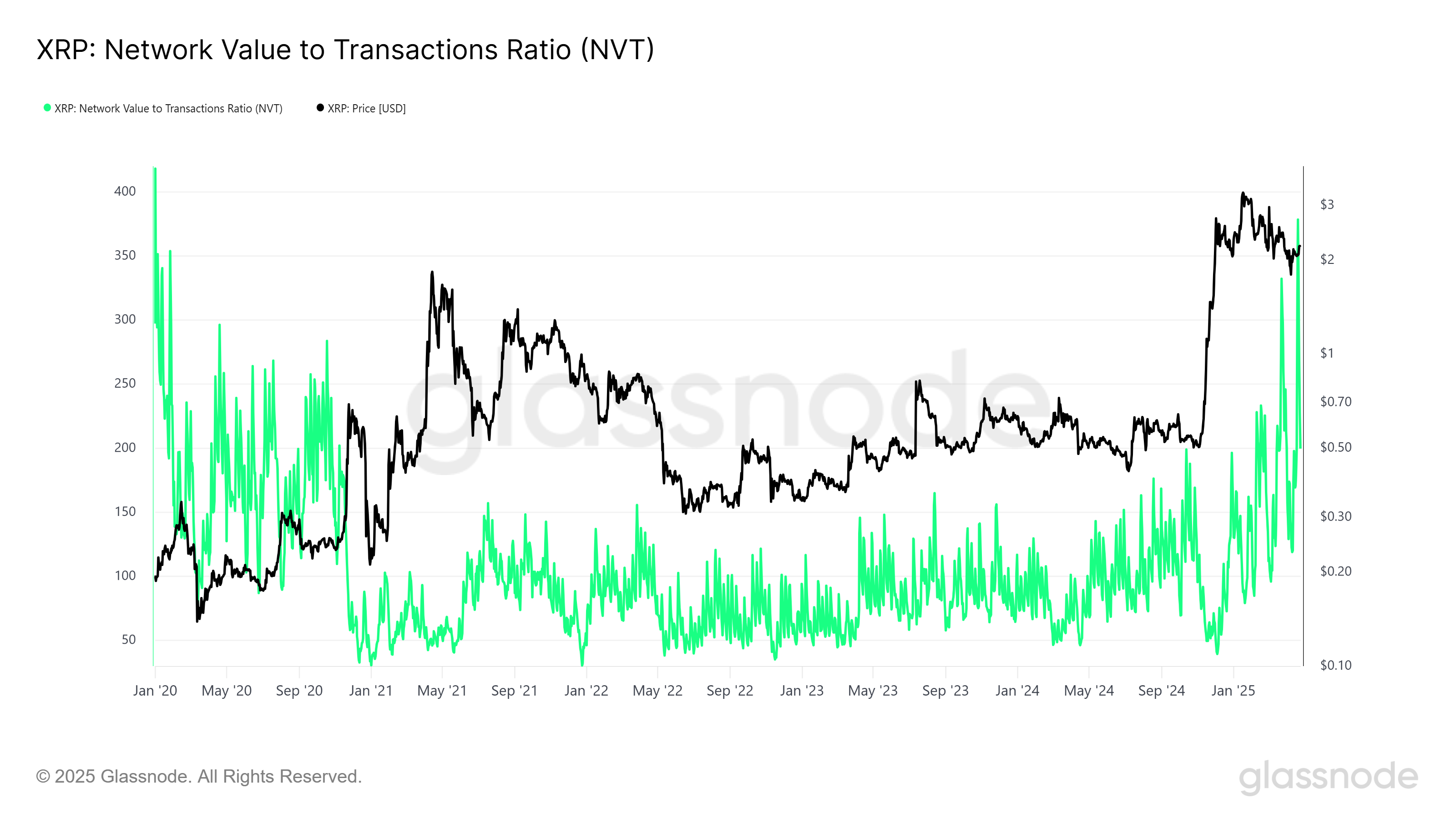

This week, XRP’s network value-to-transaction (NVT) ratio spiked to a five-year high, signaling an overvaluation. The NVT ratio is a critical indicator that compares a cryptocurrency’s market capitalization to its transaction volume. When the NVT ratio increases sharply, it suggests that the network value is outpacing actual transaction activity.

This condition has historically been associated with an upcoming correction in price. The last time the NVT ratio reached similar levels was in January 2020, just before XRP experienced a significant price downturn. The surge in NVT suggests that the market is becoming overheated, with expectations of a cooldown.

Despite XRP rallying 22% in the past two weeks, technical indicators paint a more concerning picture. The Chaikin Money Flow (CMF) indicator has displayed a significant spike, often suggesting that money flows into the market. However, a closer look at the volume of inflows reveals that substantial buying activity has not supported the price increase.

Instead, hype and speculation drive the price surge more than genuine investor interest.

With this in mind, XRP’s rally may be more of a short-term anomaly rather than a sustainable upward trend. As the market cools down and the hype subsides, the altcoin will likely struggle to maintain its recent price levels. The overvaluation condition remains a significant risk, potentially leading to a price correction.

XRP Price Faces Bearish Cues

XRP is currently trading at $2.19, showing a 22% increase in the last two weeks. The altcoin appears to be preparing for a breakout from a three-month-old descending channel. However, this breakout faces challenges, as the overvaluation condition and broader market indicators suggest that the rally may not last.

Given the potential bearish factors, even if XRP manages to break out, the rally could be short-lived. The price could retreat to $2.02, or possibly lower to $1.94, if the breakout fails to hold. The combination of overvaluation and weak buying momentum could quickly reverse any gains.

On the other hand, if XRP does manage to sustain its breakout, securing $2.40 and $2.56 as support levels could provide the necessary foundation for further price growth. Such a move would invalidate the bearish outlook, allowing XRP to push higher and continue its ascent.