Crypto Fear Hits Rock Bottom: Why Bitcoin’s 22 Fear & Greed Score Signals Massive Opportunity

Extreme fear has paralyzed crypto markets—and smart investors are loading up.

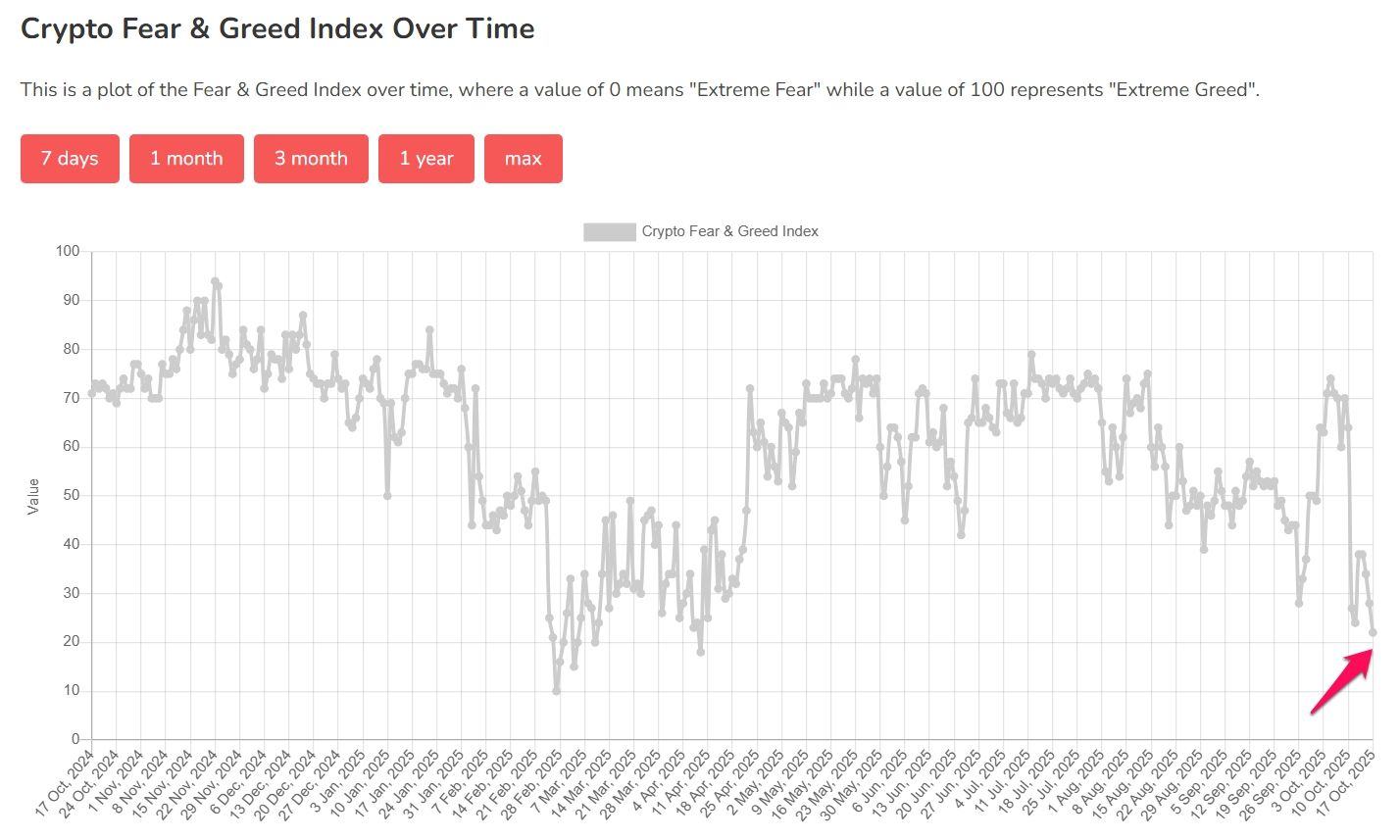

The Crypto Fear & Greed Index just flashed 22, pushing into extreme fear territory that historically precedes major Bitcoin rallies.

Market Psychology at Breaking Point

When sentiment hits these levels, it typically means weak hands have already sold. The 22 reading screams capitulation—the exact moment institutions start accumulating positions while retail panics.

Historical Patterns Don't Lie

Previous instances of extreme fear readings have consistently marked bottom formations. The current 22 score aligns with technical support levels that have held strong through multiple market cycles.

Wall Street's Contrarian Playbook

While mainstream media fuels the fear narrative, sophisticated investors recognize these signals as buying opportunities. They're executing the oldest trick in finance—buying when there's blood in the streets, even if that blood is digital.

The smart money isn't scared by a number. They're empowered by it. When fear hits 22, opportunity knocks louder than your portfolio manager's excuses.

Is October the Time to Be Greedy When Others Are Fearful?

The Fear & Greed Index is calculated based on several factors: price volatility (25%), market momentum/trading volume (25%), social media sentiment (15%), surveys (15%), Bitcoin dominance (10%), and Google Trends (10%).

A reading below 25 often signals excessive fear, creating buying opportunities. However, it also warns of the risk of further downside.

According to data from alternative.me, the index plunged from 71 (Greed) just a week earlier — a sharp shift in investor sentiment within days.

The last time the index dropped this low, in April, it coincided with a major market bottom. That period was followed by a strong rebound, during which bitcoin surged more than 70% over the next six months.

Analyst Ted also noted that Bitcoin’s funding rate on Binance recently turned negative, meaning traders holding short positions now pay fees to those holding long positions.

Historically, this signal has often marked a market bottom, followed by a strong rally, a pattern seen in mid-2025.

An investor on X calculated that there were seven negative funding rates in the past two years, each followed by an average gain of 22% within 15 days.

“Historically, this has resulted in a market bottom and rally. Will it happen again?” Ted said.

But This October Feels Different

The current fear extends beyond crypto. It has spread into the broader stock market as well.

On October 17, Barchart reported that equities had also been struck by “extreme fear” for the first time in six months.

JUST IN 🚨: Extreme Fear hits the Stock Market for the first time in 6 months 👻😱🫂 Here we go!!! pic.twitter.com/EoJzhxcxMz

— Barchart (@Barchart) October 16, 2025This negative sentiment likely reflects broader macroeconomic worries, including geopolitical tensions resulting from President Trump’s trade policies toward China and recession and inflation fears tied to recent Federal Reserve rate decisions.

Despite the gloom, André Dragosch, PhD, Head of Research at Bitwise, expressed confidence in Bitcoin’s relative resilience:

“Remember we have already seen a significant capitulation in cryptoasset sentiment. It’s TradFi sentiment that’s doing the catch up to the downside here. That’s why Bitcoin will most likely stay relatively resilient during this turmoil. Bitcoin once again the canary in the macro coalmine,” André Dragosch said.

Historical trends and Dragosch’s comments highlight Bitcoin’s potential as a store of value during times of fear. This may suggest an opportunity for investors to build positions at attractive levels.

However, the strategy of being “greedy when others are fearful” can backfire if fear persists or deepens over time.

Despite hopes for “Uptober,” a month that historically brings strong returns for Bitcoin, analysts note that 2025 is shaping up to be Bitcoin’s fourth-worst year since its creation, with year-to-date gains of less than 19% so far.